The Weekly View (11/05/18)

Last Week’s Highlights:

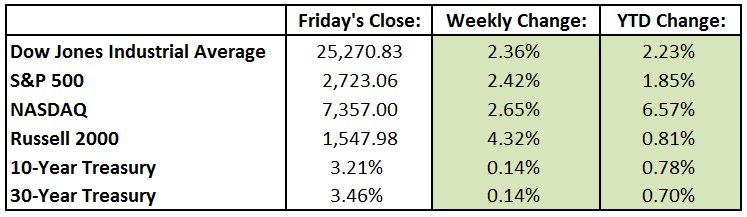

Stocks finished higher last week, as the equity markets experienced positive earnings, improved investor sentiment and progress in China trade talks. The Dow Jones Industrial Average (DJIA) rose 582 points, or 2.4%, to 25,270.83 last week, while the S&P 500 gained 2.4%, to 2723.06. The tech-heavy NASDAQ climbed 2.6%, to 7356.99. Volatility continued last week and was capped off by Friday’s huge reversal, when the Dow turned a 198 point gain into a 109 point loss. Apple stock (AAPL) was off 6.6% Friday after reporting weaker-than-expected guidance, and the payroll data that was released was strong (good news for the economy but further indication that the Federal Reserve will almost certainly hike rates again in December). Earnings season is winding down as nearly 75% of the S&P 500 companies have reported their Q3 results. Overall, quarterly profits appear to be growing at their best pace in eight years, and together with the market decline, have resulted in lower valuations. We happily bid farewell to October, as it was a tough month for stocks: the DJIA and S&P 500 declined 5.1% and 6.9%, respectively.

Looking Ahead:

Although earnings season is winding down, we’ll still see a flurry of results this week. On Monday, Loews (L), Marriott International (MAR), PG&E (PCG) and Sysco (SYY) report their third quarter results. Don’t forget to vote on Tuesday, as November 6th marks the mid-term elections. We’ll also see earnings from Eli Lilly (LLY), AmerisourceBergen (ABC), Martin Marietta Materials (MLM) and CVS Health (CVS) that day. The Federal Open Market Committee (FOMC) meeting begins Wednesday, and Cardinal Health (CAH) and KLA-Tencor (KLAC) host their annual shareholder meetings. On Thursday, the FOMC will announce its latest interest rate decision – it is widely expected that the federal-funds rate will remain unchanged at 2% to 2.25%. Friday is World Freedom Day, but the day will not be free of more economic reports. The Bureau of Labor Statistics releases the producer price index (PPI) for October (estimates are for a 0.2% gain). The University of Michigan reports its Consumer Sentiment Survey for November – expectations are for a 98 reading, down from last month’s 98.6.

The Tufton Capital Team hopes that you have a wonderful week!