The Weekly View (7/2/18)

What’s On Our Minds:

Bull Market Long in the Tooth?

Market pundits have recently turned their attention to the growing age of the bull market. Don’t fear what the specialists say; it’s their job to sell papers and they’re likely growing tired of writing about President Trump’s trade policies. In fact, they have been saying this since the bull market began 9 years ago!

Just this past weekend, Barron’s cover story was titled: “Why the Bull Market Could End in 2020.” This harks back to the old saying “a bull markets climb a wall of worry”. For years, the pundits have been saying the bull has gotten “long in the tooth” and that we are in the latter innings of the market cycle. While the threat of a looming recession always warrants a bit of caution for investors it’s not time to head for the exits. In fact, trying to time the market can be a dangerous (and costly) game.

Remember, bull and bear markets are not random or left up to chance and investor sentiment over the long-term is based on fundamentals. While all good things must come to an end and even though the current bull market has lasted longer than the historical average, the current strength of economic and earnings fundamentals suggest that this phase can be extended. Since 1950, the average stock market returns in the final two years of a bull market was 20% per year. While that’s certainly not indicative of what we may see in the near future, it goes to show that serious money can be made at the end of a bull market.

As long-term investors, it’s not our job to predict these market cycles but rather, it’s our job to position our clients’ portfolios for success over the entirety of the market cycle. Remember, as active managers focused on the long term, the Tufton Capital Investment Committee embraces the market cycle and even welcomes volatility. Both bull and bear markets offer unique opportunities that can lead to future success. We don’t head for the exits when good stocks are going on sale, nor do we go on a shopping spree when prices are at all-time highs.

Last Week’s Highlights:

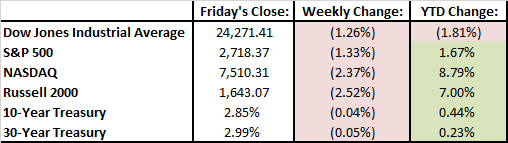

Major indices continued to take a hit this past week, each losing over 1%. Of these indices, the Russell 2000 took the worst of the beatings, followed closely by the tech-heavy NASDAQ Composite, and the Dow Jones Industrial Average, which was pulled lower by poor performance from its latest addition, Walgreens. On the bright side however, the S&P 500 finally broke its 13-day losing streak, which was the longest of the index’s history. Moreover, we are starting to see some interesting ripple effects in the wake of international tariff tensions, as the dollar surged and China’s stock market tanked, giving the United States a strong vote of confidence in the ongoing back-and-forth between the two countries.

Looking Ahead:

The 3rd fiscal quarter began today, but it looks to be a quiet week on Wall Street, as the markets close early on Tuesday and remain closed on Wednesday in observance of Independence Day. We are wishing you and yours a fun and safe July 4th from all of us here at Tufton Capital Management.