The Weekly View (10/22/18)

Last Week’s Highlights:

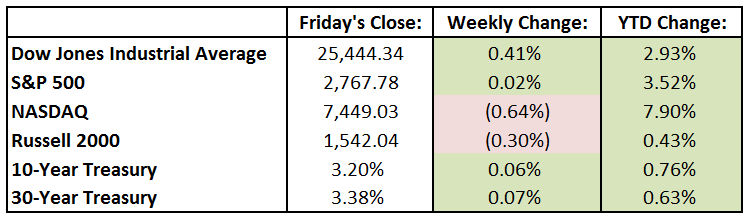

After a crazy week on Wall Street, filled with major earnings reports, Fed minutes and a volatile stock market, the S&P 500 ended the week almost exactly where it started – at 2767.78. The Dow Jones Industrial Average (DJIA) gained 104 points for the week, or 0.4%, to close at 25444.34. Despite weakness in many technology stocks, the tech-heavy NASDAQ managed to close down just 0.6% for the week to 7449.03. As mentioned above, the stock market was quite volatile – it started last week lower, rallied 548 points, or 2.2%, on Tuesday, fell 327 points on Thursday, and failed to hold on to a 200-point gain on Friday. Volatility is indeed back (more on that below). Corporate earnings seasons for third-quarter results picked up steam last week. With the exception of a few negative surprises in the industrial sector, early indications point to strong revenue and earnings growth in aggregate. Some 72% of companies that have reported Q3 earnings so far have topped analyst forecasts. Revenue growth, while still impressive, has not been as strong as the profits seen in the third quarter: some 58% of companies have exceeded top-line analyst forecasts. The suspected killing of Washington Post columnist Jamal Khashoggi in the Saudi consulate in Istanbul dominated headlines late last week, as Saudi Arabia is a very important business partner to the U.S. and many other developed countries. This escalating situation hurt attendance at an investment conference hosted by Crown Prince Mohammed bin Salman, as major figures, including Treasury chief Steven Mnuchin, called.

Looking Ahead:

Earnings season is well underway, as more than 30% of the S&P 500 companies report their third-quarter results over the next five days. On Monday, Halliburton (HAL), Hasbro (HAS), Kimberly-Clark (KMB) and TD Ameritrade (AMTD) lead the earnings charge with their reports. The Chicago Fed releases its National Activity Index for September (consensus estimates call for a 0.18 reading). Tuesday brings another very busy day for corporate earnings, as we’ll hear from 3M (MMM), Caterpillar (CAT), Harley-Davidson (HOG), McDonald’s (MCD), Verizon Communications (VZ), among others. Wednesday includes New Home Sales and the Fed Beige Book on the economics-front, and corporate earnings will be released by Boeing (BA), General Dynamics (GD), Ford (F), Visa (V) and United Parcel Service (UPS). The Census Bureau releases its Durable Goods Report for September on Thursday (consensus calls for a decline of 1.8%). Many technology companies will report that day, including Alphabet (GOOG), Amazon.com (AMZN), Intel (INTC) and Twitter (TWTR). The week ends with the Bureau of Economic Analysis releasing its advance estimate for Q3 GDP (estimates are for 3.3%). Companies reporting that day include Colgate-Palmolive (CL), Weyerhaeuser (WY) and Charter Communications (CHTR). Phew!!

The Tufton Capital Team hopes that you have a wonderful week!