By: Chad Meyer, CFA

As humidity takes hold and Fourth of July memories fade, there’s just no denying it. The dog days of summer have officially arrived. And while it’s no surprise for market activity to “cool off” around this time of year, one cannot help but suspect there’s more than the usual pre-Labor Day lull currently at work in the financial world. In this space roughly twelve months ago, I described the second quarter of 2021 as “frothy times,” characterized by the feeling that almost any stock was a winner. Looking back over the last six months, it’s clear that froth has given way to a drastically more cautious mood, due in no small part to a collective acknowledgement that uncertainty is the new normal. The view from the beach, it would seem, now includes whitecaps.

By: Eric Schopf

If the first quarter was a struggle for the financial markets, the second quarter was just plain painful. Two additional interest rate increases by the Federal Reserve have heightened awareness for a potential recession, and the stock market reaction was a 16.2% retreat in the Standard & Poor’s 500 Index. The bond market provided some protection but still delivered negative returns. Yields on the 10-year United States Treasury note moved from 2.32% to 2.97%. The Bloomberg US Intermediate Government/Credit Index, which tracks the performance of intermediate term U.S. government and corporate bonds with an average maturity of about 4.5 years, declined 2.37% during the quarter. For the year, the S&P 500 has declined 19.96% and the Bloomberg fixed income index is down 6.77%.

By: Scott Murphy

On June 13th, the S&P 500 tumbled into a bear market. It fell about 20% from the most recent high reached in January of 2022. In the post-World War period from 1945 to the present, there have been fourteen bear markets, ranging in length from one month to 1.7 years, and in severity from a 20.6% drop to a 57% decline in the S&P 500.

By: Barb Rishel

Of all the goods and services being impacted by higher inflation, the price of a gallon of gasoline may be the one that we notice the most. It certainly is the cause for a lot of conversations these days, and opinions on why the price is so high vary considerably.

How are gas prices determined?

By: Chad Meyer, CFA

For much of the last year, the investment community reaped the fruits of a truly odd phenomenon. While the world changed dramatically (and often, it seemed, without warning), the market continued its ascent. Beset by uncertainty on all fronts, the financial story of 2021 was one of growth that simply could not be bothered to share in the rest of the world’s worries. As the headlines zigzagged from one uncertainty to the next, nearly every major index climbed higher and to the right.

By: Eric Schopf

The first quarter of 2022 was a struggle for the financial markets. A more hawkish Federal Reserve combined with the Russian invasion of Ukraine resulted in the steepest losses for stocks since the first quarter of 2020. The bond market suffered its worst loss since the financial crisis in 2008. Just as the Omicron wave of Covid-19 peaked and supply chain issues eased, we were presented with a new set of problems.

By: Eric Schopf

Medtronic PLC (Ticker: MDT) is a medical technology company that develops, manufactures, distributes and sells device-based medical therapies. The company serves healthcare systems, physicians, clinicians and patients in more than 150 countries. The company was founded in 1949 and employs over 90,000 people. Although Medtronic is headquartered in Dublin, Ireland, the company operates primarily in the United States.

By: Rick Rubin, CFA

In Tufton’s Winter 2020 newsletter, we provided an overview of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which was signed into law in late 2019. The SECURE Act allows more individuals to access workplace retirement plans and to increase retirement savings. Many of the provisions became effective on January 1, 2020. But in response to the COVID-19 pandemic in the U.S., new legislation was enacted in March 2020 that delayed many of the SECURE Act’s provisions for 2020.

Notwithstanding the massive government stimulus provided during the first year of the pandemic, many individuals continued to have weak finances and less savings for retirement. U.S. lawmakers decided to take on the challenge of improving retirement outcomes for Americans and to build upon the SECURE Act. In May 2021, the House Ways and Means Committee unanimously passed the Securing a Strong Retirement Act of 2021. We wrote extensively about the bill’s provisions in Tufton’s Summer 2021 newsletter. The bill enjoyed strong bipartisan support, but unfortunately, it did not move forward in Congress last year.

In this space, a bit over twelve months ago, I admitted that I didn’t have a clue what sort of market 2021 would bring. “Perhaps the economy will thrive…buoyed by the message that America is now ‘open for business’,” I wrote. “Or perhaps…historically low interest rates coupled with strong corporate earnings and healthy balance sheets may lead to another strong year for the equity markets.”

By Eric Schopf

After limping to a close in the third quarter, the stock market came roaring back in the fourth. The Standard and Poor’s 500 provided a total return of 9.8% and closed the year with a gain of 28.7%. The ten-year U.S. Treasury yield treaded water during the quarter with a move from 1.53% to 1.51%. Stock market returns were buoyed by low interest rates courtesy of the Federal Reserve’s accommodative monetary policy.

