The Weekly View (11/26/18)

Last Week’s Highlights:

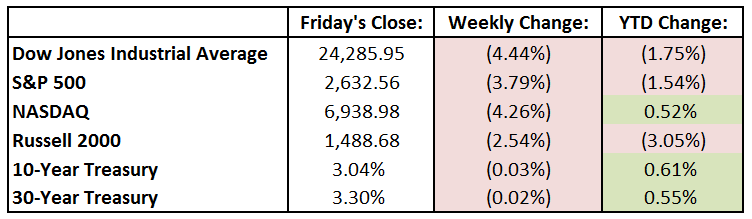

Last week’s trading activity was shortened due to the Thanksgiving holiday. There were only three and a half days of trading, as the market was closed Thursday and open until 1 PM on Friday. Nevertheless, the major indices were on the move as the Dow Jones Industrial Average fell 4.4%, the S&P 500 fell 3.8% and the tech-heavy NASDAQ declined 4.3%. The Dow Jones, which is a price-weighted index, was weighed down by some of its largest components, including Apple (AAPL), Boeing (BA) and Goldman Sachs (GS). In addition to these stocks, the S&P 500 was also affected by a 3% decline in the energy sector as West Texas Intermediate (WTI) crude oil dropped nearly 8% on Friday, closing at about $50 per barrel. WTI is now off 35% from a 4-year high of $77 per barrel set this past June. Energy investors have growing concerns about oversupply, declining demand and slowing global growth.

On the economic-front, Building Permits and Housing Starts results for October were released on Tuesday, each coming in around consensus estimates. There were 1.263 million Building Permits filed in October. As the Federal Reserve has continued to raise rates, the trend has been downward since the 10-year high of 1.3 million set in May. Housing starts were also about 1.2 million in October and slightly up from the 9-month low set in June.

Looking Ahead:

Earnings season continues to wind down this week, as most companies in the S&P have reported. Cracker Barrel (CBRL) and Salesforce (CRM) will report on Tuesday. Retail will be back in focus on Wednesday when Dick’s Sporting Goods (DKS) and Tiffany & Co (TIF) report before the opening bell. La-Z-Boy (LZB) will report after the market closes. On Thursday, Dollar Tree (DLTR) and Abercrombie & Fitch (ANF) will release their quarterly results.

Housing will be on the minds of investors again this week with the S&P/Case-Shiller Housing Price Index being released on Tuesday. Wall Street is expecting growth of 0.3% month-over-month. Information on New Homes Sales and Pending Homes will be provided to Wall Street on Wednesday and Thursday, respectively. The minutes from the most recent Federal Open Market Committee meeting will also be in focus on Thursday.