Last Week’s Highlights:

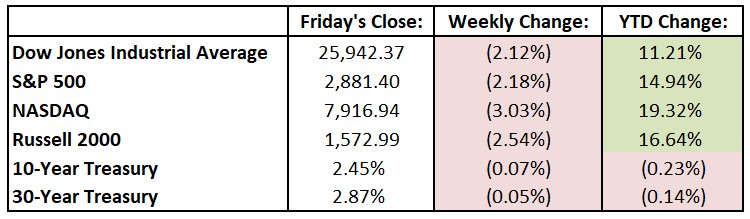

Elevated trade and tariff tensions took center stage last week and set the mood for global equities. The market had been counting on a trade deal between the U.S. and China, so stocks sold off as the rhetoric out of the White House increased. The U.S. levied new tariffs on $200 billion of Chinese goods Friday and threatened more, even as the 11th trade meeting between the U.S and China took place in Washington. For the past week, the Dow Jones Industrial Average (DJIA) declined 562.58 points, or 2.1%, to 25,942.37, while the S&P 500 fell 2.2% to 2881.40. The tech-heavy NASDAQ dropped 3.0%, closing at 7916.94. Ride-hailing leader Uber Technologies (UBER) went public on Friday, pricing its IPO at $45 per share (valuing the company at $82.4 billion). The stock opened at $42 and closed the day at $41, hardly a solid first day of trading. Apparently Wall Street isn’t buying Silicon Valley’s excitement about ride hailing and the sharing economy. On top of Uber’s weak IPO, rival Lyft’s (LYFT) stock is down 30% since its March initial offering. Trade anxieties continued through the weekend, resulting in S&P 500 futures falling sharply on Sunday night.

Looking Ahead:

Earnings season winds down this week, with only nine companies in the S&P 500 reporting their first-quarter results. Investors will continue to focus closely on continued comments from President Trump (please see details above) and their impact on trade developments and global markets. Monday brings financial reports from Legg Mason (LM) and Take-Two Interactive (TTWO). The Federal Reserve Bank of Boston will host a FedListens conference. On Tuesday, Ralph Lauren (RL), Agilent Technologies (A) and Container Store (TCS) are among companies reporting financial results. Trade results will be reported – prices for U.S. imports are expected to rise 0.7% in April, after increasing 0.6% in March. U.S. export prices are expected to advance 0.6% in April after rising 0.7% in March, according to the Bureau of Labor Statistics. On Wednesday, look for financial results from Cisco Systems (CSCO), Macy’s (M), Alibaba Group Holding (BABA) and Tencent Holding (TME). The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market index for May – economists forecast a 64 reading, up from April’s 63. Walmart (WMT), Applied Materials (AMAT) and Pinterest (PINS) report their earnings results on Thursday. The Census Bureau releases housing starts for April – economists forecast 1.22 million seasonally adjusted annual units, up from March’s 1.14 million unit change. On Friday, the Conference Board reports its Leading Economic Index for April – expectations call for a 0.2% rise after a 0.4% gain in March. The University of Michigan releases its preliminary Consumer Sentiment index – estimates call for a reading of 97.5 in May, up slightly from April’s 97.2 print.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

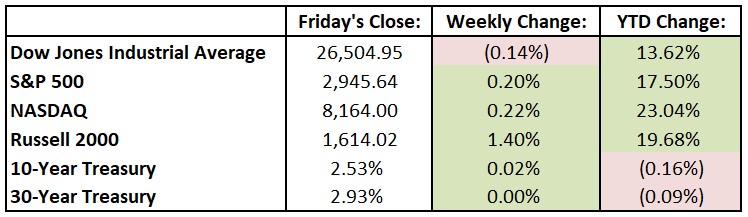

U.S. equities rallied on Friday (up 1% on the day), moving the S&P 500 to positive territory for the week and leaving it just below its recent record. A more accommodative stance from central banks, rising earnings and signs of easing trade tensions (more on that below) continue working together to keep the market moving higher. For the past week, the Dow Jones Industrial Average (DJIA) slipped 38.38 points, or 0.1%, to 26,504.95, while the S&P 500 advanced 0.2% to 2945.64. The tech-heavy NASDAQ was up 0.2%, closing at 8164.00, capping off its best four-month start to a year since 1991. The main driver for last week’s market strength was corporate earnings. With earnings season more than three-quarters over, corporate profits appear to be on track for modest gains (0.9%) in the first quarter. While these gains are small, they’re much better than feared going into reporting season. On the economic front, Friday’s jobs report was above expectations, with nonfarm payrolls increasing by a seasonally adjusted 263,000, the Labor Department reported. The unemployment rate ticked down to 3.6%, the lowest level in 50 years. The news wasn’t all rosy, as President Trump threatened to drastically ramp up U.S. tariffs on Chinese imports, a surprise twist to the recently positive trade talks. In a pair of Twitter messages Sunday, the president wrote that he planned to raise levies on $200 billion in Chinese imports to 25% starting Friday, from 10% currently. He added that he would impose 25% tariffs “shortly” on $325 billion in Chinese goods that haven’t yet been taxed. These developments resulted in S&P 500 futures falling sharply on Sunday night.

