Company Spotlight: State Street Corporation (Ticker: STT)

By Eric Schopf

Founded in 1792, State Street Corporation (STT) is headquartered in Boston, Massachusetts. State Street provides a range of financial products and services to institutional investors worldwide. The company has two lines of business: Investment Servicing and Investment Management.

The Investment Servicing business offers accounting, custody, fund administration and shareholder recordkeeping. The company offers its products and services to mutual funds, collective investment funds and other investment pools, corporate and public retirement plans, insurance companies, foundations, endowments and investment managers. They provide some or all of these integrated products and services to clients in the U.S. and in many other markets, including Australia, Cayman Islands, France, Germany, Ireland, Italy, Japan, Luxembourg and the U.K.

As of December 31, 2017, State Street serviced assets under custody agreement of approximately $24.42 trillion in the Americas, approximately $7.03 trillion in Europe and the Middle East and approximately $1.67 trillion in the Asia-Pacific region.

The Investment Management business, through State Street Global Advisors (SSGA), provides a broad array of investment management, investment research and investment advisory services to corporations, public funds and other sophisticated investors. SSGA offers passive and active asset management strategies across equity, fixed-income, alternative and cash asset classes. Products are distributed directly and through intermediaries using a variety of investment vehicles, including exchange traded funds, such as the SPDR® ETF brand. As of December 31, 2017, SSGA had assets under management (AUM) of approximately $2.78 trillion.

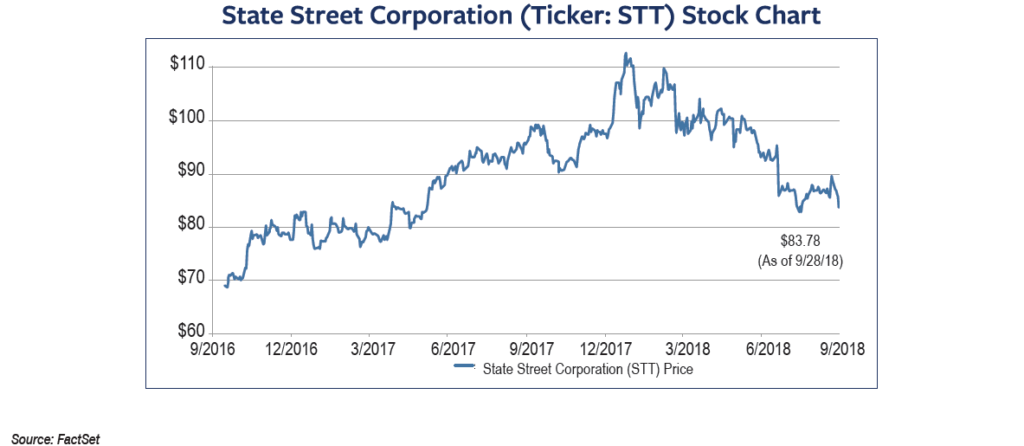

The stock has been weak for a number of reasons. First, the equity market’s recent flattish performance limits growth of assets under custody and assets under management. Second, the flattening yield curve may put pressure on the company’s net interest margins and net interest income. Finally, State Street has recently announced the acquisition of Charles River Development. The acquisition will enhance the scope of operations by improving its front-office capability. However, as with any acquisition, there are inherent risks associated with the deal.

State Street shares have declined 24% from their recent high of $111 and have lagged the peer group. This recent price weakness has created the relative value opportunity.