The Second Quarter of 2017: Steady As She Goes

by Eric Schopf

The stock market continued to march higher in the second quarter. A solid 4% total return in the second quarter of the year brings performance for the first half of 2017 to around 9%. On June 19, the Standard & Poor’s 500 reached an all-time high of 2,453. The Dow Jones Industrial Average and the NASDAQ markets also hit record highs during the quarter. This strong performance has been accompanied by very low volatility. For example, the stock market fell for three consecutive days just twice during the quarter. Another positive mark was that the largest one-day drop in the S&P 500 during the quarter was 1.82% on May 17, which more than recovered in the five trading days that followed. The lack of volatility in the stock market reflects the placid, stable U.S. economy. This year will mark the eighth consecutive year of economic growth falling in a tight range of 1.5% – 2.5%.

On the other side of the fence, the bond market marched to the beat of a different drum during the quarter. Short-term interest rates moved higher in reaction to Federal Reserve policy, but intermediate- and long-term rates moved significantly lower. The yield on 10-year U.S. Treasuries touched 2.14%, approaching levels that prevailed in December 2015, prior to the start of the Fed’s tightening cycle. Lower long-term rates cast doubt over anticipated future economic growth and the inflationary pressures that typically accompany such growth.

The mixed signals provided by the bond and stock markets will eventually be reconciled. The stock market cannot continue to move higher if the economy falters. Conversely, interest rates cannot continue to move lower if the economy continues to deliver solid growth. This disconnect will be resolved by the Federal Reserve. The Fed raised the Federal Funds Rate by 0.25% in June. This rate increase was the second this year and the fourth so far in the cycle. The lower rates in the bond market suggest that higher interest rates could slow an economy that is already weak by historical standards. Since many commercial and personal loans are adjustable in structure and tied to short-term interest rate benchmarks, further interest rate increases will begin to bite businesses and consumers. The stock market’s performance implies a continued soft touch by the Fed and perhaps questions the need to raise rates in the first place. Inflation continues to trend below the Fed’s 2% target rate, and projections for GDP growth have been tempered.