Looking Ahead:

Earnings season winds down this week, with only 10% of the companies in the S&P 500 reporting their first-quarter results. Investors will be focusing closely on Sunday’s Twitter comments by President Trump (please see details above) and their impact on trade developments and global markets. Monday brings financial reports from American International Group (AIG), Kilroy Realty (KRC) and Occidental Petroleum (OXY). Aflac (AFL) and Eli Lilly (ELI) hold their annual meetings of stockholders in Columbus, Ga., and Indianapolis, respectively. Expect earnings results on Tuesday from Allergan (AGN), Anheuser-Busch InBev (BUD), Lyft (LYFT) and Sempra Energy (SRE). American Express (AXP) and Danaher (DHR) hold their annual meetings of stockholders in New York and Washington, D.C., respectively. The Bureau of Labor Statistics releases its Jobs Openings and Labor Turnover survey for March – economists forecast 7.1 million job openings in March, even with February. Walt Disney (DIS), Microchip Technology (MCHP) and Marathon Petroleum (MPC) report earnings on Wednesday. Intel (INTC) holds an investor meeting in Santa Clara, Ca. On Thursday, look for financial results from Cardinal Health (CAH), Becton Dickinson (BDX) and Symantec (SYMC). The Bureau of Labor Statistics releases the producer price index (PPI) for April – economists look for a 0.3% increase in wholesale prices after a 0.6% rise in March. On Friday, ride-sharing giant Uber Technologies begins trading under the ticker symbol UBER. The company is going public by selling shares at an expected range of $44 to $50, which would value Uber at over $80 billion. Viacom (VIA) and Marriott International (MAR) report their first-quarter financial results.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

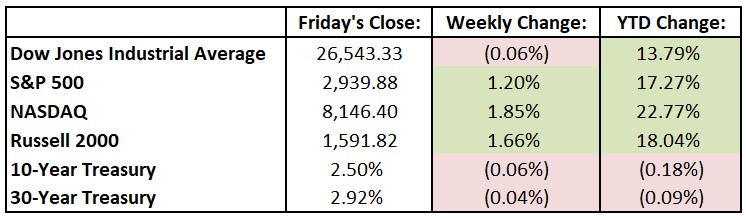

U.S. equities rallied to record closing highs – the S&P 500 and the tech-heavy NASDAQ hit record levels on Tuesday before slightly losing ground on Wednesday. A more accommodative stance from central banks, rising earnings and signs of easing trade tensions continue working together to keep the market moving higher. For the past week, the Dow Jones Industrial Average (DJIA) slipped 16.21 points, or 0.06%, to 26,543.33, while the S&P 500 advanced 1.2% to 2939.88. The NASDAQ was up 1.85%, closing at 8146.40. The main driver for last week’s market strength was corporate earnings. With over 40% of the S&P 500 companies having reported results, corporate profits appear to be on track for small gains in the first quarter, supporting current market valuations. On the economic front, Friday’s Q1 gross domestic product (GDP) number came in above expectations – the U.S. economy grew at a 3.2% pace in the first quarter, accelerating from 2.2% at the end of 2018. On the big screen, “Avengers: Endgame” became the first film in Hollywood history to gross more than $1 billion in its worldwide box office debut over the weekend.

Looking Ahead:

First-quarter earnings season remains in full swing this week. Monday brings financial reports from Google-parent Alphabet (GOOG), MGM Resorts International (MGM), SBA Communications (SBAC) and Western Digital (WDC). The Bureau of Economic Analysis releases personal income data for March – economists forecast a 0.4% rise in personal income after a 0.2% gain in February. Boeing (BA) and Honeywell International (HON) hold their annual meetings of stockholders in Chicago and Morris Plains, NJ, respectively. Tuesday is another bevy of financial results, including numbers from Advanced Micro Devices (AMD), Amgen (AMGN), Apple (AAPL), General Motors (GM) and Mondelez International (MDLZ). The Conference Board releases its Consumer Confidence Index for April – expectations call for a 125.4 reading, a slight increase from March’s 124.1 print. Wednesday is May Day – the Federal Open Markets Committee (FOMC) announces its monetary-policy decision. The central bank is widely expected to keep its benchmark federal-funds rate unchanged at 2.25% to 2.5%. Automatic Data Processing (ADP), CVS Health (CVS), Qualcomm (QCOM) and CME Group (CME) report earnings. On Thursday, look for financial results from Cigna (CI), Dow (DOW), DowDuPont (DWDP), Kellogg (K) and Under Armour (UA). The BLS releases productivity and labor-costs data for the first quarter – nonfarm productivity is expected to rise 1%, down from the 1.9% report in the last quarter of 2018. The busy business week ends with earnings reports from American Tower (AMT), Dominion Energy (D) and Noble Energy (NBL) on Friday. The BLS releases its Employment Situation Summary for April – economists forecast a 175,000 rise in nonfarm payrolls. Down from March’s 196,000 gain.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

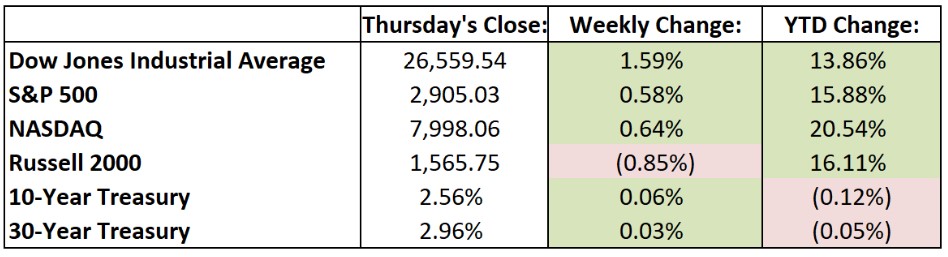

In a holiday-shortened week of trading, equities were essentially flat. Weakness in the health care sector due to increasing political headlines was offset by solid gains in industrial stocks, driven by solid earnings results and better-than-expected manufacturing data from China. It was a very quiet four days on Wall Street trading desks, as anemic trading volumes were some of the lowest seen in the past year. The Cboe Volatility Index, or VIX (also known as the “fear index” – it’s a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options), slipped below 13, further reflecting the current relatively complacent environment for many investors. For the past week, the Dow Jones Industrial Average (DJIA) rose 147.24 points to 26,559.54, while the S&P 500 dipped just over 2 points to 2905.03. The tech-heavy NASDAQ edged up slightly, closing at 7998.06. Apple (AAPL) and Qualcomm (QCOM) settled hours after a case in federal court began on iPhone patent royalties – QCOM shares rallied on the news. Strength in the initial public offering (IPO) market continued as Pinterest priced at $19 per share – two dollars above its expected range – resulting in a valuation of $12.6 billion. Later in the week, the stock rose 28% to $24.40.

