The Weekly View (9/4/18)

Last Week’s Highlights:

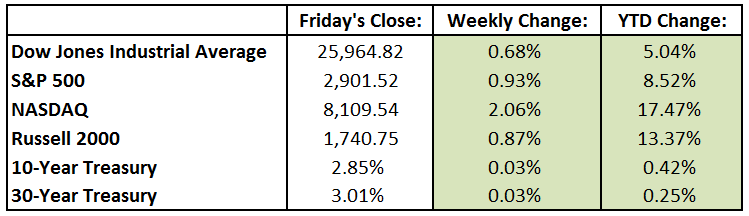

Last week, the major indices trekked higher as an agreement with Mexico signaled that new regulations could replace the North American Free Trade Agreement (NAFTA). The Dow Jones Industrial Average rose 0.7%, while the S&P 500 increased 0.9% and the Nasdaq jumped 2.1%. The S&P 500 and tech-heavy Nasdaq both reached all-time highs – surpassing their records set this past January. For the month of August, the Nasdaq surged 5.9%, the S&P 500 had a total return of 3.3% and the Dow Jones Industrial Average lagged with a total return of 2.6%. Of the 3.3% for S&P 500, Apple was the largest contributor representing 24% of the index’s return.

Looking Ahead:

This week, investors will be focused on the Trade Balance report, to be released at 8:30 AM Wednesday. Wall Street is expecting a deficit of $50 billion for the month of July. On Thursday, data on the Durable Good Orders for July, as well Unit Labor Costs for the 2nd Quarter, will be released. Consensus estimates forecast that Durable Good Orders declined 1.7% in July and Unit Labor Costs declined 0.9%, respectively. Friday is “Jobs Day” as a plethora of information is released regarding the Labor Market. Wall Street is estimating that the economy added 190,000 Nonfarm Payroll Jobs in the month of August. The Unemployment Rate is expected to decline from 3.9% to 3.8% and Hourly Earnings are expected to rise 0.3% month over month.