By Scott Murphy

The global economy dictates that successful companies compete daily for their own survival in a corporate sense and also in the minds of their customers. Wall Street is only happy to oblige by coming up with innovative and often replicated strategies from their collective corporate toolboxes. In some ways, you could view this symbiosis as the world’s greatest financial construction firm. They build it up to break it down, often repeating the process as decades pass and memories of the individual participants fade.

By Randy McMenamin, CFA

The five most dangerous words to a portfolio manager are “This time it is different”.

Inflation is a hidden tax which only stays hidden for so long. When inflation rears its ugly head and is visible to consumers, business people and politicians, there is a problem.

What causes inflation? Today’s inflation is caused by too much money chasing too few goods and services. The annualized CPI (Consumer Price Index) for December 2021 was up 7% from a year earlier – the fastest increase since June 1982. This time was different because very strong money supply growth and generous government stimulus gave rise to this high level of inflation.

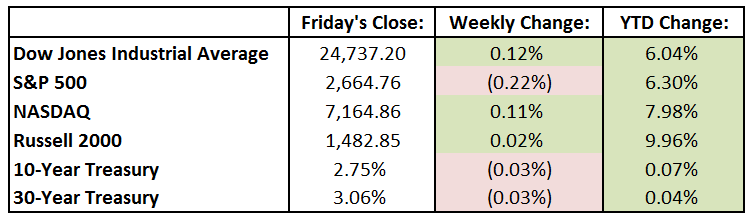

Last Week’s Highlights:

Earnings season is well underway as the market continues to digest companies’ 4th quarter results. Last week, the main US indices were essentially flat with the Dow Jones Industrial Average up just 0.12%. The S&P 500 was down 0.22% and tech-heavy NASDAQ was up 0.11%. The week brought news from many large well-known companies. Johnson & Johnson (JNJ) beat on sales and estimates, but the stock fell due to a softer 2019 outlook. Procter & Gamble (PG) also beat on sales and estimates. The stock rallied higher as the company raised their full-year guidance. On the economic front, Existing Home Sales have fell short of Wall Street estimates coming in at 4.9 million. The FHFA Home Price Index was flat month-over-month as the home prices barely budged. In addition, investors were also focused on trade tensions between the US and China as well as commentary coming out of the global economic forum in Davos, Switzerland. Finally, the government shutdown ended over the weekend.

This week, earnings will continue to be in focus as Microsoft (MSFT), Amazon (AMZN), Apple (AAPL) and Facebook (FB) all report their 4th quarter results. We will also gain some insight from the energy patch when Exxon (XOM) and Chevron (CVX) report on Friday. The behemoths of the former Telecommunications sector will also release their numbers with Verizon (VZ) and AT&T (T) reporting on Tuesday and Wednesday, respectively. In economic news, Consumer Confidence will be reported on Tuesday. Wall Street is estimating a reading of 125 versus 128.1 in December. Investors will also get a preliminary reading on 4th quarter economic growth when Gross Domestic Product is disclosed on Wednesday. Lastly, the Federal Open Market Committee (FOMC) will meet this week and are expected to leave the Federal Funds Rate unchanged at 2.25% to 2.5%.

The Tufton Capital Team hopes that you have a wonderful week!

What’s On Our Minds:

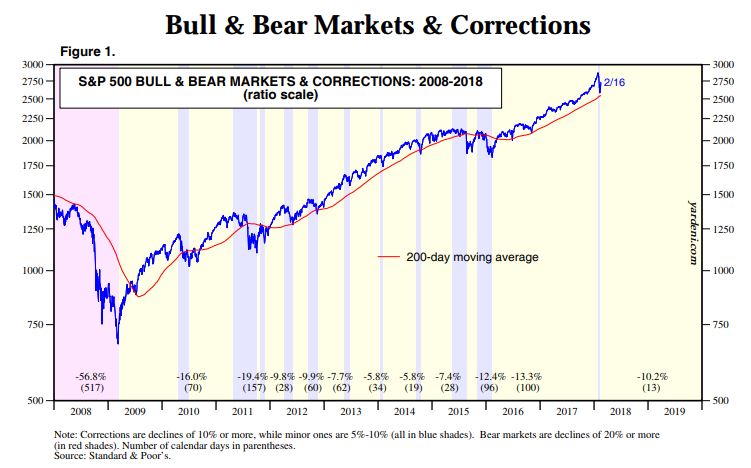

The markets have quickly recovered some of their losses, but that doesn’t mean we’re out of the woods yet.

