The Weekly View (1/29/18)

What’s On Our Minds:

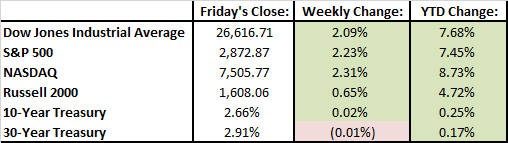

Last week, stocks rallied to fresh record highs, boosted by stronger-than-expected earnings reports from a number of US companies, corporate tax rate reductions, and an improving economy. Believe it or not, the Dow Jones and S&P 500 are both up more than 7% after just one month of trading in 2018. Equity investors who have been long the market are likely riding high and feeling great as we continue to see gains but some might be asking, “how long can this bull run?”

As always, we continue to stress the importance of staying invested over the course of the market cycle. As history has shown us time and time again, it’s nearly impossible to successfully time the market (at the top or the bottom) and long term outperformance can be enjoyed by following a disciplined approach and investing throughout the market’s ups and downs.

Retail investors (those who trade their portfolios non-professionally) have performance that significantly lags the market overall. This dynamic occurs because they tend to act on emotion, selling at the bottom and missing the large early gains of a recovery. There is a common example often given of the costs of missing the “best days in the market” that shows this point, but we find it misleading—missing the worst days is just as good as missing the best days is bad! So instead, we focus on the fact that if you act on emotion, you tend to sell near bottoms. We’re not missing “the best days,” we’re standing on the sidelines for the best months: the recovery itself.

We encourage our clients and friends to remember that we look to the long-term and that downturns are not only “ok,” they are expected, and are a reminder that our understanding of the markets is sound. We look for areas of the market that have good long-term growth. Short-term, temporary problems are at worst inconsequential, and may present a buying opportunity.

It’s easy to say these things when the market is chugging along. But we also remember the panic 10 years ago, when it seemed the world was ending. Even then, we knew of those who called their advisor or portfolio manager in March 2009 and told them to sell it all. That was the absolute bottom, and you would have missed out on one of the longest bull market runs in history.

So, when the downturn comes, just remember: we’ve been here before, we’ll be here again, and we have a plan.

Last Week’s Highlights:

The stock market notched out impressive gains last week. All sectors advanced into the green with telecom as a leader. For the most part, earnings season has shown us that corporations had a positive fourth quarter and most reports have shared a positive outlook for 2018.

Looking Ahead:

It will be a busy week for investors with a slew of important news coming across the wire. Throughout the week, 4th quarter earnings season will be in full swing. President Trump will deliver his State of the Union speech on Tuesday evening. Many are expecting him to provide some color on an infrastructure spending plan. The Federal Reserve will provide an updated policy statement on Wednesday. January’s Jobs Report will be released on Friday.