The Weekly View (10/2/17)

What’s On Our Minds:

“A year from now, it’s not going to be Tech.”

Such was the general consensus at last week’s investment meeting at Tufton Capital. While the Tech sector analyst is characteristically overenthusiastic about the forward march of technology, we are reminded by history that the high flyers are rarely up for very long, and when they are, the crash is ever the more painful.

As we look at this year’s winners, the Tufton approach gets pooh-poohed as more exciting names are gobbled up and soar ever higher. “Why isn’t half your portfolio cryptocurrencies?” is not quite the question we are always getting, but it seems that way. We are confident, however, that a disciplined approach will win out over time. But in the mean time, the temptation remains strong to jump into these names that just seem to keep going up in price. Why shouldn’t you?

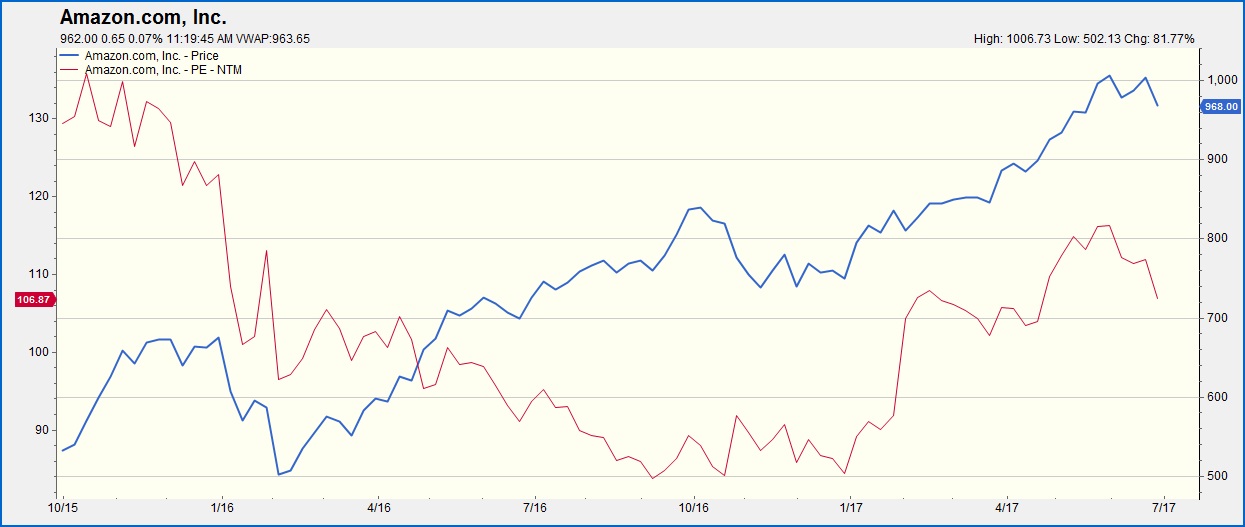

Another joke around the Tufton offices when we have another big up day is to say, “Wow, stocks just always go up!” Of course, the joke is that they don’t, and to be careful of another fall. The tech stocks at the head of the run-up have amazing possibility in them: self-driving cars, artificial intelligence, interconnected everything, a new kind of currency that will reshape accounting and the financial world. Even if all these things come to fruition, there is a price for everything, and an overvaluation for everything. How does one determine the correct valuation for Bitcoin? We’re afraid no one will know for sure until after the climb comes to a screeching halt. Similarly, Amazon and Facebook are valued like they will rule their respective worlds someday very soon. Perhaps they will, but betting on the next world-changing trend has been nothing but a loser’s game in the past.

Amazon has had Price/Earnings ratios in the triple digits for years.

What’s a value investor to do?

Last Week’s Highlights:

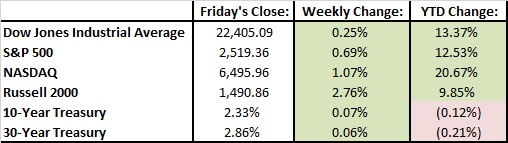

Stocks were again higher last week and hit record levels. High hopes for the Republicans’ tax plan pushed stocks ever upward. Stocks are looking at moving into mid-teen growth for the year, a solid performance to be sure. The 10-year Treasury continued to rise. While resulting in lower bond prices, increased rates are signs of a solid recovery, and gives the Fed more breathing room.

Looking Ahead:

Plenty of economic data this week, including manufacturing PMI on Monday, vehicles sales Tuesday, and the September jobs report on Friday.