The Weekly View (10/8/18)

Last Week’s Highlights:

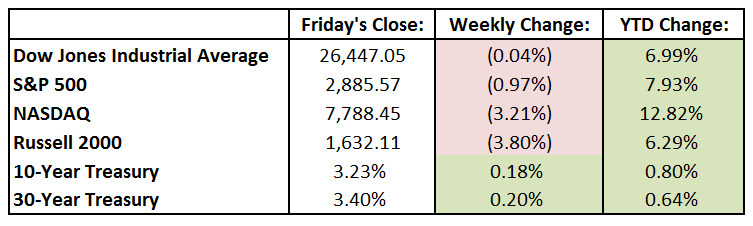

U.S. stocks were lower on the week, as volatility returned along with plenty of news and economic data for investors to digest. After hitting an all-time high early in the week, the Dow Jones Industrial Average (DJIA), along with many other indices, declined largely due to a sudden jump in the 10-year Treasury yield. The yield spiked from 3.055% to 3.227% last week, marking its highest level since May of 2011. As a result, the blue-chip DJIA dropped over 11 points for the week, to 26,447.05, while the S&P 500 fell 1%, to 2885.57. The tech-heavy NASDAQ felt even more pain for the week, dropping 3.2% to 7788.45. Why don’t stocks like these higher interest rates? Aren’t interest rates rising because of solid economic growth, which is a good thing? The answer is yet, BUT this uptick in bond yields brings on concerns that this good economic news may lead the Federal Reserve to tighten more aggressively than has been anticipated. We at Tufton Capital continue to believe that strong earnings and economic growth justifies this rising rate environment, and equities can still perform well despite the increased volatility.

Looking Ahead:

The U.S bond market is closed on Monday in observance of Columbus Day. Markets are closed in Canada for Thanksgiving and in Japan for Health and Sports Day. Proctor & Gamble (PG) holds its annual shareholder meeting in Cincinnati on Tuesday, and the National Federation of Independent Businesses reports its Small Business Optimism Index for September. On Wednesday, the Bureau of Labor Statistics releases its producer price index for September. Honeywell International (HON) hosts an investor conference in New York that day, where it will discuss its spinoff of Resideo Technologies. Thursday brings earnings reports from Commerce Bancshares (CBSH) and Walgreen Boots Alliance (WBA). We’ll also see plenty of economic reports that day, including the consumer price index for September and August’s real average weekly earnings results. The week ends with three of the four largest U.S. banks reporting their third quarter results: Citigroup (C), J.P. Morgan Chase (JPM) and Wells Fargo (WFC) all report results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!