By Eric Schopf

The first quarter of 2021 gave investors a little bit of everything. We saw a second impeachment of Donald Trump, the inauguration of Joe Biden, two more shots of fiscal stimulus, multiple Covid-19 vaccines, the rise of retail investors and meme stocks, unseasonable weather patterns and the collapse of a hedge fund masquerading as a family investment office. Through it all, the stock market maintained a bullish stance with the Standard & Poor’s 500 delivering a total return of 6.2%. The improving outlook for the economy was confirmed by the bond market as interest rates rose sharply. The yield on the 10-Year U.S. Treasury note spiked to 1.74% from 0.92% at year end.

By Eric Schopf

Wells Fargo & Co. is a diversified, community-based financial services company. It offers banking, insurance, investments, mortgages and consumer and commercial finance. WFC operates through three segments: Community Banking, Wholesale Banking and Wealth & Investment Management. The Community Banking segment offers diversified financial products and services for consumers and small businesses including checking and savings accounts, credit and debit cards and automobile, student and small business lending. The Wholesale Banking segment provides financial solutions to businesses across the United States and globally. The Wealth & Investment Management segment includes personalized wealth management and investment and retirement products and services. The company was founded in 1852 and is headquartered in San Francisco, CA. Today, WFC operates over 5,900 branches across thirty-nine states and the District of Columbia. Wells Fargo is one of the largest banks in the country with $1.9 trillion in assets.

By Eric Schopf

“There are three kinds of lies: lies, damned lies and statistics.” This phrase, popularized by Mark Twain, was right on point during the second quarter. Unbiased and accurate information regarding the coronavirus has been diluted by myriad sources tainted by political, economic or self-interest motives. The confusion sowed by half-truths and lies has resulted in uncertainty and false starts in objectively moving from economic lockdown to open-for-business. COVID-19’s source, transmission, treatment and morbidity patterns have been just one aspect of this disinformation flow. A dearth of testing and the stealth nature of the virus have created an environment ripe for deceit. True infection rates remain unknown. Even unemployment data, gathered and disseminated by the United States Bureau of Labor Statistics, a unit of the U.S. Department of Labor, was corrupted when it classified many people as employed but absent from work when in fact they were actually unemployed. This misclassification resulted in a reported unemployment rate of 14.7%, although it actually reached 19.5% during the quarter.

By Eric Schopf

The first quarter will be long remembered as the coronavirus of 2019 that developed into a full-blown pandemic. Measures to slow the virus’s spread have thrown the economy into recession and securities markets into collapse. Fear has replaced greed and investors headed for the exits. On February 20th, the Standard & Poor’s 500 was up 4.7% for the year and stood at an all-time high. The stock market needed just 22 trading days to shed 33.5%, and seven of those 22 trading days resulted in losses in excess of 4%. The single worst day was March 16th when the stock market fell 12%. The 325-point drop in the S&P 500 is the single largest point decline and the third largest percentage decline in the history of the index. For the quarter, the loss was a more modest 19.6% due to a rally into the end of the quarter.

By Eric Schopf

The stock market delivered a dazzling performance in the fourth quarter. The Standard and Poor’s 500 returned 9.07% and finished the year with a total return of 31.49%. The 10-Year U.S. Treasury yield closed the year at 1.92%. Although the rate had moved up from 1.68% at the beginning of the quarter, it is significantly below the 2.68% level where it started the year. Last year was a big departure from 2018. One year ago, I wrote that the Standard and Poor’s 500 turned in the worst fourth quarter performance since the depths of the financial crisis in 2008, and that the fourth quarter total return of -13.52% wiped out all performance gains for the year, which settled at -4.38%. What a difference a year makes!

By Eric Schopf

The third quarter provided positive returns for both stock and bond investors. The Standard and Poor’s 500 delivered a 1.7% total return, and the index reached an all-time high of 3025 on July 30. The index closed the quarter at 2977, just 1.6% below its record level. The 10-year U.S. Treasury yield fell from 2.00% on June 30 to 1.68% at the quarter’s end. Intra-quarter, the 10-year yield Treasury touched a low of 1.46% on September 3.

