The Weekly View (10/15/18)

Last Week’s Highlights:

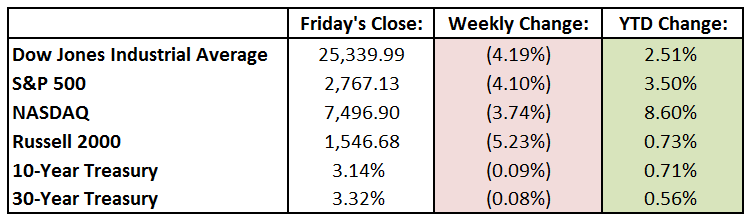

The major indices declined last week, as fears of rising interest rates outweighed several strong corporate earnings reports. The Dow Jones Industrial Average fell 4.2% for the week, while the S&P 500 declined 4.1%. The tech-heavy Nasdaq was down 3.7%, and the small capitalization companies in the Russell 2000 were hurt the most with a 5.2% selloff. On the economic front, investors received insight into inflation with the Producer Price Index (PPI) report. Producer prices were up 2.6% year-over-year. Energy prices fell 0.8% in September, as did food prices, which fell 0.6%. The prices for intermediate unprocessed goods increased 1.7% in the month. The Consumer Price Index (CPI) was also released, offering investors another indicator of inflation. Consumer prices were up 2.3% year-over-year. From last September, fuel and energy commodities were up 16% and 10%, respectively. Transportation services also rose 4%. On the downside, the prices of used cars and trucks fell the most, at 1.5%. Women’s and Girl’s Apparel prices also declined, falling 1%. In other economic news, the NFIB Small Business Index hit its third highest level of all-time. The Michigan Consumer Index dipped slightly in October, reflecting some concerns about personal finances and the long-term economic view. The index, however, remains near historic highs, as the consumer generally has a favorable view of the economy.

Looking Ahead:

Earnings season is underway! Three of the four big banks reported last Friday, and Bank of America reported on Monday morning. The banks reported strong earnings, but overall loan growth continued to slow. Over the weekend, the big-box retailer Sears filed for bankruptcy. Sears was at one point part of the Dow Jones Industrial Average. Quarterly earnings will be the main focus for the remainder of the week. On Tuesday, Morgan Stanley (MS), Johnson & Johnson (JNJ) and Goldman Sachs (GS) will all be reporting in the morning. After the closing bell, investors will hear from International Business Machines (IBM) as well as Netflix (NFLX). On Wednesday, Wall Street will gain further readings from the banking sector when U.S. Bancorp (USB) and M&T Bank (MTB) release their quarterly results. On Thursday, BB&T (BBT) and Phillip Morris (PM) will report before the opening bell and American Express (AXP) will report after the market closes. Finally, on Friday, investors will hear from Procter & Gamble (PG) and V.F. Corporation (VFC).

The Tufton Capital Team hopes that you have a wonderful week!