Looking Ahead:

First-quarter earnings season takes center stage this week, with about one-third of the S&P 500 components reporting financial results. Monday brings earnings reports from Halliburton (HAL), Kimberly-Clark (KMB), Zions Bancorp (ZION) and Cadence Design Systems (CDNS). Many markets across the globe, including those in Germany, Hong Kong and the United Kingdom, are closed in observance of Easter. Tuesday is full of more earnings reports with numbers expected from Coca-Cola (KO), Harley-Davidson (HOG), Procter & Gamble (PG), Nucor (NUE) and Verizon Communications (VZ). Northern Trust (NTRS) and Wells Fargo (WFC) host their annual stockholders meeting in Chicago and Dallas, respectively. The Census Bureau reports new-home sales data for March – economists forecast a 652,000 seasonally adjusted annual rate, down from February’s 667,000 print. Wednesday brings financial results from Anthem (ANTM), Caterpillar (CAT), Visa (V), Microsoft (MSFT) and General Dynamics (GD), among many others. Thursday includes earning reports from Amazon.com (AMZN), Ford Motor (F) and Bristol-Myers Squibb (BMY). The Bank of Japan announces its monetary policy – expectations call for the central bank to keep its key short-term interest rates at negative 0.1%. The busy business week ends on Friday with earnings numbers from Chevron (CVX), Exxon Mobil (XOM) and Archer-Daniels-Midland (ADM).

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

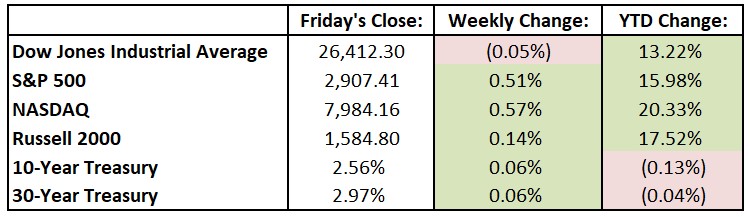

Global equity markets ended the week nearly flat, as solid earnings reports (largely from large U.S. banks on Friday) offset somewhat disappointing economic data. The International Monetary Fund cut its 2019 global growth forecast from 3.5% to 3.3%, pointing to tighter money, trade disputes, policy uncertainties and declining confidence for the estimate change. The week ended on a high note as markets were encouraged by solid bank earnings in the U.S. (led by JP Morgan Chase (JPM)) and a big acquisition in the energy space (Chevron (CVX) agreed to buy Anadarko Petroleum (APC)). For the past week, the Dow Jones Industrial Average (DJIA) dipped 12.69 points to 26,412.30, while the S&P 500 inched up 0.5% to 2907.41. The tech-heavy NASDAQ was up 0.57%, closing at 7984.16. Brexit drama continued, as talks continued between Conservative and Labour parties in the U.K.. Theresa May traveled to the Continent on what a German newspaper called her “begging tour”, seeking a longer extension past the April 12th deadline. The E.U. has offered a new deadline of October 31st. Walt Disney (DIS) hosted an investor day on Thursday, at which it unveiled new content and financial projections for its coming streaming service, Disney +. The stock popped 11.5% on Friday, finishing at its highest close ever ($130.04). Tiger Woods rallied from behind on Sunday to win the Masters golf tournament, his first major win since 2008.

Looking Ahead:

Monday is April 15th – Tax Day! Earning season picks up steam, with reports expected from Citigroup (C), Goldman Sachs (GS) and M&T Bank (MTB). Apple (AAPL) and Qualcomm (QCOM) face off in a San Diego courtroom over various patent disputes. Tuesday is a busy one for earnings results – look for numbers from Bank of America (BAC), Johnson & Johnson (JNJ), Netflix (NFLX), and IBM (IBM), among others. The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market Index for April – economists forecast a 63 reading, up from March’s 62. Wednesday brings earnings reports from Abbott Laboratories (ABT), Bank of New York Mellon (BK), Morgan Stanley (MS), Crown Castle International (CCI) and PepsiCo (PEP). The Census Bureau reports the trade deficit in goods and services for February – expectations are for a $54 billion deficit after a $51.1 billion shortfall in January. Earnings reports continue in force on Thursday, with results out from American Express (AXP), Honeywell International (HON), Travelers (TRV) and many more. Pinterest, the online image-search company, will begin trading on the New York Stock Exchange under the ticker PINS – it is expected to go public at $15 to $17 per share. Financial markets throughout the world are closed for Good Friday.

The Tufton Capital Team hopes that you have a wonderful week and a Happy Holiday!

Last Week’s Highlights:

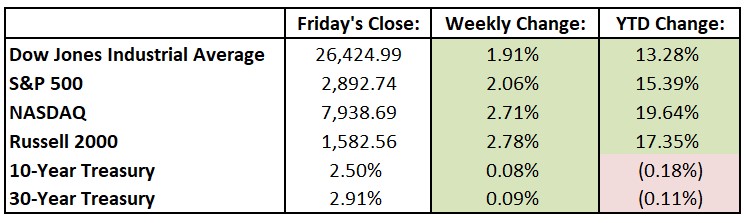

Global equities were strong last week, with the S&P 500 finishing higher each day (capping off seven straight trading sessions in the green for the index). International stocks, especially those in emerging markets, had a solid five days, and cyclical sectors outperformed the defensive ones. Positive economic results from China, the world’s second-largest economy, was the main catalyst for the global rally. The China March Purchasing Managers’ Index (PMI) showed a return to expansion after over six months of mild contraction, signaling that the tax cuts and other policies may be producing faster growth than previously expected. Domestically, the March jobs report (196,000 new jobs) showed that hiring rebounded last month following a soft reading in February. For the past week, the Dow Jones Industrial Average (DJIA) rose 496.31 points, or 1.91%, to 26,424.99, while the S&P 500 advanced 2.06% to 2892.74. The tech-heavy NASDAQ was up 2.71%, closing at 7938.69. Chinese officials came to Washington last week for the sixth round of trade talks. President Trump indicated that discussions are going well and that both sides are aiming for a deal next month. Across the pond, despite a hard Brexit looming for England on April 12th, the House of Commons continued to vote down plans presented by Prime Minister Theresa May.

