The First Quarter of 2016: Lessons in Investing

The first quarter started with a bang as the stock market began a precipitous decline. By the end of the fifth trading day of the year, the Dow Jones Industrial Average and Standard & Poor’s 500 indexes had recorded losses of 6.2% and 6.0%, respectively. The losses are both records for the time period. The selling persisted and the market continued to head lower. The trough was reached in mid-February, but not before the major averages gave back over 11%. As stomach churning as the first six weeks were, the markets bounced back very strongly. After all the gyrations, we closed the quarter almost exactly where we started.

Interest rates were a sharp contrast to the stock market during the quarter. The 10-year U.S. Treasury bond started the year at 2.3%. As the stock market was reaching a low in mid-February, interest rates were also falling with the 10-year reaching 1.66%. As interest rates fall, the price of bonds rise. Bond prices have remained strong, and we closed the quarter with a 10-year treasury yield of 1.81%.

If we view the first quarter as a voting booth for the Federal Reserve’s decision to raise interest rates last December, we find that investors voted “nay.” The Fed has gotten the message and has turned more dovish with regards to monetary policy. The new stance was punctuated during a speech that Fed Chair Janet Yellen delivered to the Economic Club of New York on March 30, where she articulated that only gradual increases in the federal funds rate are likely to be warranted in coming years.

The first quarter reinforces some valuable lessons in investing. First, equity investing is a long-term proposition. Timing the market in January and February may have led to big losses while missing the market’s recovery. Second, fixed income securities, whether they are Treasury bonds, corporate bonds or certificates of deposit, provide valuable diversification that helps reduce an investment portfolio’s volatility.

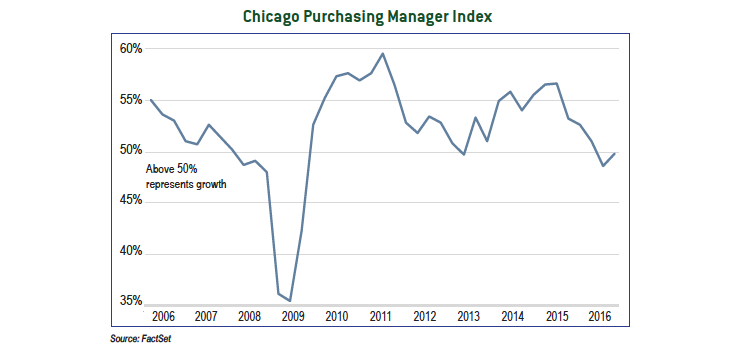

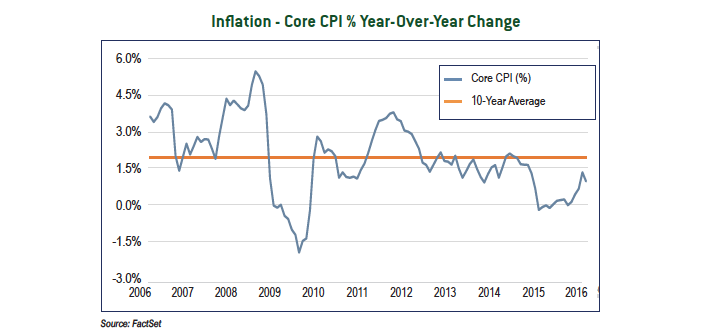

The economic environment continues to improve slowly. Employment numbers remain at impressive levels, and housing starts and housing permits are trending higher. More importantly, manufacturing, which has been volatile and generally weak over the past year, demonstrated strong growth in March. The combination of moderate economic growth with little inflation continues to be a winning combination for the stock market. Although inflation is low today, we closely monitor the situation for change. The Fed’s accommodative policy has provided a strong tailwind for nine years. An unanticipated increase in inflation could lead to a shift in Fed policy, resulting in headwinds. The dramatic collapse in the price of West Texas Intermediate crude oil from about $140/barrel in 2008 to $33/barrel earlier this year is clearly disinflationary. The price of energy percolates through many goods and services. However, the lowest prices are most likely behind us as supply and demand have worked towards equilibrium. A rise in energy prices will be inflationary to some degree. The response of supply and demand to higher prices will dictate pricing levels and the impact on future inflation.

The stock market gets more attractive as prices continue to languish. Obstacles to profit growth like a strong U.S. dollar and weak international markets are now being lapped, making year-over-year earnings comparisons easier. Valuations remain reasonable and are supported by the low interest rate environment. Bonds, on the other hand, are less attractive given the big drop in interest rates over the past three months. We are more selective in maturity patterns given the higher prices.

The lessons learned in the first quarter may continue to serve investors well over the balance of the year. Risks and volatility are ever-present. The terrorist attacks in Belgium are a reminder of the geopolitical tensions around the world. The political landscape at home remains unsettled. The presidential election includes a cast of characters with political views that run the gambit and party infighting is headline news. The uneven economic recovery has left many citizens angry and ready for radical change. The uncertainty of the outcome may weigh on the markets as we get closer to the election. As always, we will use the volatility to uncover opportunities as we seek to add value to your portfolio.