The Weekly View (10/10/16 – 10/14/16)

What’s On Our Minds:

Corporate earnings season kicked off last week with aluminum producer Alcoa reporting after the bell last Tuesday. The “Big Banks” followed to finish out the week. Each of them – JP Morgan, Citigroup, Bank of America, and Wells Fargo – reported earnings that beat Wall Street’s expectations. However, all of them, with the exception of Bank of America, experienced earnings declines compared to the same quarter last year. Results continue to be weighed down by lower interest rates.

Though at large the “Big Banks” generally are perceived as almost identical, each of them have established a different reputation since the Financial Crisis.

JP Morgan has been associated with being extremely conscious of cost, while investing in mobile platforms, internet banking and cyber security. CEO Jamie Dimon continues to boast about the bank’s strong capital position with their “fortress balance sheet.” The bank also has strong investment banking and asset management divisions, which helped beat earnings this past quarter.

Citigroup has earned lower returns than peers as the have continued to dispose of some of their legacy assets that no longer fit management’s business strategy. The bank continues to own one of the largest banks in Mexico, which many Wall Street analysts believe they should sell.

Bank of America has been known to move slightly slower than their competitors when it comes to integrating Merrill Lynch and cleaning up expenses. Thus, this has weighed on their returns to shareholders over the years. Although, the bank is considered to be the biggest beneficiary of rising interest rates, if they are to ever increase.

Finally, Wells Fargo has made been in the headlines almost on a daily basis due to their falsifying accounts scandal. The company was traditionally known to earn the most on their loans to customers when compared to peers. Their cross-selling strategies helped the bank produce some of the best returns of any bank since the Financial Crisis. Now, the former CEO has retired and the new CEO, Tim Sloan, is determined to repair the company’s reputation.

In all, higher rates would appear to help increase earnings for all of the “Big Banks.” However, they can only improve on what they can control – the rest is up to Chair Yellen.

KBW Nasdaq Bank Index (Year-to-date)

Last Week’s Highlights:

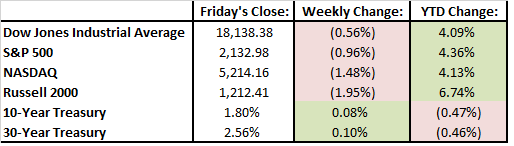

For the week of October 10th, the broader market indices were slightly down as the Dow Jones fell 0.56%, the S&P 500 fell 0.96% and the Nasdaq fell 1.48%. Corporate earnings report from Alcoa, which lowered their guidance, weighed on the market earlier in the week. Weak exports numbers out of China were also a concern on minds of investors. The Federal Reserve obviously continues to be a focus of the markets. Investors were listening closely to Chair Yellen’s speech last Friday for hints of an interest rate hike that may come before the end of the year.

Looking Ahead:

The week ahead will be filled with additional corporate earnings reports. Netflix will report after the closing bell on Monday. Wall Street is expecting sales growth of nearly 30% year over year for the streaming media company. On Tuesday, many of the blue chip stocks of the Dow Jones will report their results with Goldman Sachs, Johnson & Johnson, and United Health Group all releasing earnings before the opening bell. Intel will provide their quarterly earnings update after the market closes. Wednesday will give investors a look into the conditions of the housing market as housing starts for September are released. In addition, Morgan Stanley, American Express and Halliburton are all report earnings. Halliburton will be one of the first energy companies to give investors an idea of conditions in the oil patch. Finally, on Thursday and Friday, tech giant Microsoft and industrial conglomerate General Electric will provide details about their third quarter.