Looking Ahead:

The business week begins with Synopsys (SNPS) holding its annual meeting of stockholders in Sunnyvale, California. The Final Four hoops championship game is Monday night, with Virginia playing Texas Tech for the NCAA tournament title. On Tuesday, The Bureau of Labor Statistics releases its Job Openings and Labor Turnover Survey for February – the consensus estimate is for 7.54 million job openings, in line with January’s print. Bank of New York Mellon (BK) hosts its annual shareholders meeting. On Wednesday, Delta Air Lines (DAL) and Bed Bath & Beyond (BBBY) discuss their quarterly earnings results. The Treasury Department releases the U.S. budget statement for March – economists forecast a $179 billion deficit after a $234 billion shortfall in February. Wednesday is National Siblings Day. Walt Disney (DIS) webcasts its investor day on Thursday. The BLS releases its producer price index for March – consensus estimates call for a 1.8% year-on-year rise after a 1.9% gain in February. The Masters golf tournament tees off in Augusta, Georgia. First Republic Bank (FRC) and PNC Financial Services Group (PNC) report earnings on Friday. Bristol-Myers Squibb (BMY) holds a special shareholder meeting to vote on merging with Celgene (CELG). The deal is expected to win approval after two leading proxy advisory firms backed the combination.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

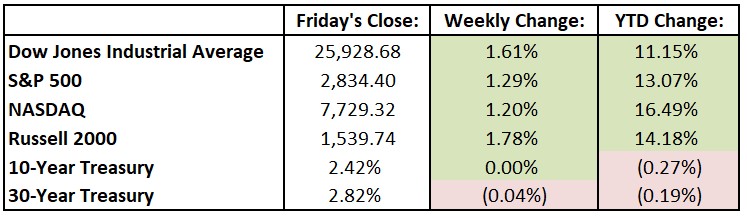

U.S. equities ended the week and the quarter on a high note. For the first quarter, the S&P 500 recorded its strongest quarterly performance in a decade, rising 13% and leaving the index just 3% from its all-time high. Much of this year’s market rally has been fueled by investor relief that central banks may be willing to back off of their interest rate-increase campaigns given slower global growth. Markets now see a rate cut as a possibility in 2019, a different view from when the year started with market expectations for at least one rate hike. For the past week, the Dow Jones Industrial Average (DJIA) rose 426.36 points, or 1.6%, to 25,928.68, while the S&P 500 advanced 1.3% to 2834.40. The tech-heavy NASDAQ was up 1.2%, closing at 7729.32. The yield curve continued to be on investors’ minds last week as it tried to straighten itself out – the 10-year Treasury closed Friday at 2.41% while three-month bills were 2.40%. The yield curve briefly inverted several weeks ago for the first time since 2007, raising investors’ concerns about the state of the economy. As a reminder, an inverted yield curve means that long-term Treasury yields (the 10-year note in this case) are lower than both the three-month and one-year yields. Such an inversion has been a reliable indicator of a looming recession. Last week also saw the IPO of Lyft (LYFT) – the new shares took off, resulting in a $22 billion market cap for the ride-hailing company.

Looking Ahead:

Monday is the first day of April (Rabbit, Rabbit!) and the first day of the second business quarter. It’s also April Fools’ Day, so please look out. The week starts with the release of retail sales data for February by the Census Bureau – economists forecast a 0.3% rise after a 0.2% bump in January. Excluding autos, retail sales are seen gaining 0.3% after rising 0.9% in January. On Tuesday, earnings results will be released by GameStop (GME), Walgreens Boots Alliance (WBA) and Lamb Weston Holdings (LW). Dow begins regular trading on the New York Stock Exchange under the ticker symbol DOW after a split from DowDuPont. The Census Bureau releases its Durable Goods report for February – economists forecast a 0.5% decline, down from January’s gain of 0.3%. Tuesday is World Autism Awareness Day. On Wednesday, ADP releases its National Employment Report for March – consensus estimates call for a gain of 170,000 in private-sector employment after an increase of 183,000 in February. Earnings will be out from Acuity Brands (AYI) and Signet Jewelers (SIG). Constellation Brands (STZ) hosts a conference call to discuss financial results on Thursday. On Friday, the Bureau of Labor Statistics releases its Employment Report for March – consensus estimates are for a 175,000 increase in nonfarm payrolls after a small gain of 20,000 in February. The unemployment rate is expected to remain stable at 3.8%.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

U.S. equities ended last week lower as global growth concerns outweighed favorable news that the Federal Reserve would keep interest rates at current levels. The yield curve briefly inverted for the first time since 2007, raising investors’ concerns about the state of the economy. An inverted yield curve means that long-term Treasury yields (the 10-year note in this case) are now lower than both the three-month and one-year yields. Such an inversion has been a reliable indicator of a looming recession. Disappointing European manufacturing data, along with a more dovish Federal Reserve, resulted in a 10-year Treasury yield trading at the lowest level in over a year (2.459% as of Friday’s close). For the week, the Dow Jones Industrial Average (DJIA) fell 346.55 points, or 1.3%, to 25,502.32, while the S&P 500 dropped 0.8% to 2800.71. The tech-heavy NASDAQ lost 0.6%, closing at 7642.67. The Department of Justice told Congress on Friday that it had received the report on special counsel Robert Mueller’s investigation into Russian interference in the 2016 election. Mueller found that President Trump and his campaign did not conspire with Russia, but no conclusion was drawn on whether Trump obstructed justice. Britain’s Prime Minister Theresa May’s plan to use the threat of a long delay to pressure the House of Commons to support her European Union exit plan fell apart. Blue jeans inventor Levi Strauss (LEVI) returned to the public markets with an IPO of $17 a share. LEVI first went public in 1971 but was again taken private in 1985. The stock soared on its opening day, rising 32% and resulting in a $8.7 billion market cap for the denim company.

