The Weekly View (11/19/18)

Last Week’s Highlights:

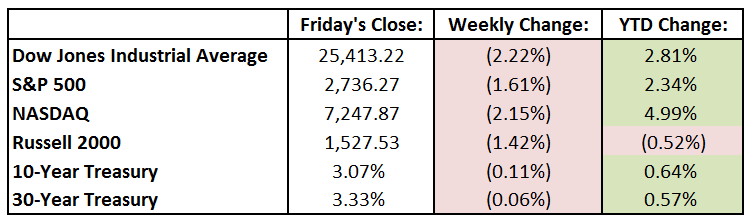

U.S. stocks were lower on the week, as volatility continued along with plenty of news and economic data for investors to digest. Fears that business growth is ebbing and the U.S. economy may be in for a slowdown next year weighed on domestic equities. The Dow Jones Industrial Average (DJIA) dropped 575 points, or 2.2%, to 25,413.22, while the S&P 500 fell 1.6% to 2736.27. The tech-heavy NASDAQ continued its recent weakness, dropping 2.1% for the week to 7247.87. Technology stocks were down following warnings from Apple (AAPL), supplier Lumentum Holdings (LITE) and dismal guidance from Nvidia (NVDA). The tech sector, which is up 7.9% for the year, has now been replaced as the top-performing sector by health care, which has gained 11% in 2018. Internationally, a draft deal for England’s withdrawal from the European Union was reached, but the plan needs to survive vetting in Parliament.

Looking Ahead:

It’s a short week for the markets, as exchanges are closed all day Thursday for Thanksgiving and will close at 1pm Friday. On Monday, we’ll see earnings from Intuit (INTU), JD.com (JD) and L Brands (LB). The National Association of Home Builders’ November Housing Market Index is expected to show a slight decline from October when it releases numbers Monday. Several retailers, including Best Buy (BBY), Lowe’s (LOW), TJX (TJX) and Target (TGT), will report earnings on Tuesday. Deere (DE) releases results on Wednesday, and we’ll get a reading on existing-home sales (expectations call for continued weakness as mortgage rates continue their climb). Black Friday is the retail industry’s Super Bowl, and a strong consumer is expected to help increase this year’s holiday spending by 4.8% from last year.

The Tufton Capital Team wishes you and your family a very Happy Thanksgiving!