2016: Cautiously Optimistic on Equities, Concerns About Credit Risk

A surge in the stock market over the closing two weeks of the year allowed the S&P 500 to post a positive total return of 1.4% for 2015. This meager return is more than welcome given the market’s mid-summer swoon of 10% and an increase in volatility prior to the Federal Reserve’s decision to increase short-term interest rates in December.

Although we flip the calendar to a new year, many of the headwinds buffeting the stock market persist. The U.S. Dollar remains strong, in part because Europe, China and Japan are stimulating their economies while the Fed is taking steps to limit future inflation. In turn, the strong Dollar has a pronounced negative impact on reported revenue and earnings by those U.S. companies with extensive international exposure. Further, the highly valued Dollar keeps a lid on energy and other commodity prices. Lower energy prices will reduce output in America, leading to slower economic growth in the short term. The impact of a strong Dollar and weak overseas markets can be seen in returns from the different major stock market indexes. The industrial-rich Dow Jones Industrial Average has now underperformed the S&P 500 and the NASDAQ for the fourth consecutive year.

The economic windfall provided to consumers from lower energy prices has not fully percolated through the economy. Instead, savings rates have increased. Expectations were for savings at the pump to be spent in other areas. Higher savings rates may portend a lack of confidence in our economy – a troubling development. Similarly, the popularity of Donald Trump may be a reflection of a loss in confidence and the dissatisfaction with the status quo.

Federal Reserve actions will also continue to impact the markets. We continue to believe the Fed will move slowly and deliberately. William McChesney Martin, Jr., the Chairman of the Federal Reserve from 1951 to 1970, once said that the Fed’s job is to take the punch bowl away just as the party gets going. From the depths of the recession in 2009 through the first half of 2015, average annual real gross domestic product growth in the U.S. has been just over 2%. This doesn’t exactly constitute a party. Although the first few rate hikes may remove a few hors d’oeuvres, the punch is still flowing.

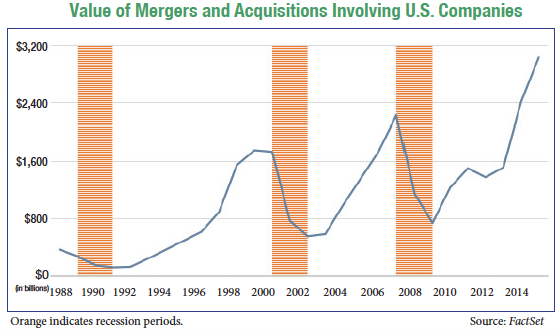

A few additional areas of concern have emerged during the course of the year. The value of merger and acquisition activity involving U.S. companies has reached $3 trillion. Prior peaks of $2.25 trillion in 2007 and $1.75 trillion in 1999 preceded recessions. The lack of organic growth has companies turning to M&A to provide the growth that investors expect.

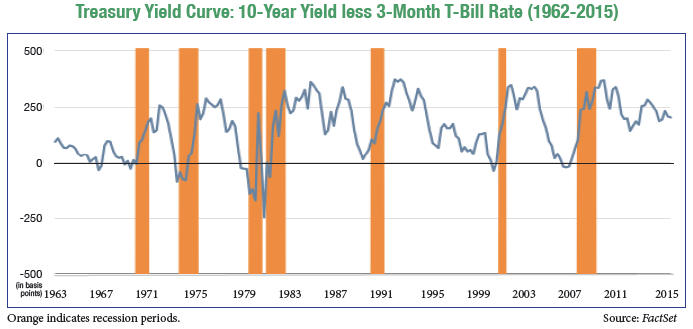

The compression of interest spreads in U.S. Treasury yields has also entered our radar screen. The Fed’s decision to begin raising short-term rates has had little impact on the 10-year Treasury. While the Fed has great sway over short-term rates, longer-term rates are controlled by the market and expectations for growth. A critical level for the spread is at the point of inversion, which occurs when the short-term rate actually exceeds the longerterm rate. The scenario is a good indication of a looming recession. We are not close to inversion yet, but the spread contraction is something we monitor very closely.

The upcoming presidential election will certainly begin to shape the investment landscape. It is difficult to handicap the race, especially for the Republican Party. However, with the left and the right pulling further apart, gridlock may be the end result. In any case, we continue to monitor the candidates and their platforms to determine the impact on your portfolios.

Not to be completely overshadowed, the economy continues to expand and the employment ranks grow. A late-year budget deal included increased government spending without raising taxes, which should boost our GDP by as much as 0.5% next year. Equity valuations are not cheap, but at the same time they are not excessively high. We anticipate below-average equity returns for 2016 with the S&P 500 delivering a total return of around 3%. We remain cautious but opportunistic in our equity investments.

The bond market has also experienced gyrations this year. Most of the action has been in the high-yield area. Many energy companies, having incurred high amounts of debt to build infrastructure to capture abundant deposits, have fallen on hard times as both oil and natural gas prices have collapsed. Bond prices have fallen and liquidity is now a concern. Investors who entered the space in a hunt for yield may precipitate further weakness as they head for the exit. Our investment-grade strategy has held up well. We own bonds for their stability and steady income. Equities are the asset class for risk-taking.

Given our outlook for modest interest rate increases, our primary concern is credit risk, not interest rate risk. Credit risk reflects the issuer’s ability to make interest and principal payments. Interest rate risk reflects price changes due to movements in interest rates. As interest rates move higher, the price of a bond with a fixed rate of return will move lower. Although interest rates are still at very low levels, we have started to extend maturities as rates have crept higher from the depths reached in 2012.

Each new year presents uncertainty and unique challenges, and 2016 will be no different. We appreciate your support and confidence as we work hard to add prosperity to your New Year.