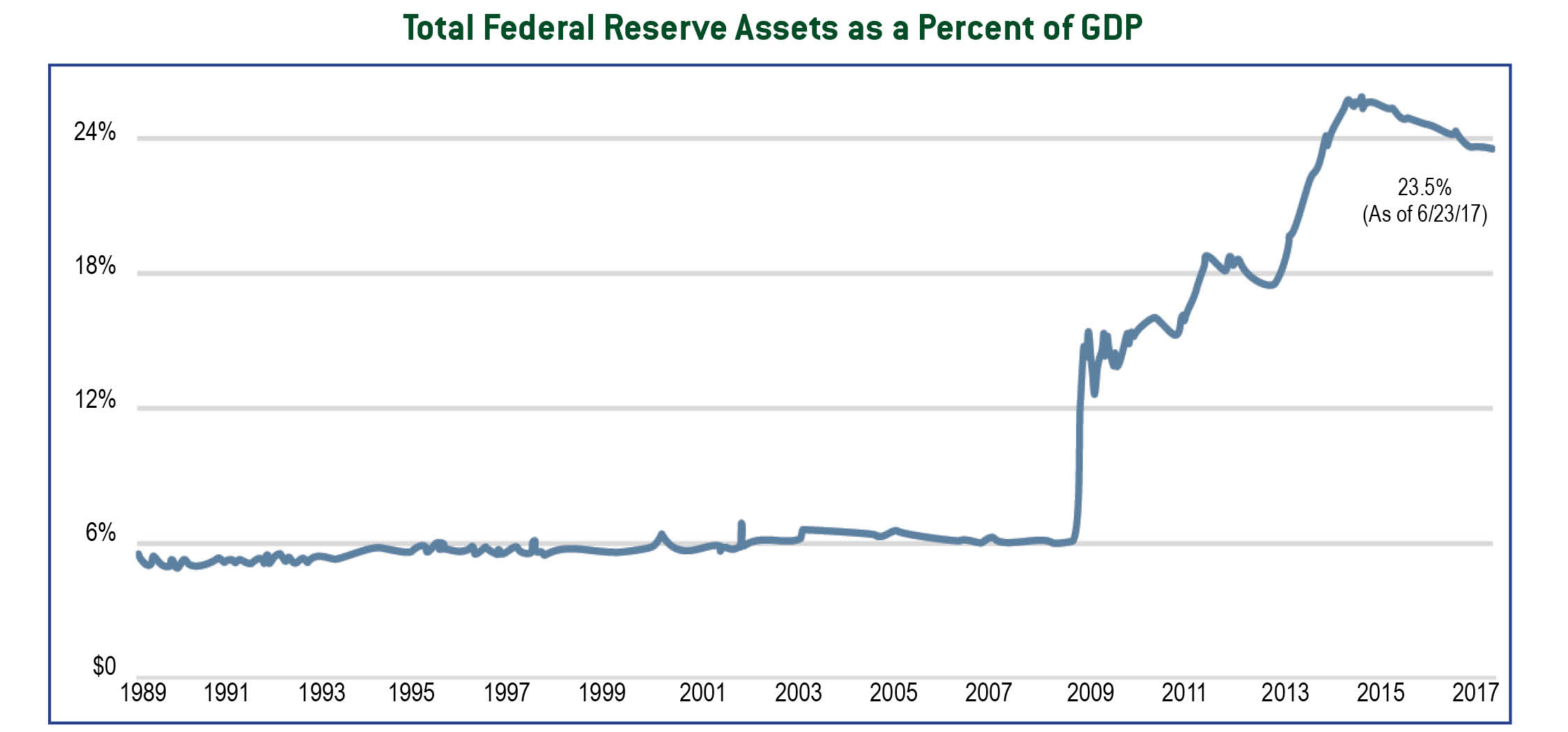

The Fed continues to garner attention as they prepare to normalize their balance sheet. The Fed holds $4.2 trillion in U.S. Treasuries and mortgage-backed securities. The assets were accumulated to push longer-term interest rates lower in an effort to stimulate the economy following the financial crisis. The plan is to let securities mature and cap reinvestment of the proceeds, thereby reducing assets held. The unwinding of the balance sheet, combined with increases in the Federal Funds Rate, should lead to higher interest rates across the yield curve.

The Fed would like to engineer a soft landing – slowing the economy just enough to curb any inflationary pressure but stopping short of throwing the economy into recession. Unfortunately, the Fed has a poor track record here. They are 1 for 16, with their lone victory coming in 1994. That is fifteen recessions in sixteen attempts. This abysmal batting average is exactly why we spend so much time scrutinizing the Fed and providing updates on their activity.

The activity in Washington, or lack thereof, is also very important. The healthcare reform effort is collapsing under the weight of disparate interest groups. The outcome of any reform impacts health insurers, states, hospitals, healthcare providers, real estate owners, pharmaceutical manufacturers and medical device manufacturers. However, the greatest impact may be on tax reform. Repealing and replacing the Affordable Care Act was projected to reduce taxes by $1 trillion. The tax reductions combined with cuts in Medicaid spending were projected to be budget neutral. Keeping the status quo on healthcare will necessitate the need to look elsewhere if any meaningful tax reform is possible.

One area of great activity has been on the regulatory front. Following the Financial Crisis, financial regulations formulated and applied under Dodd-Frank Wall Street Reform and Consumer Protection Act helped purge the system of dangerous practices and forced institutions to rebuild capital bases. Now that most financial institutions are on solid ground, many tentacles of the Act are being modified. The release of the latest Federal Reserve stress test confirms that the time is right for change. All 34 participating bank holding companies passed the test on the first try. The stress test assumed a severely adverse scenario, where unemployment rose to 10%, and there was heightened stress in corporate loan markets and commercial real estate. According to the Federal Reserve, the firms’ Tier 1 capital ratio (which compares high-quality capital to risk-weighted assets) would fall from 12.5% in the fourth quarter of 2016 to 9.2% in the hypothetical stress scenario. The Tier 1 capital level following the adverse scenario would actually be higher than the Tier 1 capital level prior to the financial crisis. Since 2009, the 34 firms have added more than $750 billion in common equity capital. Decreased regulatory burdens will increase the capacity of banks to lend money and pay higher dividends which is a sure positive for the economy.

The outlook going forward continues to be positive. Steady growth, low inflation, and employment gains provide a favorable setting. However, the Federal Reserve has taken additional steps that may disrupt the outlook. Eventually, they will go too far and will tip the apple cart. Until then, steady as she goes. As always, we will continue to monitor the situation and invest to profit and preserve.