The Weekly View (1/21/19)

Last Week’s Highlights:

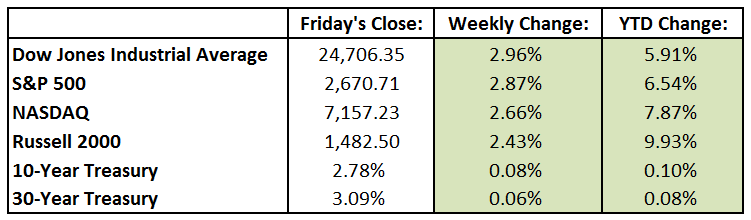

U.S. equities continued their winning ways last week, as the Dow Jones Industrial Average (DJIA) rose 710.40 points, or 3%, to 24,706.35, while the S&P 500 advanced 2.9% to 2670.71. The tech-heavy NASDAQ gained 2.7% for the week to 7157.23. The Dow is now up 5.9% in 2019, its best start to a year since 1997, and the S&P has gained 6.6%, its best start since 1987. Investor appetites for stocks continued as data suggesting that the U.S. economy is still growing and decreased tension in trade talks with China have increased market optimism. Perhaps more importantly, corporate earnings are providing a tailwind to U.S. equities – 55 companies in the S&P 500 have posted their fourth-quarter results, with 76% of the earnings coming in ahead of expectations. The government shutdown dragged on. President Trump remained unyielding, while the House voted for two bills that would reopen the government that then stalled in the GOP-controlled Senate. British Prime Minister Theresa May’s Brexit plan came up for a vote in the House of Commons and was handily defeated, one of the worst losses for a British leader since the 1920s. The Los Angeles Rams (NFC) and New England Patriots (AFC) won their playoff games and will meet each other in Super Bowl LIII in Atlanta on February 3rd.

U.S. markets are closed on Monday in observance of Martin Luther King Jr. Day. Earning season continues on Tuesday with reports from Capital One (COF), Halliburton (HAL), Johnson & Johnson (JNJ), IBM (IBM) and Travelers (TRV). The National Association of Realtors reports existing-home sales data for December (analysts forecast a 5.2 million seasonally adjusted annual rate, down from November’s 5.3 million). Wednesday is busy with more earnings, including results from Abbott Laboratories (ABT), Comcast (CMCSA), Ford (F), Proctor & Gamble (PG) and Texas Instruments (TXN). The Bank of Japan announces its monetary-policy decision, and the Federal Housing Finance Agency reports its House Price Index for November. On Thursday, the Federal Reserve Bank of Kansas City releases its Manufacturing Survey for January. Expectations are for a three reading, equal to December’s, which was the lowest in over two years, reflecting slowing manufacturing activity in the region. Earnings continue with numbers from Bristol-Myers Squibb (BMY), Intel (INTC), Starbucks (SBUX) and Union Pacific (UNP). The busy week concludes with earnings releases from AbbVie, Inc. (ABBV), Colgate-Palmolive (CL), D.R. Horton (DHI) and Synchrony Financial (SYF).

The Tufton Capital Team hopes that you have a wonderful week!