The Weekly View (11/13/17)

What’s On Our Minds:

This morning, Tufton Capital Associates Ted Hart, John Kernan, and Neill Peck taught a sixth-grade math class at Mid Town Academy in Bolton Hill. The purpose of the trip downtown was to teach the students about stocks and the stock market. The students participate in the Stocks in the Future program which is a 501C3 charitable organization that partners with schools in downtown Baltimore and provides a three-year financial literacy curriculum for middle school students in under-served communities.

The Stocks in the Future Program introduces students to business concepts, expansion possibilities, reasons for taking a company public, and ways to compare company performance. As students progress through the program, they earn money by attending school regularly and improving their grades. The students can earn up for $80 per year which enables them buy shares in a publicly traded company. When they graduate from high school, they get to keep the shares they have purchased. Today, our Associates explained how an investment advisory firm operates and we showed them how to analyze two companies; Facebook and Under Armor.

By the end of the class, the students remembered the 3 most important rules of investing.

1. Don’t Lose Money.

2. Don’t Lose Money.

3. Don’t Lose Money.

To learn more about Stocks In the Future’s Mission, follow the link below:

Last Week’s Highlights:

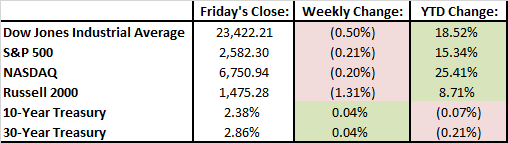

After 8 straight weeks of gains, U.S. large-cap stocks fell last week. Investors were focused on tax reform and the overall consensus is that the federal government is nowhere close to passing a bill. Congress and the Senate have both presented a plan and it will be in limbo until both houses compromise and present a mutually agreed upon plan.

On Thursday, the Dow was down over 200 points at its lows and the S&P 500 nearly broke its more than 40-day streak of no losses greater than 0.5% for a given session. Investors should see last week’s dip as a healthy retreat based on the rally we have seen in the last year. Remember, we have been experiencing one of the calmest markets in history this year and we remain close to all time highs.

Looking Ahead:

Earnings season is coming to an end. 483 companies in the S&P 500 have already reported. Economic news and progress on tax reform will likely rule the headlines this week. On Wednesday, retail sales numbers will be released and on Friday, we will hear housing starts and building permit figures.