The Second Quarter of 2018: As a Trade War Looms, What’s an Investor to Do?

By Eric Schopf

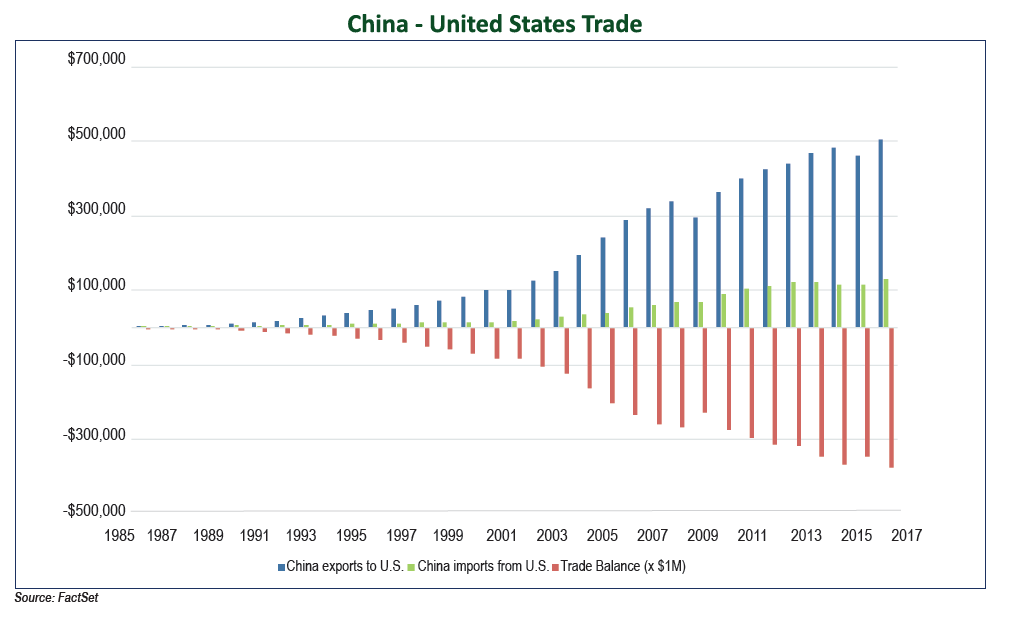

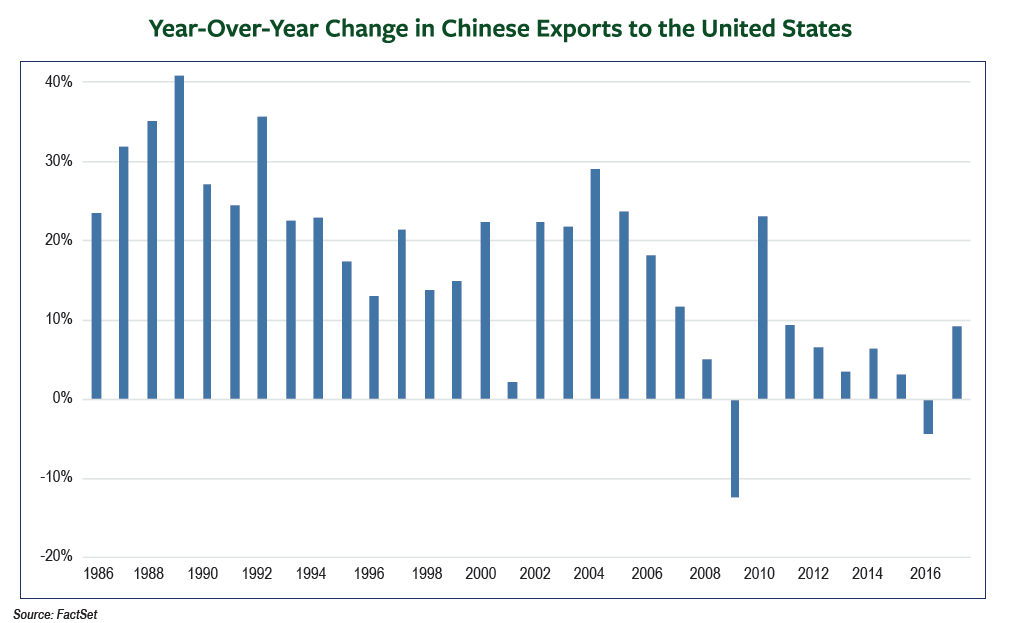

Trade tensions escalated during this past quarter, leaving the markets with a renewed sense of uncertainty. In May, the United States imposed a 25% tariff on steel and a 10% tariff on aluminum imports, in a decision that primarily affects Canada, Mexico and the European Union. These tariffs are in addition to those levied during the first quarter on goods, such as solar panels and washing machines. Furthermore, in mid-June, President Trump announced new tariffs of 25% on up to $50 billion of Chinese goods. As a result, Canada and China, two of our largest trading partners, retaliated with tariffs on various goods imported from the United States. In response, Trump shot back by threatening an additional tariff of 10% on up to $200 billion more of Chinese goods, while also ordering the U.S. Trade Representative to identify an additional $200 billion of goods that would face the same 10% tariff. At this rate, the United States is on track to levy tariffs on nearly 90% of the approximate $505 billion worth of Chinese imports. In 2017, U.S. exports to China were just $133 billion, leading the president to believe he has more leverage in the situation.