Looking Ahead:

The week kicks off with an earnings report from Red Hat (RHT). Apple (AAPL) announce its plans for video- and news-subscription services at this much-anticipated corporate event. McCormick (MKC), KB Home (KB) and Cronos Group (CRON) release their quarterly financial results on Tuesday. The Census Bureau reports its new residential construction data for February – consensus estimates are for a seasonally adjusted annual rate of 1.25 million housing starts and 1.31 million building permits. Earnings reports continue on Wednesday, with numbers out from Lennar (LEN), Paychex (PAYX) and At Home Group (HOME). The Census Bureau releases the U.S. international trade balance in goods and services for January – economists forecast a $57.5 billion shortfall for the month. Accenture (ACN) hosts a conference call on Thursday to discuss earnings results. The National Association of Realtors releases its Pending Home Sales Index for February – consensus estimates call for a 0.5% rise after a 4.6% jump in January. Thursday is also opening day for Major League Baseball – play ball! The week ends with quarterly reports from BlackBerry (BB) and CarMax (KMX) on Friday. The Institute for Supply Management releases its Chicago Purchasing Managers Index for March – economists forecast a 61.7 reading, down from February’s 64.7. Ride-sharing company Lyft goes public on the NASDAQ exchange under the ticker symbol LYFT with an estimated company valuation in the $21 – $23 billion range.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

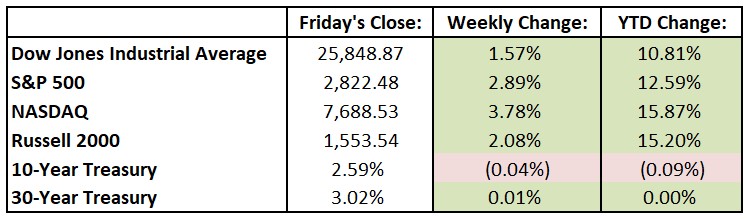

U.S. equities returned to their winning ways last week as stocks posted their best five day run since November. The Dow Jones Industrial Average (DJIA) rose 398.63 points, or 1.6%, to 25,848.87, while the S&P 500 advanced 2.9% to 2822.48. The tech-heavy NASDAQ gained 3.8% for the week to 7688.53. While the global economy is always on investors’ minds, macro factors were on the back burner last week as the attention was largely focused on individual stocks. The week began with news of the tragic crash of a Boeing 737 MAX 8 jet in Ethiopia. Boeing (BA) is a member of the Dow Jones, an index that calculates weighting by share price rather than market capitalization, so the stock’s price movement had an especially amplified impact on the DJIA throughout the week. Other individual names highlighting the tape included GE (GE), Tesla (TSLA), Facebook (FB) and Apple (AAPL). Friday was the busiest trading day so far this year, as the day marked a quarterly collision that traders call “quad witching”. This occurs when equity and index futures and options all expire on the same day. Adding to the action, dozens of S&P 500 indexes were scheduled to rebalance their holdings at the end of the day. The House of Commons took a series of Brexit votes last week after Prime Minister Theresa May returned with what she called European Union “legal concessions”. Her new Brexit plan quickly suffered another defeat in the House. The White House submitted a $4.7 trillion 2020 budget to Congress that featured cuts in safety-net and discretionary items and large additi0ns to defense and border protection.

Looking Ahead:

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for March on Monday – expectations call for a 63 reading, up slightly from February’s 62. Marriott International (MAR) discusses earnings prospects for 2021. On Tuesday, FedEx (FDX), HD Supply Holdings (HDS) and Tencent Music Entertainment (TME) release their quarterly results. Nvidia (NVDA) holds its annual investor day in San Jose, CA. Wednesday brings financial results from General Mills (GIS) and Micron Technology (MU). Starbucks (SBUX) and Agilent Technologies (A) hold their annual stockholder meetings. The Federal Reserve is on center stage Wednesday as the FOMC announces its monetary-policy decision. The central bank is widely expected to keep its benchmark federal-funds rate unchanged at 2.25% to 2.5%. On Thursday, earnings reports will be released by Conagra Brands (CAG), Nike (NKE) and Darden Restaurants (DRI). The Conference Board reports its Leading Economic Index for February – consensus estimates call for a 111.5 reading, a tad bit higher than January’s 111.3. The business week ends with Tiffany (TIF) reporting quarterly financials on Friday. The Census Bureau releases wholesale inventories data for January – economists forecast a 0.3% decline after a 1.1% jump in December.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