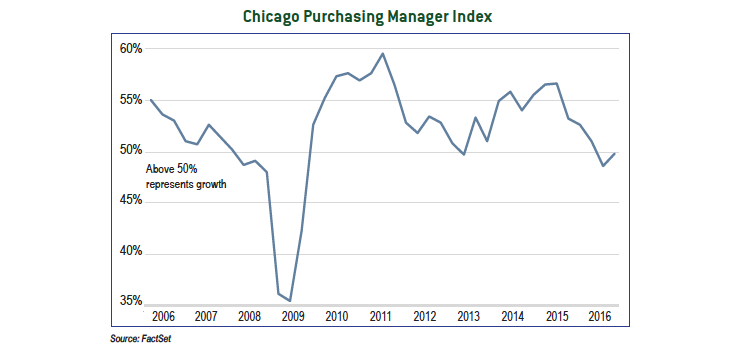

The first quarter started with a bang as the stock market began a precipitous decline. By the end of the fifth trading day of the year, the Dow Jones Industrial Average and Standard & Poor’s 500 indexes had recorded losses of 6.2% and 6.0%, respectively. The losses are both records for the time period. The selling persisted and the market continued to head lower. The trough was reached in mid-February, but not before the major averages gave back over 11%. As stomach churning as the first six weeks were, the markets bounced back very strongly. After all the gyrations, we closed the quarter almost exactly where we started.

Interest rates were a sharp contrast to the stock market during the quarter. The 10-year U.S. Treasury bond started the year at 2.3%. As the stock market was reaching a low in mid-February, interest rates were also falling with the 10-year reaching 1.66%. As interest rates fall, the price of bonds rise. Bond prices have remained strong, and we closed the quarter with a 10-year treasury yield of 1.81%.

If we view the first quarter as a voting booth for the Federal Reserve’s decision to raise interest rates last December, we find that investors voted “nay.” The Fed has gotten the message and has turned more dovish with regards to monetary policy. The new stance was punctuated during a speech that Fed Chair Janet Yellen delivered to the Economic Club of New York on March 30, where she articulated that only gradual increases in the federal funds rate are likely to be warranted in coming years.

The first quarter reinforces some valuable lessons in investing. First, equity investing is a long-term proposition. Timing the market in January and February may have led to big losses while missing the market’s recovery. Second, fixed income securities, whether they are Treasury bonds, corporate bonds or certificates of deposit, provide valuable diversification that helps reduce an investment portfolio’s volatility.

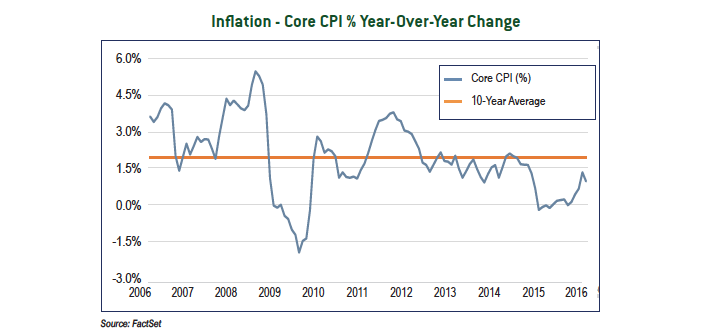

The economic environment continues to improve slowly. Employment numbers remain at impressive levels, and housing starts and housing permits are trending higher. More importantly, manufacturing, which has been volatile and generally weak over the past year, demonstrated strong growth in March. The combination of moderate economic growth with little inflation continues to be a winning combination for the stock market. Although inflation is low today, we closely monitor the situation for change. The Fed’s accommodative policy has provided a strong tailwind for nine years. An unanticipated increase in inflation could lead to a shift in Fed policy, resulting in headwinds. The dramatic collapse in the price of West Texas Intermediate crude oil from about $140/barrel in 2008 to $33/barrel earlier this year is clearly disinflationary. The price of energy percolates through many goods and services. However, the lowest prices are most likely behind us as supply and demand have worked towards equilibrium. A rise in energy prices will be inflationary to some degree. The response of supply and demand to higher prices will dictate pricing levels and the impact on future inflation.

