The Third Quarter: Strong Economy and Surging Corporate Profits

By Eric Schopf

The third quarter brought wet conditions to many areas of the country. We in Maryland experienced the soggiest July ever with nearly 17 inches of rain measured at Thurgood Marshall Airport. Not only was this the wettest July ever, it was within a few inches of being the rainiest month ever for our area. Although we may have been shrouded in clouds, the sun was shining brightly on Wall Street. The Standard and Poor’s 500 provided a total return of 7.71% for the quarter. The total return for the year stands at 10.56% as of September 30.

The impressive market returns reflect a strong economy and surging corporate profits. Second quarter Gross Domestic Product (GDP) grew at 4.2%. Preliminary estimates for the third quarter are 3.1% growth – quite respectable. Third quarter year-over-year earnings growth for the S&P 500 was 18%. We are also gaining clarity on the trade front. The United States – Mexican – Canada Agreement (USMCA) was reached at the end of September. The USMCA will replace the North American Free Trade Agreement, which was implemented on January 1, 1994. Major provisions of the new agreement will impact dairy farmers and automobile manufacturers. More importantly, the USMCA eliminates the uncertainty surrounding nearly $1.2 trillion of combined trade with Canada and Mexico. Trade negotiations, particularly with China, are continuing behind the scenes. The European Union is also unresolved business. These discussions promise to be contentious and may stretch out longer than we like.

The Federal Reserve maintained its methodical approach to normalizing interest rates by raising the Federal Funds rate by 0.25% during its September meeting. Interest rates rose across the curve over the past three months. The yield on the 10-Year U.S. Treasury note has climbed from 2.85% to 3.05%. We touched 3.1% during the quarter, which is the highest seen since 2011. Higher interest rates provide the Fed with the ammunition needed to fight the next recession – interest rate cuts.

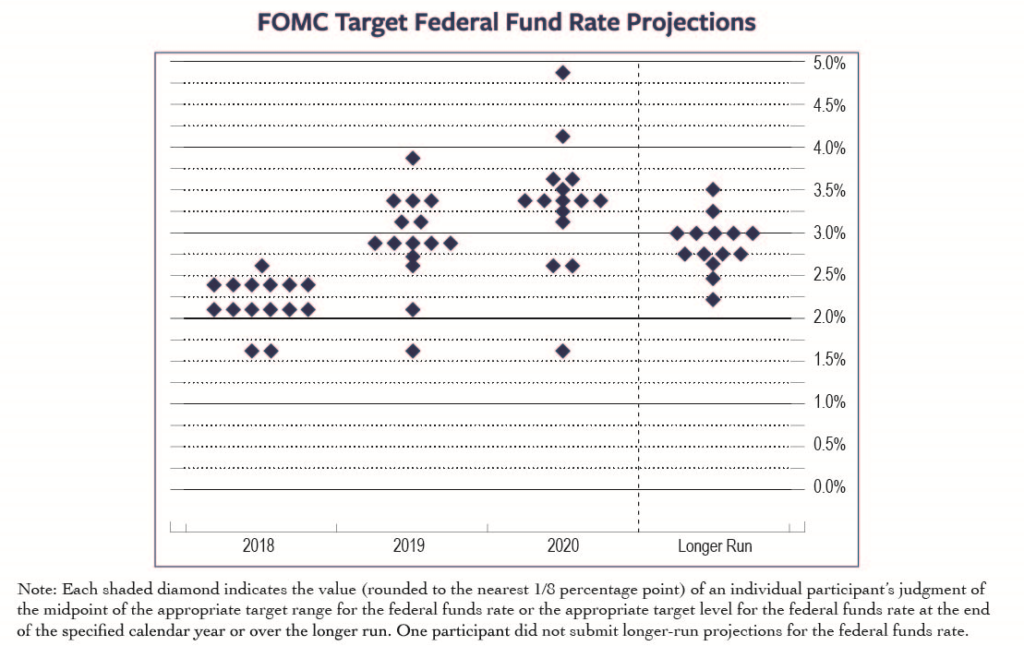

We are clearly in the boom phase of the market cycle. Robust economic growth, tightening labor markets, higher wages and rising product input costs are all present. Inflation should build as GDP remains above trend and labor demand remains high. Aggressive fiscal policy has stoked the furnace. The Fed’s response has been steady and well communicated, so market reaction has been measured with volatility remaining low. The impact of the last few rate hikes has been difficult to gauge given the recent corporate tax cut. Recent weakness in global manufacturing is an indication that higher rates may be beginning to bite. However, recent trade tensions may have also played a role in the dip. The Fed plans to raise interest rates through the balance of the year and into 2019. The Federal Open Market Committee (FOMC) publishes a dot plot chart detailing the target federal funds rate expectations for each of the next five years. The opinion of each of the fifteen Committee members is reflected on the chart, which provides us a glimpse into their crystal ball. Current expectations are for an additional rate hike in December with three more in 2019 and one in 2020.

