The Weekly View (2/5/18)

What’s On Our Minds:

Equity investors have spent the last year enjoying green flashing across their trading screens and have shrugged off economic and geopolitical risk. They’ve cited the strength of the U.S. economy, driven by banner corporate profits and President Trump’s push for lower taxes and reduced regulation. This bullish sentiment drove major indexes to gain more than 20% in 2017 and had the market hitting all-time highs. After a string of records, an eventual pullback should not be viewed as cause for panic.

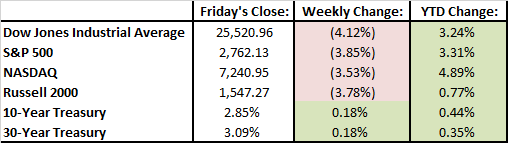

Last week, investors suddenly became skittish as we saw volatility return to equity markets. The Dow Jones and S&P 500 fell by more than 3.5%, posting their worst week since January 2016. The pullback is being attributed to a recent bump in interest rates. Expectations for further Fed policy tightening and stronger economic readings have pushed rates and caught investors’ attention. It should not be forgotten that interest rates are still sitting at historically low levels, and while we are expecting them to rise gradually this year, rates should remain well below levels that risk choking off economic growth.

In times like these Tufton Capital stresses the importance of staying level headed in the face of changing market conditions. In fact, most experts have been predicting this sell off for some time, given that we have enjoyed unprecedented levels of low volatility over the past 12 months. Since 1900, the U.S. has seen 125 corrections of 10% or more (roughly one per year). So, if we end up getting into the 5-10% correction territory, remember this is to be expected annually.

In short, as a firm focused on the long-term growth of our clients’ portfolios, we understand that volatility can be unsettling, but it should not be forgotten that the market is up 52% over the past 2 years and periodic dips should be expected. Occasionally, even the strongest of bull can get tired.

Last Week’s Highlights:

President Trump delivered his first State of the Union address on Tuesday evening. He attempted to stress unity and touted a strong economy and record stock prices. He outlined a path to citizenship for 1.8 million “dreamers” (children who were brought to the U.S. illegally by their parents) in exchange for funding a wall on the southern border and ending a visa lottery system.

Amazon, Berkshire Hathaway, and JPMorgan announced their intention to form a healthcare company that would lower healthcare costs for their employees. The company would be free from profit making incentives.

Fed Chair Janet Yellen ended her last meeting of the Federal Open Markets Committee without raising rates.

Friday’s Jobs Report stated that the US labor force grew by 200,000 in January, beating analyst estimates. Average hourly earnings increased by 2.9% on an annualized basis, the best gain since the early days of the recovery in 2009.

Looking Ahead:

Earnings season will continue to be in full swing this week. On Monday we will hear from Bristol-Myers Squibb, Hess, and Sysco. On Tuesday dozens of companies report including Chipotle, Gilead Sciences, Disney, and General Motors. Wednesday will bring along reports from 21st Century Fox, Humana, and Michael Kors. Thursday’s earnings released will be headlined by Grubhub, Kellogg, Yum Brands, and Tyson Foods. On Friday, we finish the week with reports from Pacific Gas & Electric and Brookfield Infrastructure.