The stock market gets more attractive as prices continue to languish. Obstacles to profit growth like a strong U.S. dollar and weak international markets are now being lapped, making year-over-year earnings comparisons easier. Valuations remain reasonable and are supported by the low interest rate environment. Bonds, on the other hand, are less attractive given the big drop in interest rates over the past three months. We are more selective in maturity patterns given the higher prices.

The lessons learned in the first quarter may continue to serve investors well over the balance of the year. Risks and volatility are ever-present. The terrorist attacks in Belgium are a reminder of the geopolitical tensions around the world. The political landscape at home remains unsettled. The presidential election includes a cast of characters with political views that run the gambit and party infighting is headline news. The uneven economic recovery has left many citizens angry and ready for radical change. The uncertainty of the outcome may weigh on the markets as we get closer to the election. As always, we will use the volatility to uncover opportunities as we seek to add value to your portfolio.

A surge in the stock market over the closing two weeks of the year allowed the S&P 500 to post a positive total return of 1.4% for 2015. This meager return is more than welcome given the market’s mid-summer swoon of 10% and an increase in volatility prior to the Federal Reserve’s decision to increase short-term interest rates in December.

Although we flip the calendar to a new year, many of the headwinds buffeting the stock market persist. The U.S. Dollar remains strong, in part because Europe, China and Japan are stimulating their economies while the Fed is taking steps to limit future inflation. In turn, the strong Dollar has a pronounced negative impact on reported revenue and earnings by those U.S. companies with extensive international exposure. Further, the highly valued Dollar keeps a lid on energy and other commodity prices. Lower energy prices will reduce output in America, leading to slower economic growth in the short term. The impact of a strong Dollar and weak overseas markets can be seen in returns from the different major stock market indexes. The industrial-rich Dow Jones Industrial Average has now underperformed the S&P 500 and the NASDAQ for the fourth consecutive year.

The economic windfall provided to consumers from lower energy prices has not fully percolated through the economy. Instead, savings rates have increased. Expectations were for savings at the pump to be spent in other areas. Higher savings rates may portend a lack of confidence in our economy – a troubling development. Similarly, the popularity of Donald Trump may be a reflection of a loss in confidence and the dissatisfaction with the status quo.

Federal Reserve actions will also continue to impact the markets. We continue to believe the Fed will move slowly and deliberately. William McChesney Martin, Jr., the Chairman of the Federal Reserve from 1951 to 1970, once said that the Fed’s job is to take the punch bowl away just as the party gets going. From the depths of the recession in 2009 through the first half of 2015, average annual real gross domestic product growth in the U.S. has been just over 2%. This doesn’t exactly constitute a party. Although the first few rate hikes may remove a few hors d’oeuvres, the punch is still flowing.

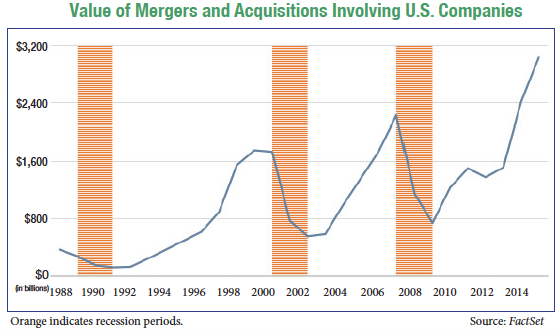

A few additional areas of concern have emerged during the course of the year. The value of merger and acquisition activity involving U.S. companies has reached $3 trillion. Prior peaks of $2.25 trillion in 2007 and $1.75 trillion in 1999 preceded recessions. The lack of organic growth has companies turning to M&A to provide the growth that investors expect.