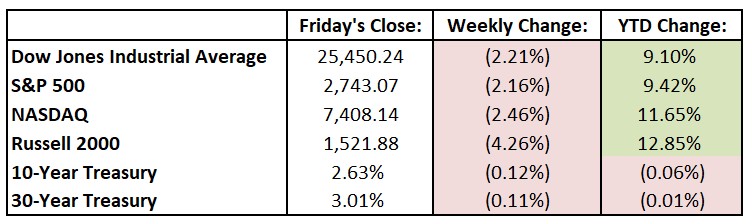

Major U.S. equity markets closed out their worst week since December, largely due to increasing worries about slowing economic growth around the globe. Investors grew more concerned about the fate of a trade agreement between the U.S. and China, and Thursday’s decision by the European Central Bank (ECB) to deploy additional stimulus contributed to global economic concerns. Domestically, Labor Department data released on Friday showed that U.S. nonfarm payrolls rose a seasonally adjusted 20,000 in February, falling well short of economists’ expectations for 180,000 new jobs. The economic news wasn’t all gloomy, however, as the unemployment rate decreased to 3.8% from 4% the preceding month, while wages grew 3.4% from a year earlier – the strongest pace since April of 2009. For the week, the Dow Jones Industrial Average (DJIA) fell 576.08 points, or 0.2%, to 25,450.24, while the S&P 500 declined 2.2% to 2743.07. The tech-heavy NASDAQ led the weekly declines, closing down 2.5% to 7408.14. The markets, however, still sit on nice gains for the year, with both the Dow and S&P still up over 9% for 2019. Saturday marked the 3,653rd day since domestic markets began their bull run in the wake of the financial crisis. The S&P 500 index has returned 400% (including reinvested dividends) since the March 9, 2009 market bottom.

Looking Ahead:

Earnings season winds down with several financial reports this week, including ADT (ADT), Stitch Fix (SFIX) and Coupa Software (COUP) on Monday. The Census Bureau reports retail sales data for January – economists forecast a flat reading after a 1.2% decline in December. Excluding autos, retail sales are seen rising 0.2% after falling 1.8% in December. Try to stay awake on Monday, as it’s National Napping Day. The U.K.’s House of Commons will vote on Prime Minister Theresa May’s revised Brexit deal on Tuesday, as the deadline for Britain’s exit looms. Dick’s Sporting Good (DKS) releases its quarterly earnings results. On Wednesday, the Bureau of Labor Statistics reports its producer price index (PPI) for February – economists forecast a 0.2% rise after a 0.1% decline in January. Adobe (ADBE), Broadcom (AVGO) and Dollar General (DG) release their financials on Thursday. The Census Bureau announces new-home sales data for January – expectations are for an annual rate of 615,000, down from December’s 621,000 print. The business week ends with Friday’s report by the Bank of Japan of its monetary policy decision. The central bank is widely expected to leave its key interest rate at negative 0.1%.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

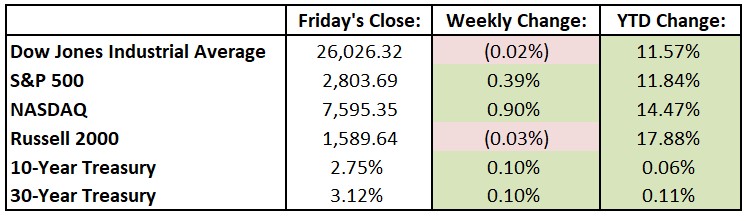

Despite a bumpy week, U.S. equity markets are off to their best start to a year in three decades, closing out February with gains of roughly 3%. Gains year-to-date have lifted the Dow Jones Industrial Average (DJIA) and the S&P 500 to within 4.3% of their records (the indices are up 11.6% and 11.8%, respectively, for the year). For this past week, the DJIA slipped 5.49 points, or 0.02%, to 26,026.32, while the S&P 500 advanced 0.39% to 2803.69. The tech-heavy NASDAQ edged up 0.90% for the week to 7595.35. Federal Reserve Chairman Jerome Powell testified before Congress, reiterating that the Fed was close to reducing its balance sheet. Gross Domestic Product (GDP) came in at 2.6% for the fourth-quarter of 2018, slightly beating estimates, and full-year GDP was 2.9%. The White House announced that it would delay the March 1st trade deadline for additional tariffs on Chinese goods as negotiations progressed. Michael Cohen’s testimony and the U.S.-North Korea summit in Vietnam generated plenty of headlines but few market implications.

Looking Ahead:

Earnings season nears its end with reports from Salesforce.com (CRM) and Ctrip.com (CTRP) on Monday. The Census Bureau reports construction spending data for December – analysts forecast a 0.3% gain after a 0.8% rise in November. Tuesday is Mardi Gras – the party starts with financial reports from Ciena (CIEN), Ross Stores (ROST), Target (TGT) and Kohl’s (KSS). The Census Bureau is back with its new-home sales data for December – expectations are for a seasonally adjusted annual rate of 580,000 units, down from 657,000 in November. On Ash Wednesday, earnings reports will be released by Dollar Tree (DLTR), Brown-Forman (BF) and Guidewire Software (GWRE). Estee Lauder (EL) and Exxon Mobil (XOM) host investor days in New York. Wednesday is also National Oreo Day for the sweet tooths out there. On Thursday, Costco Wholesale (COST), Kroger (KR) and H&R Block (HRB) report their earnings for the past quarter. The European Central Bank announces its monetary-policy decision – the bank is widely expected to keep its key interest rate at negative 0.4% due to falling growth projections for the euro zone. The business week ends with Vail Resorts (MTN) releasing its financial results.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