While it is too early to determine the impact of the new trade restrictions given the tiered plan of implementation over the coming weeks and months, things are starting to heat up fast. The initial tariff of 25% on $34 billion of Chinese imports went into effect on July 6, and a retaliatory tariff of 25% on $34 billion of United States’ exports to China is set to begin around the same time. For perspective, the U.S. economy is the largest in the world at $20.4 trillion, and China is the second largest at $14 trillion. Given the size of their combined economies, the initial tariffs themselves will have minimal impact. However, we are heading in a potentially dangerous direction. Accusations of unfair trade practices could lead us into a full-blown trade war.

Slower economic growth and the resulting impact on corporate profits are the uncertainties introduced by a potential trade war. Supply chains and distribution channels are complex and at times can be difficult to trace. As a result, the admirable goal of bringing jobs back to America and renegotiating more equitable trade agreements may bring about unintended consequences in the short term. China has become the world’s largest manufacturing base, leaving many U.S. domiciled companies vulnerable to disruptions brought about by protectionist trade measures. In essence, the creation of one job could simply lead to the elimination of another. These uncertainties may also result in deferred capital investment since companies may be reluctant to commit financial resources until potential future trade restrictions are resolved. Moreover, weaker corporate sentiment could spill over to the consumer side and decelerate the strong global growth momentum we are currently experiencing.

The greatest risk is that of rising inflation. Corporations are masters of reducing costs and maximizing profits, and global trade is ultimately a result of the pursuit of profit maximization. Thus, companies either must settle for lower profits as input costs rise or pass the higher costs on to their customers through higher prices. Moreover, a net increase of jobs in the U.S. would most likely be inflationary given the tight labor market. With the unemployment rate now hovering around 4%, companies would likely be forced to offer higher wages to lure new hires. Again, wage pressure would either be absorbed by companies through lower profits or passed along to customers through higher prices. This is not to say that corporations could not address the inflationary pressures through productivity enhancements over the longer term. In the short term, however, they would have to make some tough choices.

Despite the aforementioned disruptive forces, the stock market was strong this quarter and delivered a total return of 3.4%. On the other hand, interest rates were far more volatile, with the yield on the 10-Year U.S. Treasury note opening the quarter at 2.74% and peaking at 3.1% on May 17. Interest rates then beat a hasty retreat to 2.85% on fears that restrictive trade policies would slow economic growth. The Federal Reserve has been on center stage since the financial crisis, and high inflation resulting from new trade restrictions would shine an even brighter spotlight on the Fed. Thus, should inflationary pressure build, their go-slow monetary policy will be put to the test. Lastly, during the second quarter, the Fed raised the federal funds rate by 0.25%. For those keeping score at home, this was the seventh rate increase since the tightening cycle began in December of 2015.

Although global trade garnered most of the headlines during the quarter, robust economic news was prevalent as well. The Federal Reserve Bank of Atlanta now projects second quarter Gross Domestic Product growth as high as 4.1%, which would mark only the fifth time we have posted year-over-year growth that strong since 2005. Further, nonfarm payrolls rose 223,000 in May, which was 33,000 higher than consensus estimates. Moreover, the unemployment rate hit its lowest mark this quarter since April of 2000. For reference, since the United State Department of Labor began tracking the data in 1948, unemployment rates have only been lower in 1968-1969 when they reached 3.4%. This data, coupled with wage growth, which perked up with year-over-year growth of 2.7%, provided the grist for the Fed’s recent interest rate hike. We are gaining some clarity on what companies are doing with their recent tax-cut windfalls as well. The reduction of the corporate income tax rate has unleashed a combination of dividend increases and share buybacks. These are both positive developments for stocks.

The strong economic news is somewhat tempered by the surging U.S. dollar. This year, consistent economic growth and rising interest rates have pushed the dollar higher versus other major currencies. When the dollar is strong, translating foreign currencies to U.S. dollars reduces reported earnings. It also places companies that produce in the U.S. at a competitive disadvantage based on product price. The positive aspects of a strong dollar include lower inflation and a partial offset of anticipated tariffs. Furthermore, the price of oil has steadily risen, and at nearly $80/barrel, Brent crude oil is well above trough levels of $29/barrel reached in 2015. Although prices are a long way from the triple-digit levels experienced from 2011 – 2014, higher energy prices lead to greater spending at the pump. This could siphon consumer spending away from other areas and possibly drag down consumption if prices continue to meaningfully rise in the future.

We exit the second quarter with a tailwind of economic growth and strong corporate profits. However, the uncertainty of trade agreements has brought greater caution to the markets. We will not let the winds of change blow us off course and will continue to monitor the situation to take advantage of the opportunities that the market presents.