Investment Opportunity of a Lifetime

As Warren Buffet said, “Be fearful when others are greedy and greedy when others are fearful.” Maryland investors do not need a “high-powered” New York investment advisory firm to follow this advice. Our Baltimore-based firm believes so strongly in these words that we’ve placed the quote at the top of the agenda for our weekly investment committee meeting. It’s so easy to get caught up in the emotional side of investing because it is our emotions about money that drive us to invest in the first place. We all love to make money and hate to lose it—greed and fear are the engines of the markets no matter where you live.

As Warren Buffet said, “Be fearful when others are greedy and greedy when others are fearful.” Maryland investors do not need a “high-powered” New York investment advisory firm to follow this advice. Our Baltimore-based firm believes so strongly in these words that we’ve placed the quote at the top of the agenda for our weekly investment committee meeting. It’s so easy to get caught up in the emotional side of investing because it is our emotions about money that drive us to invest in the first place. We all love to make money and hate to lose it—greed and fear are the engines of the markets no matter where you live.

There are many reasons why truly successful investors are terrific at what they do. Foremost is their ability to take the emotion out of investing, which allows them to sell closer to peaks and buy nearer the bottom. One doesn’t have to look much further than downtown Baltimore to find famously successful investors—Bill Miller of Legg Mason and Brian Rogers of T. Rowe Price come to mind.

Most individual investors do the opposite, and play entirely to their emotions, as they chase yesterday’s winners and dump their losers at precisely the wrong time. One thing I can say with some certainty—by the time the individual investor hears about the next great investment, be it at the cocktail party or networking event, it has already made most of its move. A good piece of advice might be to sell short any investment you hear about socially. We all would like to be involved in an investment mania, whether it is an individual investment or entire asset class, but not after it is well under way.

Most individual investors do the opposite, and play entirely to their emotions, as they chase yesterday’s winners and dump their losers at precisely the wrong time. One thing I can say with some certainty—by the time the individual investor hears about the next great investment, be it at the cocktail party or networking event, it has already made most of its move. A good piece of advice might be to sell short any investment you hear about socially. We all would like to be involved in an investment mania, whether it is an individual investment or entire asset class, but not after it is well under way.

Over the last 15 years, we have experienced rolling “bubbles” throughout the investment landscape. Each of these “bubbles” burst with rather violent effects on our collective balance sheets. We all remember the Tech Wreck of the late 1990’s, the current housing collapse, and $150 oil. The last one into and the last one out of these investments seems to be the average investor. This is mainly due to greed. I can’t tell you how many clients would call me when I purchased a non-tech stock in the late 1990’s to ask me if I was paying attention. And by the way, they had several stock tips for me if I couldn’t come up with some technology stocks to buy. We had clients borrow money from their investment accounts to invest in real estate in 2006 and 2007 because “real estate is the best investment you will ever make… it always goes up.”

Although Maryland has been somewhat insulated, today’s investment landscape is terrible and most of the calls we are getting are about buying gold. That should probably tell you something about that investment. The European sovereign debt crisis is not going well. The US economic recovery is in jeopardy and the possibility of a double-dip recession is growing. Foreign bank liquidity is being tested, as they have not adequately written down sovereign debt holdings to reflect market realities—more simply put, European banks are afraid to lend to each other. Concerns over the possibility of another Lehman Brothers event occurring abound. China is slowing its growth rate, which could affect world-wide economic growth. These are the main issues of the day confronting investors. It all smells bad. Fear is everywhere… what an excellent opportunity for long-term investors.

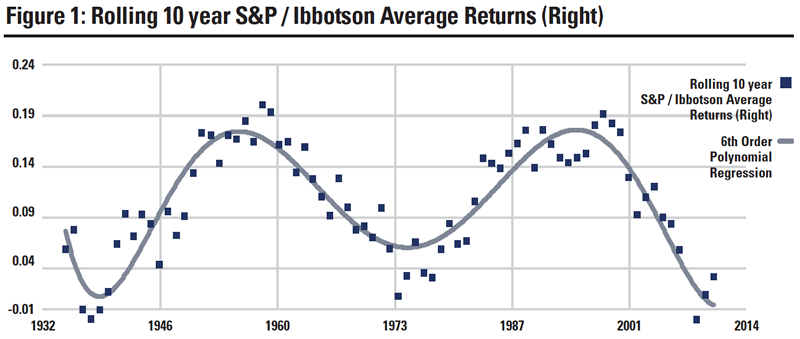

This is precisely when investors should buy stocks. As the accompanying chart shows, stocks tend to follow cyclical patterns and we are currently at the low end of that cycle. The chart measures the compound average annual rate of return over rolling 10-year periods. The period from 2000-2010 marked the worst rolling ten-year period for stocks since 1932.

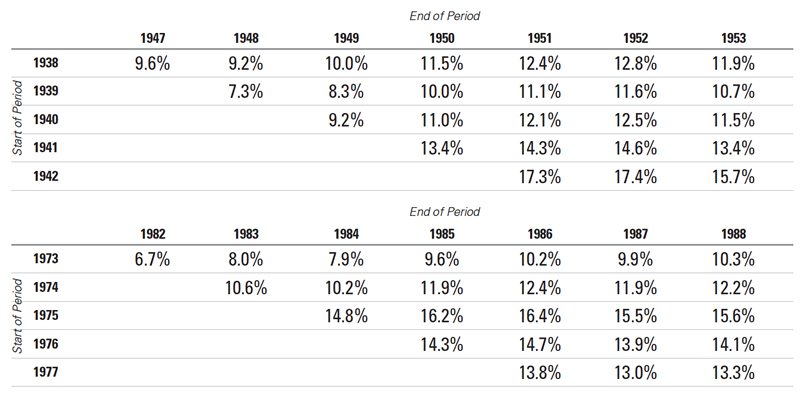

In the two prior cyclical lows for stocks, outsized returns were experienced, but not right away. In the accompanying table, we show the 10-year compounded average annual returns for the periods at the bottom of the cycle. The outsized returns, in both cases, did not come right away. They came several years after what proved to be the bottom of the market. Of course, we only know the bottom of the market cycle after the fact. The data suggest, however, that perhaps we have seen the bottom. The “sweet spot” to experience those outsized returns seem to be a few years after the low point of the cycle—it appears to be about now.

