Benefits of Value Investing Over the Long Term

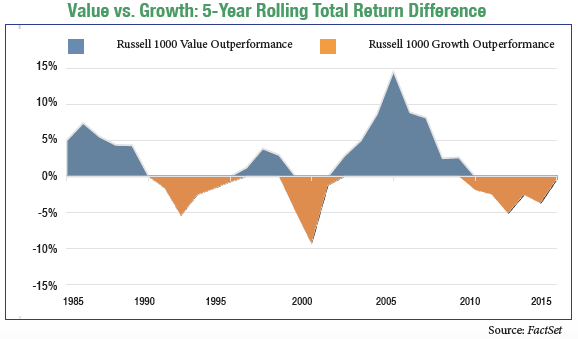

Generally speaking, there are two schools of investing: growth and value. Growth investors look to invest in companies that are normally growing their sales, earnings, and perhaps customers at a rate well above the typical company. A successful growth company firing on all cylinders and achieving the above factors often leads to the company’s stock outperforming the broader market. However, when the markets start to decline and overall growth is anticipated to slow, growth stocks frequently decline more than the market. On the other side of the spectrum lies value investing. Often, value investors are more risk-averse and first look for the downside scenario that might face a company. With the downside determined, value investors attempt to buy the company’s stock at a discount to the estimated intrinsic value. While the company’s earnings may not grow at a rate faster than or even matching the broader market, the expected downside in the company’s stock price is limited during periods of stock market volatility. As a result, value investing has proven to outperform growth investing over the long term.

The investing styles move in and out of favor depending on what investments are perceived to deliver the best returns. Since the beginning of this bull market in 2009, growth investing has been en vogue as investors have sought companies that are actually growing in a no-to-slow-growth economic environment. 2015 was no exception as Facebook, Amazon.com, Netflix, and Google were among the S&P 500’s best performers. Often known by the acronym FANG, these four companies held up the S&P 500 from further declines during the year, while the average stock in the index was down 18% from its 52-week high.

A handful of stocks leading the market is nothing new to Wall Street. In the late 1960s and early 1970s, investors were enamored with “the Nifty Fifty” which included companies such as IBM, Walt Disney, Coca-Cola & McDonalds. All came crashing down when the bear market arrived in 1974. A similar craze occurred in the late 1990s and early 2000s with several technology stocks, such as Microsoft and Intel, leading the market. Once the “tech bubble” burst, some overvalued technology stocks lost more than 80% of their value. A share purchased in Microsoft or Intel early in the 2000s would, even today, not have made an investor a single dollar.

At Tufton Capital, we practice the value investing philosophy, looking to outperform in bear markets while performing adequately in bull markets. There is no telling when the next bear market will arrive, but one thing is definite – we are currently in the second longest bull market of all time. Our style will come back into favor. Until then, we will maintain our discipline, be patient, and continue to focus on finding a dollar’s worth of assets trading for fifty cents.