Tax Loss Harvesting

Hardesty Capital Management spends a considerable amount of time searching the universe of publicly traded companies for undervalued stocks to purchase in our clients’ accounts. Aside from research roles, our portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Hardesty Capital Management spends a considerable amount of time searching the universe of publicly traded companies for undervalued stocks to purchase in our clients’ accounts. Aside from research roles, our portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, and with the end of the year quickly approaching, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must pay a longterm capital gains rate of 15%. The tax savings increases for the highest income earners in the 39.6% Federal tax bracket, who must pay 20% on long-term capital gains. Plus, depending on where you live, you may be subject to capital gains taxes at the state level. Our clients in Maryland know this all too well!

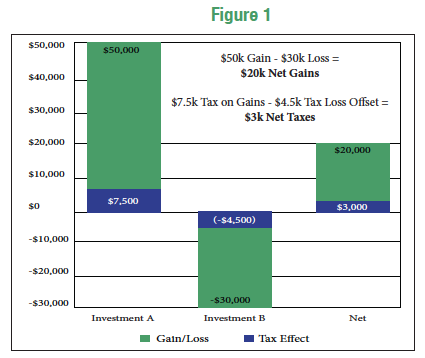

Take for example a single person who has an annual income of $100,000. He would be in the 15% long-term capital gains bracket. In his brokerage account, he has a realized long-term capital gain of $50,000 in Investment A and an unrealized long-term capital loss of $30,000 in Investment B. If he sells his shares of the losing stock, he can offset the $50,000 gain against the $30,000 loss, resulting in $20,000 of net long-term gains. If he does not harvest the loss, the Federal tax on his $50,000 long-term gain would be $7,500. By partaking in this tax loss harvest, he will save himself $4,500, which would have otherwise been a piece of his Federal tax liability for the year (See Figure 1).

Portfolios with large unrealized gains will likely have some positions that have unrealized losses. Although a loss may be hard to look at, sometimes it’s best to bite the bullet and clean these losers out of a portfolio. This management strategy allows investors to free up cash in the portfolio, which can be deployed into other, more attractive investments. Moreover, it can be prudent to realize losses sooner rather than later because many investors wait until the last few days in December, which can result in selling stocks into weakness.

While it’s important to avoid the tax tail wagging the investment dog in your overall investment strategy, a disciplined approach to managing tax liabilities is an important component of wealth management.