The Weekly View (11/14/16 – 11/18/16)

What’s On Our Minds:

Our focus in recent weeks has been on the election and while we like to keep our topics fresh from week to week, it would be remiss for us to ignore the effect that the election’s results are having on financial markets.

While campaign promises don’t always come to complete fruition, based on recent market movements, it’s clear that investors are expecting a lot out of Trump. Specifically, his plans to rebuild the country’s infrastructure through a stimulus package, cut taxes on corporations and individuals, and increase trade barriers are being seen has major policies that could improve our domestic economy and thus, move the market. While these plans have been good news for equity markets, it has triggered a selloff in the fixed income market.

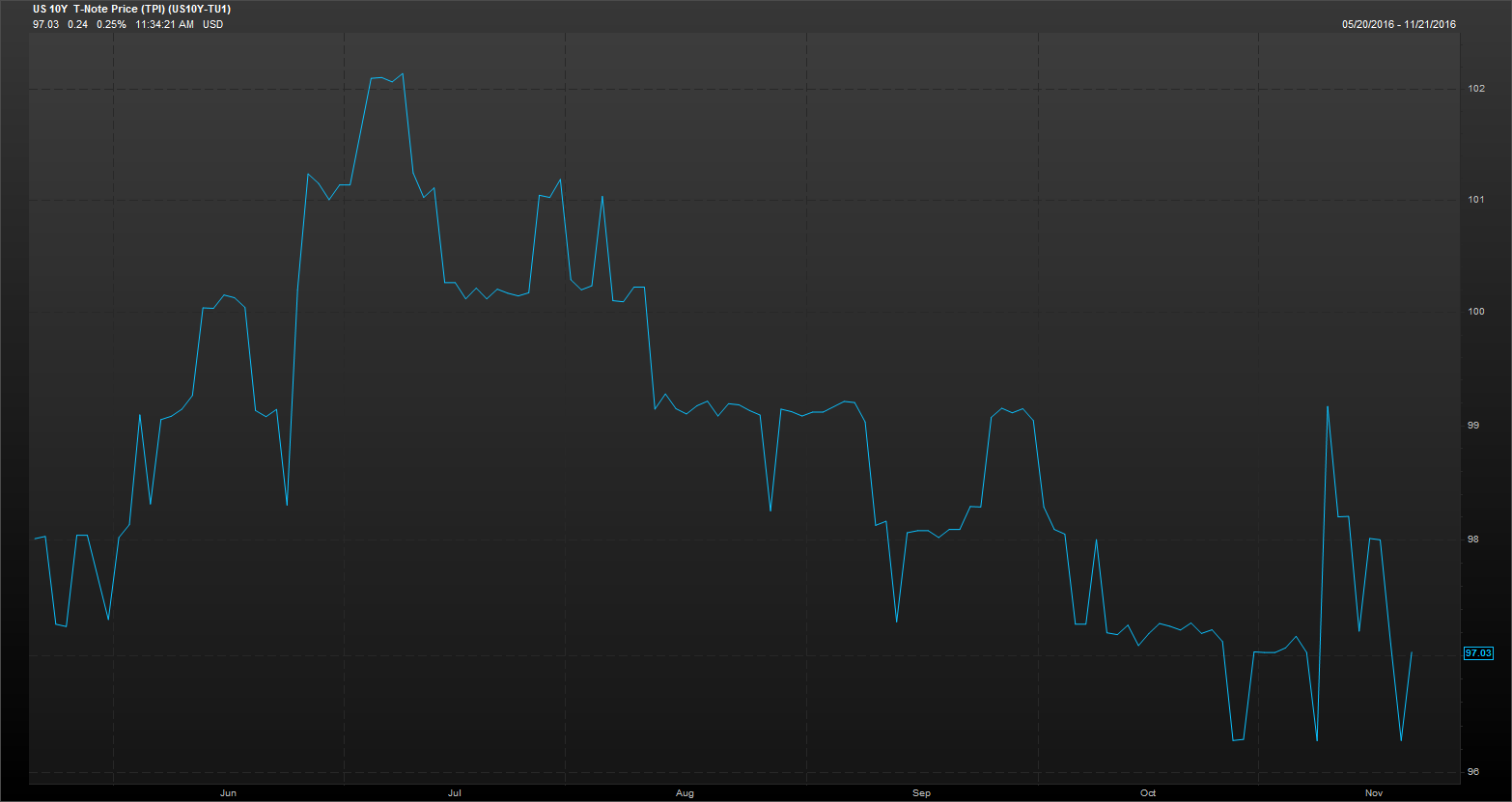

Global bond yields, which rise as bond prices fall, have been falling since the Brexit in June, but the selloff has accelerated since Trump’s upset victory. The rationale behind the continued sell off is that Trump’s policies will provide a boost to inflation, which is the enemy of long-term bonds, because it erodes the value of interest payments. Furthermore, bonds just seem less attractive compared to stocks when hopes of economic growth is on the horizon.

All of this action in the market is exciting, but we continue to remind our clients and friends of the importance of sticking to a long term investment plan. Instead of speculating how new policies may affect the investment landscape, we believe it is best to focus on underlying fundamentals and make investments accordingly. With the benefit of hindsight, recent market moves can be viewed as an example of how tough it is to predict short-term market moves. Media pundits had many convinced that a Trump victory would be calamitous for the markets, but we’ve seen numerous record highs since his election. As is usually the case, we believe that calm heads prevail over the long-term.

10 Year Treasury Since 6/1/2016

Last Week’s Highlights:

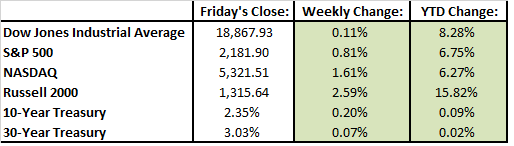

It was another busy week on Wall Street. The Dow Jones finished the week marginally higher last week after reaching numerous record highs. The S&P 500 had a better week and was up 80 basis points due to its lower exposure to industrial and financial services sectors. With only a few weeks left in the year, both indexes are up by more than 6% year to date.

Janet Yellen delivered remarks to the Joint Economic Committee of the US Congress on Thursday. She stated that the economy is making good headway and that a hike in interest rates could be coming “relatively soon”. Markets are currently pricing in a 25 basis point hike for the next FOMC meeting in December.

Retail sales numbers came in strong last week. Merchants in the U.S. reported increased retail sales in October by 0.8%. These numbers should bolster the Fed’s pending decision to increase rates next month.

Looking Ahead:

Higher yields and a strong dollar should continue to dominate financial headlines this week.

On Tuesday, Barnes & Noble, Campbell Soups, Chico’s FAS, GameStop, Dollar Tree, and Hewlett Packard Enterprises report their quarterly results.

Some important economic data comes across the wire this week. U.S. existing home sales are released on Tuesday and Global Flash Purchasing Managers’ indices will be released on Wednesday.

It will be a short week for investors as domestic markets will be closed on Thursday for Thanksgiving and the stock market closes at 1 PM on Friday.