Beyond the cyclicality of stocks, there are many other data points to suggest stocks are inexpensive. One indicator that is not discussed very often is the fact that the market is yielding more than a 10-year Treasury. The last time this occurred for an extended period of time was in 1958. The problem with many investors is that they demand instant gratification regarding their investments—they are greedy. Investors typically are given choices between asset classes. Their primary choice is deciding whether to buy bonds or stocks. Investing in a 10-year Treasury offers investors a 2% yield with the promise of returning your original investment. Stocks are collectively yielding more than 2%, and the worst outcome in the history of the stock market over a 10-year holding period was -1.4%. Since 1926, there have been only four 10-year holding periods with negative compound returns. They occurred for holding periods ending in 1938, 1939, 2008 and 2009. Two major economic events, The Great Depression and “The Great Recession,” highlighted these holding periods.

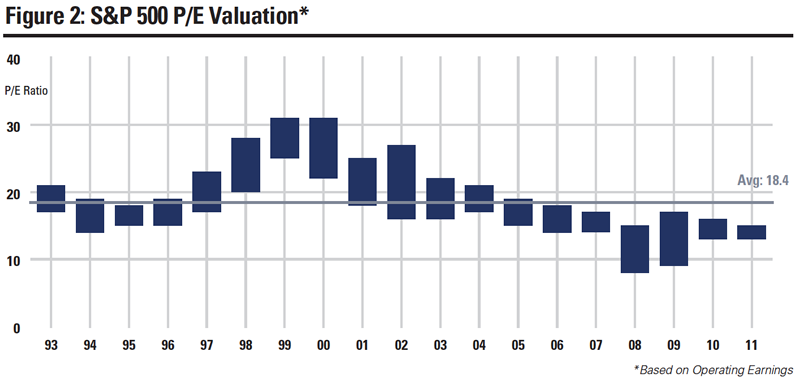

Another indicator is the Price-Earnings (P/E) multiple. The S&P 500 is trading at just 12 times the current year’s estimated earnings. In spite of the economic environment, U.S. corporate profits continue to grow. Companies have done an excellent job of managing their businesses through this difficult backdrop. Corporate profits have exceeded the prior peak level experienced in 2007 and are now at record levels. In spite of this, investors have been driving down the multiple that they are willing to pay for a dollar of earnings. The bar graph shows the recent historical trend for the P/E multiple. The time period selected shows the P/E multiple has been contracting since the bear market of 2000-2002. Single digit P/E multiples are very rare. We experienced them in the market lows of 2008-2009 and during the 1970’s, when inflation was running in the double digits. An old valuation adage is you take the number 20 and subtract the current inflation rate to get a “fair” value P/E multiple. If you apply a 3% inflation rate, that method results in a P/E multiple of 17, and we are at 12. Stocks are cheap by valuation and much of the fear is probably in the price.

Another indicator is the Price-Earnings (P/E) multiple. The S&P 500 is trading at just 12 times the current year’s estimated earnings. In spite of the economic environment, U.S. corporate profits continue to grow. Companies have done an excellent job of managing their businesses through this difficult backdrop. Corporate profits have exceeded the prior peak level experienced in 2007 and are now at record levels. In spite of this, investors have been driving down the multiple that they are willing to pay for a dollar of earnings. The bar graph shows the recent historical trend for the P/E multiple. The time period selected shows the P/E multiple has been contracting since the bear market of 2000-2002. Single digit P/E multiples are very rare. We experienced them in the market lows of 2008-2009 and during the 1970’s, when inflation was running in the double digits. An old valuation adage is you take the number 20 and subtract the current inflation rate to get a “fair” value P/E multiple. If you apply a 3% inflation rate, that method results in a P/E multiple of 17, and we are at 12. Stocks are cheap by valuation and much of the fear is probably in the price.

To find some inexpensive stocks in the market, Maryland investors have to look no further than their own state. Coventry Health (CVH) is a national managed healthcare company trading at just nine times next year’s earnings. Lockheed Martin (LMT), a global defense contractor, has seen its share price drop due to uncertainty surrounding defense spending. The stock is now trading at just ten times next year’s earnings. Corporate Office Properties (OFC) is a Columbia-based REIT that specializes in properties that service the US Government and the defense technology industry. Shares are trading at over 50% off the 5-year high and yield almost 7%. This is not intended as an endorsement to buy these stocks, but is intended as a starting point to find value in the stock market. Our firm owns a position in LMT.

To be sure, there is a lot to frighten us in the investment landscape. The European Financial Crisis looks unsolvable. The US economy is not growing and unemployment is over 9%. China is trying to slow its growth. Political tensions are high everywhere. So, be greedy when others are fearful. Buy stocks for the long term, as we could be experiencing the buying opportunity of a lifetime.

References: FactSet, MorningstarDisclosures: At the time the article was submitted, Hardesty Capital Management’s clients owned shares of Lockheed Martin Common Stock and Corporate Office Properties Preferred but do not hold positions in any of the other companies mentioned. The author does not own any of the companies discussed. This article is not a recommendation or offer to buy or sell any security.

—as published in CFA Society Baltimore’s annual Baltimore Business Review