The Weekly View (10/29/18)

Last Week’s Highlights:

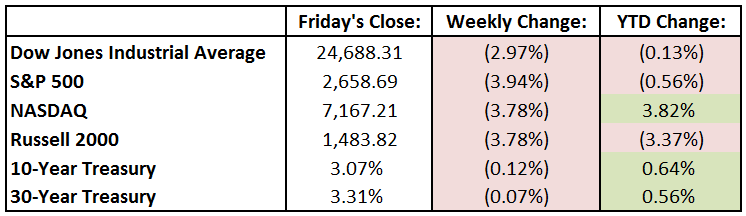

Last week, the major indices were down as investors feared a slowing of global growth, the US economy overheating and a possible recession in sight. The Dow Jones Industrial Average held up best, falling 2.97%. The S&P 500 dropped the most as the index declined 3.94%. The technology-heavy Nasdaq fell 3.78%. As of the opening bell Monday morning, with the exception of the Nasdaq, the S&P 500 and Dow Jones had fully wiped out their year-to-date gains with the recent market volatility. On the economic-front, Building Permits came in above Wall Street’s forecast, with 1.27 million reported in the month of September. Despite beating estimates, permits have generally been on the decline since reaching a ten-year high in March. New Home Sales missed estimates coming in at 553,000 for the month of September – Wall Street was forecasting 625,000 new home sales. High interest rates have hurt growth in mortgage applications, as increases in borrowing costs have discouraged many consumers. Last Friday, the first reading on 3rd Quarter GDP growth was released. At first glance, the US economy grew 3.5% in the quarter. Regarding corporate earnings, 48% of S&P 500 companies have reported their quarterly results. 78% of those companies have outperformed their respective earnings estimates. Lastly, over the weekend, International Business Machines (IBM) announced a takeover of cloud-service provider Red Hat (RHT) for $33 billion, representing the second largest tech deal in history.

Looking Ahead:

This week, further earnings reports and information on US employment will be in focus. On Monday, results showed that Personal Income grew 0.2% month-over-month. Wall Street was expecting growth of 0.4%. On Tuesday, a gauge of Consumer Confidence will be released by the Conference Board. Consumer Confidence is expected to remain near a 20-year high. Friday is “Jobs Day” as investors get a read on average hourly earnings, growth in nonfarm payroll jobs and the unemployment rate. For S&P 500 companies, Mondelez International (MDLZ) will report after the closing bell on Monday. Tuesday brings a plethora of well-known companies as General Electric (GE), Mastercard (MA), Coca-Cola (KO), Under Armour (UAA), and Pfizer (PFE) will all report before the market opens. Facebook (FB) and eBay (EBAY) will report once the market closes. On Halloween, General Motors (GM), Molson Coors (TAP) and American International Group (AIG) will provide their quarterly results. Starting off November on Thursday, investors’ eyes will be on Apple (AAPL), Starbucks (SBUX) and DowDupont (DWDP). Finally, wrapping up the week, Friday will give Wall Street a read on the energy sector with ExxonMobil (XOM) and Chevron (CVX) both reporting.

The Tufton Capital Team hopes that you have a wonderful week!