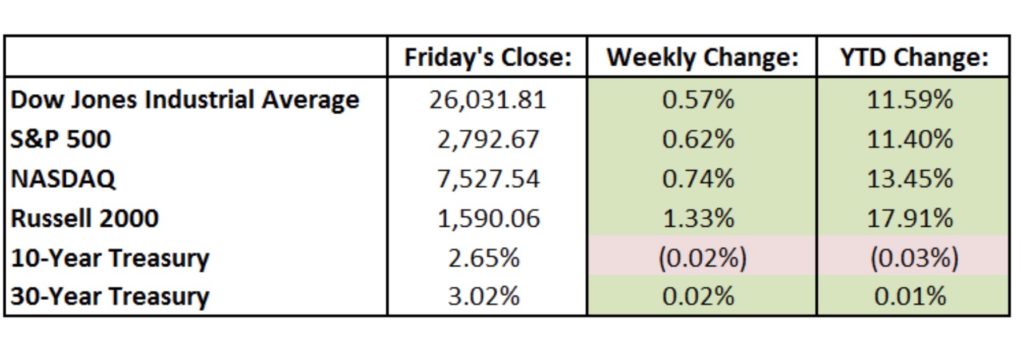

U.S. equity markets extended their winning streak to nine consecutive weeks and are on track for their largest early-year advance in three decades. A more flexible approach to monetary policy from the Federal Reserve, a stronger-than-expected corporate earnings season and easing U.S.-China trade tensions have helped fuel investor enthusiasm. For this past week, the Dow Jones Industrial Average (DJIA) rose 148.62 points, or 0.57%, to 26,031.81, while the S&P 500 advanced 0.61% to 2792.67. The tech-heavy NASDAQ gained 0.74% for the week to 7527.54. The DJIA and S&P 500 indexes are now sitting at 3% and 4.7%, respectively, below last year’s all-time highs. Sixteen states joined to file a suit opposing President Trump’s declaration of a national emergency over the Southern border. These states argue that the move violates the constitutional provision that Congress appropriates funds. House Democrats also prepared to vote on a resolution opposing the step. Trouble continued in Venezuela, as Trump threatened the country’s military that it would “lose everything” if it remained loyal to President Maduro. Talks of a busy year for IPOs continued, as ride-hailing company Lyft and on-line image-search operator Pinterest filed to possibly go public in the coming months. The much anticipated (at least in Tufton’s offices) annual letter from Warren Buffett came out Saturday morning. Topics ranged from Berkshire Hathaway’s frustration with finding good “elephant-sized acquisitions” to new accounting rules. Importantly, Buffett remains sanguine about the health of the U.S. economy.  Looking Ahead:

Looking Ahead:

Etsy (ETSY), Mosaic (MOS) and Shake Shack (SHAK) report quarterly results on Monday. The Federal Reserve Bank of Dallas releases its Texas Manufacturing Outlook Survey for February – forecasters call for a 4.5 reading, well above January’s 1.0 print. Earnings continue on Tuesday, as we’ll see numbers from Home Depot (HD), Mylan (MYL), Macy’s (M) and Discovery (DFS). Fed Chairman Jerome Powell is scheduled to deliver the central bank’s semi-annual Monetary Policy Report and provide testimony before the Senate Banking Committee. The Conference Board releases its Consumer Confidence Index for February – consensus estimates are for a 125 reading, slightly higher than January’s. JP Morgan Chase (JPM) and T. Rowe Price Group (TROW) host their 2019 investor days. On Wednesday, earnings reports are due from American Tower (AMT), Best Buy (BBY), Campbell Soup (CPB) and Lowe’s (LOW). Chairman Powell is back in action, as he’ll appear before the House Financial Services Committee. Edison International (EIX), Nordstrom (JWN) and Gap (GPS) report financials on Thursday. The day also brings preliminary fourth quarter U.S. GDP data from the Bureau of Economic Analysis – consensus estimates are for 2.5% growth, down from the third quarter’s 3.4%. Friday is the first day of March and brings the end of the 90-day negotiating period agreed upon by Trump and Chinese President Xi Jinping. Trump has hinted that the deadline could be extended. The day also brings earnings results from Marriott International (MAR), Foot Locker (FL) and Dentsply Sirona (XRAY).

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

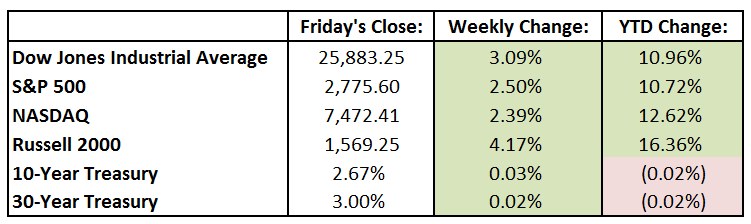

U.S. equity markets continued moving higher, as the Dow Jones Industrial Average (DJIA) completed its eighth-straight winning week. Rising optimism about talks with China, combined with a newly accommodative Federal Reserve, have helped push domestic stock markets higher by over 10% since the year began. For this past week, the DJIA rose 776.92 points, or 3.1%, to 25,883.25, while the S&P 500 advanced 2.5% to 2775.60. The tech-heavy NASDAQ gained 2.4% for the week to 7472.41. The House and Senate agreed to a compromise on border security, hoping to avoid another government shutdown. Although President Trump signed the funding bills on Friday, he also declared a “national emergency” and seeks to find funds elsewhere for his wall. Earnings season continued last week, and two-thirds of S&P 500 companies have reported their fourth-quarter results so far. Earnings are on track to have grown 13% from a year ago, marking the fifth straight quarter of double-digit earnings growth. Amazon.com (AMZN) pulled out of its HQ2 New York plan after being hit by opposition from local groups and politicians.

Looking Ahead:

U.S and Canadian financial markets are closed on Monday in observance of Presidents Day and Family Day, respectively. On Tuesday, earnings season powers on with 46 S&P 500 components releasing financials this week. Tuesday’s earnings include results from Walmart (WMT), Noble Energy (NBL) and Medtronic (MDT). The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for February – economists expect a 60 reading, up from January’s 58. On Wednesday, we’ll see more fourth-quarter numbers from GoDaddy (GDDY), Analog Devices (ADI), CVS Health (CVS) and Entergy (ETR). Thursday brings the Census Bureau release of its Advance Report on Durable Goods. Expectations call for December durable-goods orders to be up 1.7% after rising 0.7% in November. Domino’s Pizza (DPZ), Zillow Group (Z) and Hormel Foods (HRL) report earnings. On Friday, the University of Chicago hosts its annual U.S. Monetary Policy Forum. AutoNation (AN), Wayfair (W) and Cabot Oil & Gas (COG) are among the companies reporting financials Friday. Warren Buffett’s eagerly awaited annual shareholder letter will be released by Berkshire Hathaway on Saturday.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