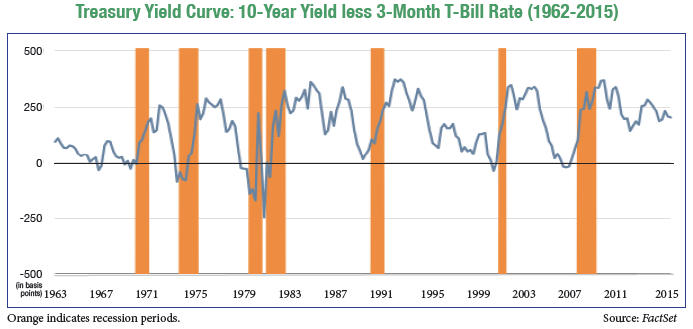

The compression of interest spreads in U.S. Treasury yields has also entered our radar screen. The Fed’s decision to begin raising short-term rates has had little impact on the 10-year Treasury. While the Fed has great sway over short-term rates, longer-term rates are controlled by the market and expectations for growth. A critical level for the spread is at the point of inversion, which occurs when the short-term rate actually exceeds the longerterm rate. The scenario is a good indication of a looming recession. We are not close to inversion yet, but the spread contraction is something we monitor very closely.

The upcoming presidential election will certainly begin to shape the investment landscape. It is difficult to handicap the race, especially for the Republican Party. However, with the left and the right pulling further apart, gridlock may be the end result. In any case, we continue to monitor the candidates and their platforms to determine the impact on your portfolios.

Not to be completely overshadowed, the economy continues to expand and the employment ranks grow. A late-year budget deal included increased government spending without raising taxes, which should boost our GDP by as much as 0.5% next year. Equity valuations are not cheap, but at the same time they are not excessively high. We anticipate below-average equity returns for 2016 with the S&P 500 delivering a total return of around 3%. We remain cautious but opportunistic in our equity investments.

The bond market has also experienced gyrations this year. Most of the action has been in the high-yield area. Many energy companies, having incurred high amounts of debt to build infrastructure to capture abundant deposits, have fallen on hard times as both oil and natural gas prices have collapsed. Bond prices have fallen and liquidity is now a concern. Investors who entered the space in a hunt for yield may precipitate further weakness as they head for the exit. Our investment-grade strategy has held up well. We own bonds for their stability and steady income. Equities are the asset class for risk-taking.

Given our outlook for modest interest rate increases, our primary concern is credit risk, not interest rate risk. Credit risk reflects the issuer’s ability to make interest and principal payments. Interest rate risk reflects price changes due to movements in interest rates. As interest rates move higher, the price of a bond with a fixed rate of return will move lower. Although interest rates are still at very low levels, we have started to extend maturities as rates have crept higher from the depths reached in 2012.

Each new year presents uncertainty and unique challenges, and 2016 will be no different. We appreciate your support and confidence as we work hard to add prosperity to your New Year.

As the third quarter wound to a close, we learned from the Bureau of Economic Analysis that gross domestic product for the second quarter was revised to 3.9% year-over-year growth from a previous estimate of 3.7%. Despite the strong economic data, the stock market posted dismal performance, with the broad Standard & Poor’s 500 index down 6.9% for the quarter. Volatility has reemerged as investors face an uncertain landscape. Although we often analyze economic data to provide insight into future stock market returns, more often is the case that the stock market provides a glimpse into the future of the economy.

As the third quarter wound to a close, we learned from the Bureau of Economic Analysis that gross domestic product for the second quarter was revised to 3.9% year-over-year growth from a previous estimate of 3.7%. Despite the strong economic data, the stock market posted dismal performance, with the broad Standard & Poor’s 500 index down 6.9% for the quarter. Volatility has reemerged as investors face an uncertain landscape. Although we often analyze economic data to provide insight into future stock market returns, more often is the case that the stock market provides a glimpse into the future of the economy.

