Company Spotlight: VF Corp. (Ticker: VFC)

by Scott Murphy

VF Corp. (Ticker: VFC) is one of the largest apparel and footwear companies in the world. VF has a diverse portfolio of brands, including five with revenue exceeding $1 billion: The North Face, Vans, Timberland, Wrangler, and Lee.

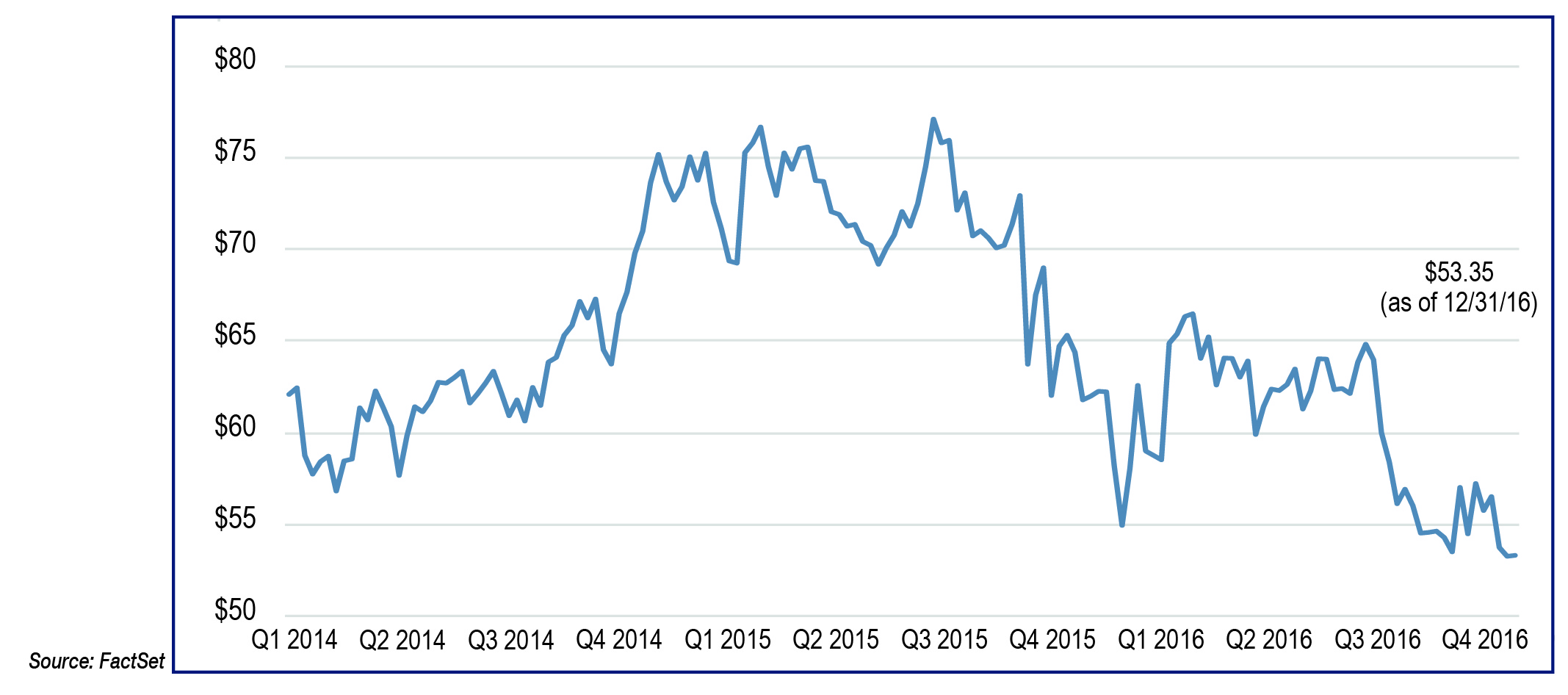

The stock has underperformed the market by (16%) in 2015 and (24%) in 2016. This 40% relative underperformance to the S&P 500 should prove to be a nice entry point. It seems Wall Street is questioning VFC’s ability to maintain its prior growth. Other issues potentially causing a drag on the stock include a strong dollar, which has impacted earnings growth over the past few years, and some downgrades by Wall Street analysts.

VF Corp is a pioneer in inventory management, enabling them to partner with their customers (retail stores) to effectively and efficiently get the right assortment of products that matches consumer demand in a real-time environment. Retailers value this “just in time” inventory replenishment system since it allows them to minimize inventory costs. Internally, VF is organized into four segments: Outdoor and Action Sports, Jeanswear, Imagewear, and Sportswear/Contemporary Brands. VF derives approximately 70% of revenues from the Americas, 20% from Europe and 10% from its Asia Pacific business.

Steven Rendle will become the new CEO in the first quarter of 2017. He is currently the President of VF and his tenure with the company began when VF purchased The North Face in 2000. This was a planned transition and he is succeeding current CEO, Eric Wiseman, who will continue as the Chairman of the Board. With an improvement in earnings slated for next year due to better internal performance coupled with a reinvigorated consumer, the stock is ripe for a recovery in 2017.

VF Corp. (Ticker: VFC)