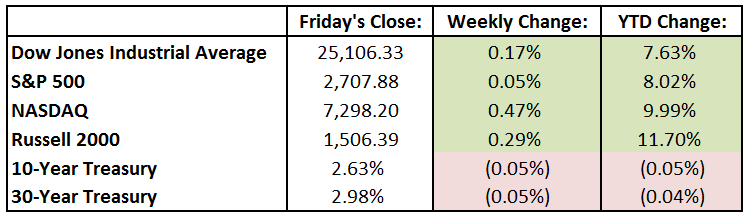

Strong quarterly earnings results, led largely by several technology companies, fueled an early-week rally in U.S stock markets. The fun was short-lived, however, as trade and global economic worries weighed on equities later in the week. Despite this volatility, the main U.S. indices were essentially flat for the week, as the Dow Jones Industrial Average rose 0.17% and the S&P 500 was up just 0.05%. The technology-heavy NASDAQ ended 0.47% higher, led largely by solid weekly performances from Microsoft (MSFT) and Apple (AAPL). Investors remained focused on U.S. trade negotiations with China as well as reports of soft economic data coming out of Europe. Regional banks BB&T (BBT) and SunTrust (STI) announced their merger in a $28 billion all-stock deal, the largest since 2009. Earnings season continued, highlighted by Google-parent Alphabet (GOOG) reporting its fourth quarter results. While GOOG reported sales and earnings that exceeded expectations, the stock slipped as investors worried about higher costs and lower margins. Walt Disney (DIS) also beat analysts’ forecasts, as the company launched the Disney+ streaming service and completed the acquisition of 21st Century Fox.

Looking Ahead:

The week begins with earnings results from Loews Corp. (L), Brighthouse Financial (BHF) and Restaurant Brands (QSR) on Monday. Japan’s financial markets are closed for National Foundation Day. The Bureau of Labor Statistics reports the Job Openings and Labor Turnover Summary (JOLTS) for December on Tuesday. Economists forecast a seven million reading, up from November’s 6.9 million. Earnings will be released by Under Armour (UA), Martin Marietta Material (MLM) and Activision Blizzard (ATVI). On Wednesday, the BLS reports the consumer price index for January – consensus estimates call for a year-over-year rise of 1.5%, down from December’s 1.9%. Reporting season continues, with results coming from Cisco Systems (CSCO), American International Group (AIG) and Hilton Worldwide Holdings (HLT). The Census Bureau reports data on business inventories for November on Thursday. Earning will be released by Applied Materials (AMAT), CBS (CBS), Waste Management (WM) and Zoetis (ZTS). The week ends with financial results from Deere (DE) and Newell Brands (NWL). The BLS reports its export and import data for January – prices are expected to decline by 0.2% for both exports and imports.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

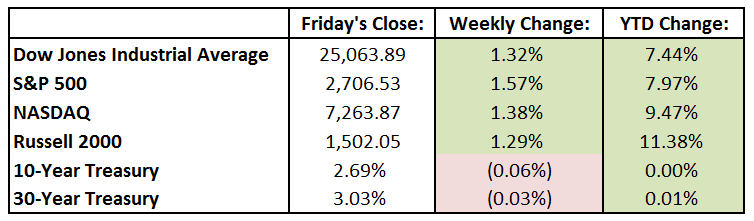

Corporate earnings and the Federal Reserve dominated business headlines last week, leading to continued strength for U.S. equities. The Dow Jones Industrial Average (DJIA) rose 326.69 points, or 1.3%, to 25,063.89, while the S&P 500 advanced 1.6% to 2706.53. The tech-heavy NASDAQ gained 1.4% for the week to 7263.87. The Dow was up 7.2% last month, its best January since 1989. Last week saw a large batch of earnings results, providing a continued tailwind to U.S. equities. Nearly half of the companies in the S&P 500 have posted results so far, with 70% surpassing analyst expectations. Companies in the index are on track to post year-over-year earnings growth of 12%, marking the fifth straight quarter of double-digit earnings increases. On Wednesday, Fed Chairman Jerome Powell indicated that the case for raising interest rates “has weakened somewhat”, easing concerns about tighter monetary policy in the U.S. Results from the Labor Department on Friday exceeded expectations as U.S. nonfarm payrolls rose a strong 304,000 in January, further evidence of a strong economy. The New England Patriots defeated the L.A. Rams 13-3 in the lowest-scoring game in Super Bowl history, leading the Pats to yet another Lombardi Trophy.

Looking Ahead:

Fourth-quarter earnings season remains in full swing, with 90 S&P 500 components reporting financial results this week. Monday brings earnings reports from Google-parent Alphabet (GOOG), Gilead Sciences (GILD) and Clorox (CLX). The Census Bureau releases its final Durable Goods report for November, with economists forecasting a 1.5% rise after falling 4.3% in October. Monday is also World Cancer Day. Tuesday begins the Chinese New Year, with many stock markets closing across Asia in observance of the start of the Year of the Pig. We’ll see earnings from Chubb (CB), Walt Disney (DIS), Viacom (VIA) and Becton Dickinson (BDX). The State of the Union will take place Tuesday night. Wednesday includes financial results from Boston Scientific (BSX), General Motors (GM), MetLife (MET) and Eli Lilly (LLY). The Census Bureau releases its Trade Balance in Goods and Services for November – the estimate is for a deficit of $54 billion. The Bank of England announces its monetary policy decision on Thursday, with the central bank expected to keep its benchmark interest rate at 0.75%. Earnings releases are expected from Kellogg (K), Twitter (TWTR), Yum! Brands (YUM) and Fiserv (FISV). The busy week ends with financial results from Exelon (EXC), Hasbro (HAS) and Phillips 66 (PSX).

The Tufton Capital Team hopes that you have a wonderful week!