The global economy is as weak as it has been since the Great Recession. A slowing of the Chinese economy is the latest cause of indigestion. It is difficult to overemphasize the importance of the second largest economy in the world. With reported annual average GDP expansion rates in excess of 7% for many years, the Chinese economy has been the global growth driver. As Chinese production has slowed, the prices of raw materials for that (more…)

Our outlook for 2015, presented in our January issue, was titled “Don’t Fight the Fed.” Low interest rates have made bonds an unattractive investment option during a period when common stocks continue to plow higher. However, with the Federal Reserve now poised to begin raising interest rates, the uncertainty regarding the timing and magnitude of rate increases has left the equity and fixed income markets skittish. The market, in anticipation of Fed action, sent stocks lower during the second quarter. By the first week of June, nearly all stock market gains for the year had been erased. The Fed’s statement following its mid-June meeting led to a market rally as commentary was more dovish than anticipated. The bond market has also moved in anticipation of higher rates. The yield on the 10-year U.S. Treasury followed suit, climbing from a low of 1.86% to as high as 2.48% during the quarter.

Our outlook for 2015, presented in our January issue, was titled “Don’t Fight the Fed.” Low interest rates have made bonds an unattractive investment option during a period when common stocks continue to plow higher. However, with the Federal Reserve now poised to begin raising interest rates, the uncertainty regarding the timing and magnitude of rate increases has left the equity and fixed income markets skittish. The market, in anticipation of Fed action, sent stocks lower during the second quarter. By the first week of June, nearly all stock market gains for the year had been erased. The Fed’s statement following its mid-June meeting led to a market rally as commentary was more dovish than anticipated. The bond market has also moved in anticipation of higher rates. The yield on the 10-year U.S. Treasury followed suit, climbing from a low of 1.86% to as high as 2.48% during the quarter.

Although the Fed is nearing an inflection point, we do not see near-term rate actions negatively impacting the economy. In the Fed we trust: we believe any rate increases will be slow and measured. (more…)

The sentencing of Bernard Madoff brings the Securities and Exchange Commission one step closer to closing the book on one of the largest Ponzi schemes ever perpetrated. While Madoff has garnered most of the headlines, numerous other fraudulent schemes of various magnitudes have come to light over the past six months.

The sentencing of Bernard Madoff brings the Securities and Exchange Commission one step closer to closing the book on one of the largest Ponzi schemes ever perpetrated. While Madoff has garnered most of the headlines, numerous other fraudulent schemes of various magnitudes have come to light over the past six months.

The common thread between many of these schemes is quite simple. The criminal serves dual roles as investment manger and qualified custodian of the same assets. As investment manager, funds are accumulated, often under the guise of guaranteed high investment returns. Once in possession of the money, funds are transferred between accounts in order to meet withdrawal requirements. As custodian, fake account statements with bogus information are provided in order to create the illusion of a legitimate operation. If the money inflow from new clients offsets the outflow from withdrawals, the fraud may be perpetrated for a long time.

Hardesty Capital does not take custody of client assets. Independent third-party qualified custodians, such as banks and broker-dealers, are utilized for the vital function. Qualified custodians are subject to extensive regulation and oversight. Included in the oversight is a daily reconciliation conducted by our firm to assure the accuracy of custodial records.

In response to the financial schemes, the SEC has modified their registered investment adviser examination process. They will now perform a valid verification of assets by requesting independent confirmation of investor assets from various third parties, including custodians and advised clients. The SEC exam staff may ask clients to confirm that their account balances as of a specific date were consistent with their own records and that the contribution and withdrawals from their account were authorized.

—Eric Schopf

First, it was the technology bubble of the late 1990’s. Shortly thereafter, we experienced the real estate bubble. Now, we may be witnessing the third bubble—commodities, specifically energy.

First, it was the technology bubble of the late 1990’s. Shortly thereafter, we experienced the real estate bubble. Now, we may be witnessing the third bubble—commodities, specifically energy.

The chart below shows us how painful the unwinding of a speculative bubble can be. The Nasdaq index exceeded 5,000 eight years ago but still remains more than 50% below the peak level. Housing is a similar story as the seasonably adjusted number of new homes starts has declined by 50% from 2004 and 2005 levels. Oil is showing signs of similar speculation as massive amounts of money are flooding into the sector. The price of oil is up 40% just this quarter. (more…)