The Weekly View (11/21/16 – 11/25/16)

What’s On Our Minds:

This week, investors’ eyes will be on OPEC and their meeting in Vienna, Austria. The members of the Organization of Petroleum Exporting Countries (OPEC) will come together on Wednesday to decide on whether or not to cut oil production in their respected countries. Saudi Arabia, the world’s largest oil producer with production of approximately 10.5 million barrels per day, has allegedly proposed that they will cut 4.5% of their production if Iran freezes their own production at roughly 3.8 million barrels per day. In addition, the Saudis also desire additional outside countries, such as Russia, to agree to freeze as well. Production levels would be verified by a third party to avoid any kind of cheating.

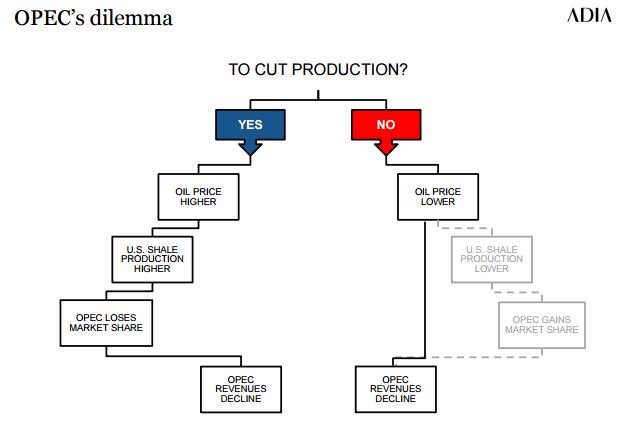

OPEC is in quite a situation as Saudi Arabia is no longer the world’s swing producer. US shale producers can react to increases in the price of oil in a matter of days to weeks. Christof Ruhl, Head of Global Research at the Abu Dhabi Investment Authority, presented the chart diagram below nearly two years ago before the November OPEC meeting and the argument still holds true today. In the current situation, with lower oil prices, OPEC countries obviously have lower oil sales than they did when oil was at $100 per barrel. If they cut production, propping up the price of oil, US shale producers will ramp up production and take market share from OPEC. As OPEC loses market share, sales will again be lower.

Could this be the end of the traditional OPEC as we know it? Only time will tell.

Source: Christof Ruhl – Abu Dhabi Investment Authority

Last Week’s Highlights:

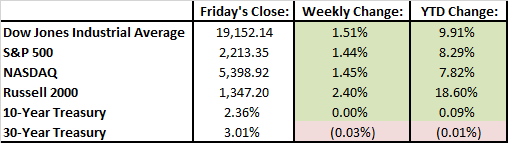

For the third week in a row, stocks were up on continued reflationary hopes following the US presidential election. On Tuesday, for the first time since 1999, the Dow Jones, the S&P 500, the Nasdaq, and the Russell 2000 all set record highs. Domestic small-caps had a particularly good week as investors believe these companies will benefit from accelerated growth and tax reform.

Existing home sales were reported at 5.6 million. Durable goods sales were up 4.8% month over month. Jobless claims were reported and are down to 251,000.

American shoppers unofficially kicked off holiday shopping season on Friday. As has been the trend in recent years, brick and mortar store sales are shrinking and online sales are growing. On Thursday and Friday, online sales surpassed $5 billion with more than $1.2 billion coming from mobile devices.

Looking Ahead:

Thanksgiving is now behind us and Americans are back to work after a holiday packed full of turkey and rivalry football games. Online holiday sales will continue on “Cyber Monday”. On Tuesday, Third Quarter US GDP will be released and Chicago O’Hare airport workers are set to go on strike. OPEC is having a meeting on Wednesday where they will try to agree on a production cut. On Thursday, we will get automotive sales figures from November. Friday is a big day as November’s jobs report will be released.