The dot plot chart clearly reflects an opinion that the economy can withstand more restrictive monetary policy. Although projections are for higher rates, the most recent Federal Reserve minutes excluded prior language that referred to monetary policy as being accommodative. The change in language is a nod to the impact of the eight interest rate hikes over the past twelve quarters. The dot plot may be telling us that the Fed is hawkish on inflation, while the minutes seem to reflect a more dovish stance. The mixed messages reflect a Fed that is becoming more challenged in its efforts to support stable prices and full employment.

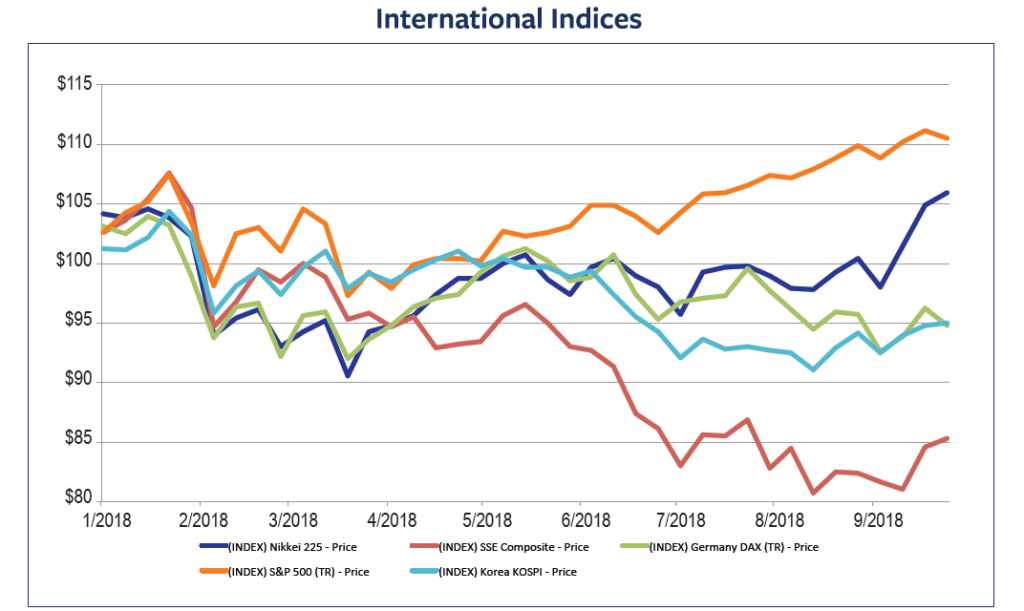

Although the U.S. stock market is strong, the same cannot be said about most major foreign markets (see chart). China, Korea, Germany, and Japan have all struggled to stay in positive territory for the year. Countries with some of the largest trade surpluses have the most to lose from protracted trade disputes or modified trade agreements. Italy, the third largest economy in the Eurozone, is experiencing a slow boil in its credit market due to the wide gap in economic performance with Germany. Diverging economic performance has led to a strong U.S. dollar, wreaking havoc in some emerging markets. Emerging market countries such as Turkey and Argentina, which fund their government through U.S. dollar denominated debt, have been hit hard by higher rates. Strong economic growth and high interest rates relative to these other sovereign nations have led to a collapse in the Turkish lira and the Argentinian peso.

Higher interest rates expose the weakest links in any economic chain. An ongoing analysis by many economists is determining where those weak links lie and whether breakage in the chain may lead to a contagion. Dot com stocks twenty years ago and toxic mortgages ten years ago led to widespread economic and social pain. Although we do not see the current circumstances leading to a wide spread slow-down, we are keeping a close eye on interest rates and the stresses they impose.

The calm stock market is no cause for complacency. We continue to monitor the financial and economic landscape for darkening clouds. Our job is to determine if an umbrella is required or whether we need to come in from the rain.