Company Spotlight: Helmerich & Payne (Ticker: HP)

Helmerich & Payne (Ticker: HP) is a contract driller that provides well-drilling services for oil and gas exploration and production, specializing in meeting the unconventional needs of the Shale Boom. Counting some of the best oil and gas companies among its clients, HP leads the market in unconventional onshore drilling rig services, having developed a rig uniquely suited to drill horizontal shale wells with outstanding efficiency. The company primarily operates through its 343 US-based onshore rigs, though it also operates offshore and internationally in Latin America.

Since the 1990s, the rig specialist has secured a position at the forefront of the Shale Revolution through a history of principled innovation, anticipating the demands of the market to make drilling faster, safer, more adaptable, more mobile, and exploit any opportunity to increase the output on a drilling site. The company first introduced its FlexRig technology in the late 1990s to provide the market with a rig that has increased mobility and an ability to drill at a range of depths. The first two models of the FlexRig line, FlexRig1 and the FlexRig2, were designed to drill at depths between 8,000 feet and 18,000 feet. In 2001, HP introduced the FlexRig3 with enhanced safety features and an even wider range of depth capability – from 8,000 to 22,000 feet. The company next focused on increasing the efficiency of the drill site as a whole. The FlexRig4 in 2006 introduced a “skidding” feature that gave improved mobility, allowing up to 22 wells to be drilled on a single pad space. In 2011, the FlexRig5 continued this trend and facilitated long lateral drilling of multiple wells in a single location. But the most important contribution of recent years has been the FlexRig’s ability to adapt to unconventional horizontal shale wells with staggering efficiency. The rigs, in fact, are capable of fetching daily rates nearly 50% higher than their peers.

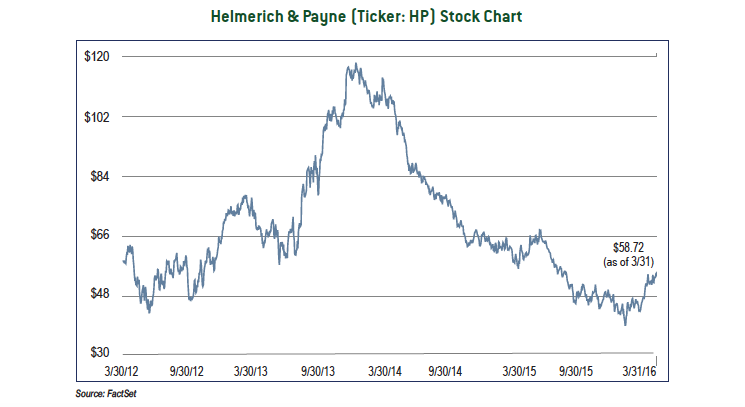

Despite uncertainty in the energy markets, Helmerich & Payne is trading at an attractive valuation. Though forecasting the sales and earnings may prove to be difficult, conventional valuations of onshore drilling companies can be calculated on the basis of the value per rig and per unit of horsepower. Given the company’s market share and the exceptional efficiency delivered by their rigs relative to competitors’, Helmerich & Payne is more than likely to command a premium rate on either basis. Previously, acquirers have paid as much as $24 million per rig in precedent transactions, according to investment bank Johnson Rice. At a valuation of $24 million per rig, Helmerich & Payne is worth $87 per share. On a basis of horsepower, acquirers have paid as much as $17,500 per unit. Based on this valuation, the company is worth nearly $97 per share.

More than likely, Helmerich & Payne will not be acquired, but their market position and current valuation provide a solid margin of safety for investors. Its management has proven to be prudent and conservative with their capital, distinguishing the company as one of the few in the energy universe that entered the downturn without any debt. Further, Helmerich & Payne has paid a dividend every year since 1977, and the stock is currently yielding about 5%. In a no-to-low growth world, we would be happy to be “paid to wait.”