As we said last week, the market has taken, on average, 220 days after a 10% correction to reach its previous highs. In this quick dip, we’re already up some 7.5% from the bottom and have only about 5% more to go to get back to record highs. Or, 150 points on the S&P and 1,400 on the Dow.

Phew, back to normal, right? Hopefully not. We hope that this dip and the emotions that it stirred will help to reverse two related trends in the financial markets.

First, the “stocks always go up” mentality in savers. While we have certainly had corrections since the Great Recession, there has been just one since 2011: the 12.4% correction in late 2015. Any associated woes were quickly forgotten in the wildly positive markets of 2016 and 2017. Therefore, there is a generation of savers who have been working since 2009-2011 that have never really seen their investment accounts decline.

It’s easy to call yourself a long-term investor when the market numbers are green. “Oh, me? I don’t worry about market volatility. I know if I leave my 401(k) alone, it’ll all work itself out, on average, over the next 15 years,” says the 29-year old as he sips on his latte. “Frankly, I don’t even check my account balance that often,” he lies, as he closes the internet browser he had open on his phone just moments before.

We hope at Tufton that the fictitious Millennial above is as good as his word, because a “market correction of 15%” is a lot easier to rationalize than seeing $13,000 disappear from your accounts in a week. The latter tends to have a lot more impact than we realize. OF course, strength is forged through trials, and this correction wasn’t so bad, so it might temper savers for the next one.

Second, the over-reliance on (or undue faith in) index funds. More and more investors have heard that index funds, on average, outperform their actively managed counterparts. As more money moves into indexes, there are fewer analysts moving dollars to take advantage of mispricings in the market. That is, if a respected analyst comes out and says “Google is too hot! Sell Sell Sell!”, it won’t stay hot for long. But if everyone’s in index funds, it will stay too hot. Those mispricings can grow and cause market distortions.

What will that means for the market? No one knows yet. But a few corrections will help to remind people that we need to have active traders for the markets to function.

What’s On Our Minds:

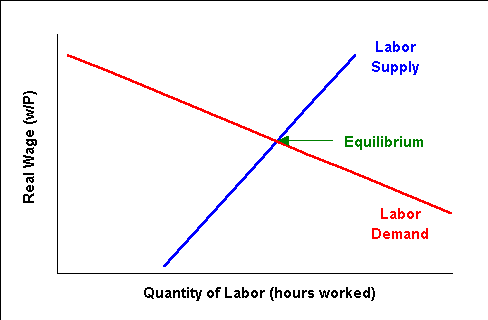

The Economics Team at Tufton Capital normally takes the helm of the blog only every fourth week. It is filling in this week for its vacationing colleagues, and would like to take the opportunity to talk about the fabled “economic equilibrium” that is used as a guiding star- but somehow never reached.

We begin with Kenneth Arrow, a Nobel Prize-winning economist who passed away last month. Arrow mathematically showed many economic ideas to be true, and in fact has a mathematical theorem named after him, but of interest to us now is his work on market equilibriums. Arrow showed in his Nobel-winning work that a market exists where an equilibrium price can be reached for all goods. This intersection of Supply and Demand is an extension of Adam Smith and Economics 101. However, Arrow’s theorem requires, among other things, that a futures market exists for all goods. And of course, we do not trade our babysitter’s labor costs two years from now on the NYSE (that said, could babysitter futures be a good product for an enterprising salesman on Wall Street?).

Despite this and other discrepancies, the idea that there is a perfect equilibrium price that will be reached and will balance all costs- human, economic, and otherwise- prevails in many discussions of the markets and politics today. The Tufton Economics team is quick to caution (as it always does) that real life is rarely so orderly as the simple graphs of 18th century economics. While they certainly illustrate some basic ideas about markets, applying them to a society at large can be overly simplistic.

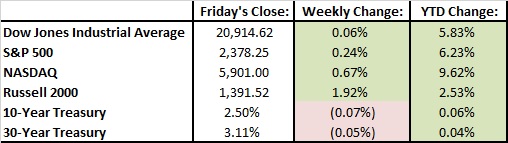

Last Week’s Highlights:

Stocks managed to eke out some gains last week, returning tentatively to what has been the bull market of early ’17. The S&P 500 and Dow Jones both gained under a quarter percent. Both remain up roughly 6% year to date. Interest rates, while still very low by historical (or any) standards, seem like they might be rending up, with the Fed indicating more rate hikes are on the way, despite the tick down this week.

Looking Ahead:

A pretty quiet week ahead. We’ll be interested to see home sales numbers, as they could be confirmation- or a warning flag- of the general belief that the US economy is still chugging healthily along.