The Weekly View (10/30/17)

What’s On Our Minds:

The Tufton Investment Committee meets weekly to discuss our current holdings and examines our entire universe of companies that we would like to own at the right price. Managing all assets in house and conducting independent research is a timely process but the strategy is designed to pay off over the long term. We believe that it is our responsibility to manage a portfolio of individual securities, rather than merely play “quarterback” by redirecting funds to outside managers.

The Tufton Investment Committee is very conscious of price and we shy away from overpaying for shares in a company. While this may hurt us when the rest of the street is chasing momentum stocks higher, we believe that by purchasing undervalued securities our clients are provided a “margin of safety”. We believe that our independence is an advantage.

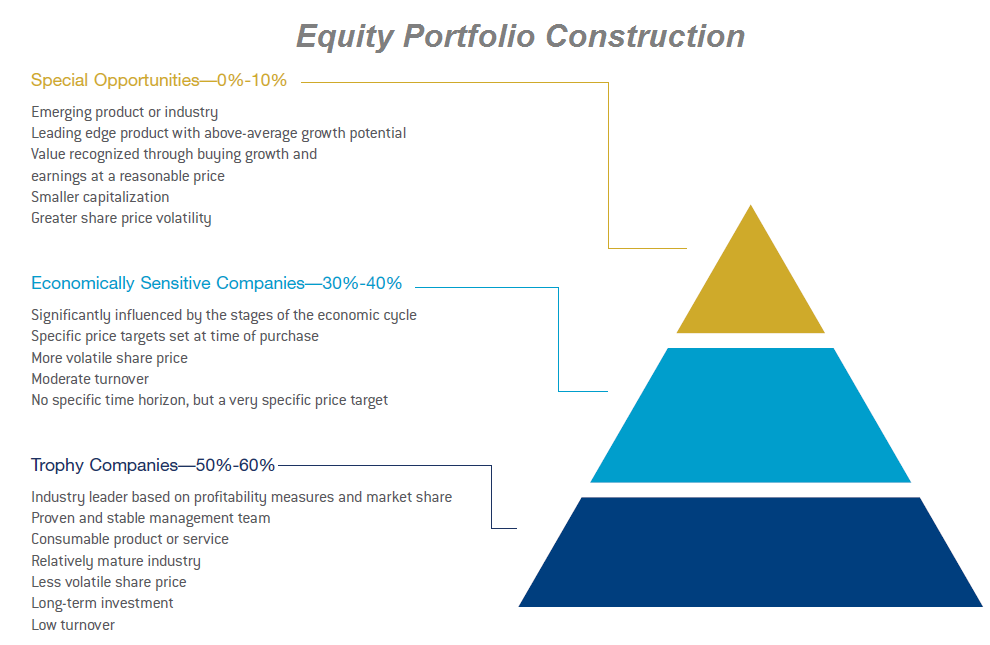

Tufton Capital seeks to build our equity portfolios of 40-50 stocks. Of these companies, 50-60% equities we hold are what we consider to be “trophy companies”. These companies are industry leaders based on profitability measures and market share. These companies have proven and stable management teams, consumable products or services, operate in a relatively mature industry, pay a dividend, and their share price is typically stable. We look to buy and hold these stocks for the long haul.

30-40% of a Tufton’s equity portfolios are made up of what we consider to be “economically sensitive companies”. These companies we purchase with no specific time horizon, but we set very specific price targets. These companies are significantly influenced by the stages of the economic cycle and can be more volatile than our trophy companies.

The remaining 0-10% of an equity portfolio is what we consider to be “special opportunities”. These companies are typically have smaller market capitalization, operate in an emerging industry, have some sort of leading edge product with above average growth potential. These companies’ share prices can be volatile but we recognize the value in buying shares in these types of companies at a reasonable price.

Last Week’s Highlights:

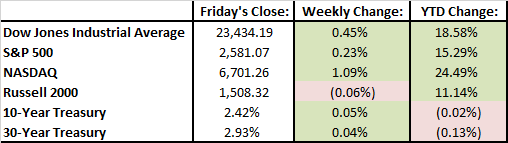

For the seventh week in a row, domestic equities were positive and reached record levels. It was the busiest week of third quarter earnings season and investor optimism was confirmed by strong numbers. The technology sector had a particularly strong week. The NASDAQ was up 2.2% on Friday. While single stock volatility can be increased during earnings season, overall, equity markets continue to be strong.

Looking Ahead:

It’s a busy week with 135 of the S&P 500’s companies reporting third quarter earnings. The Federal Reserve will issue its decision on interest rates on Wednesday. October’s jobs report will come across the wire on Friday morning.