The Weekly View (11/7/16 – 11/11/16)

What’s On Our Minds:

Many would agree that we were put through the ringer with divisive campaign rhetoric this year. Well, it’s finally come to an end and the uncertainty is behind us. Folks on both sides of the aisle were surprised by last week’s election results but many would probably agree that it’s nice to have the contentious campaign season in the rear view mirror.

After a majority of market pundits had predicted that a Donald Trump victory would send equity markets crashing, the markets have been on a tear since he delivered his quelled down acceptance speech on Wednesday morning. Perhaps this is a sign of a new Donald Trump? The pollsters may have expected a Clinton landslide and market pundits predicted a doom and gloom if Trump won, but markets posted one of their strongest weeks in history. Rather than panic selling, investors repositioned themselves for how the election results will effect public companies, financial markets and the economy.

While Trump had some grandiose ideas and lofty rhetoric on the campaign trail, it will be interesting to see how his policies play out now that he’s actually headed to Washington. Like any campaign, it’s likely that a good deal of Trump’s campaign rhetoric won’t actually be implemented in legislation. For instance, he has said that his wall is now probably going to just be a fence. On a corporate level, Trump’s campaign promises to slash the 35% corporate tax rate for some of the largest U.S. companies to 15% is being seen as a rallying point for investors. On the national level though, a trade war with China probably won’t make investors and US consumers very happy. Whatever happens, we’ll have to wait and see how Trump handles the transition from twitter ranting Donald to Mr. President in White House.

While the president may be a significant figure in influencing the financial markets, it’s important to remember that stock and bond prices are closely tied to fundamentals that don’t just change on the flip of a dime. With that in mind, instead of trying to speculate, the Tufton investment team remains focused on investing in high quality yet undervalued companies that may be temporarily out of favor in the financial markets.

The S&P 500 Index Last Week

Last Week’s Highlights:

Stocks rose last week as investors weighed what a Trump Presidency means for the markets and the economy. Initially, futures crashed on Tuesday night with news that Trump was going to win but then, to many peoples’ surprise, domestic markets rebounded sharply on Wednesday morning. The rally in blue chip stocks continued through Friday. Trump’s promises of decreased regulation and increased infrastructure spending had investors repositioning themselves into shares of industrial companies and banks. Biotech and pharma stocks had also had a big week after investors previously priced expected a Hilary Clinton victory. Many of these stocks had been beaten up after Secretary Clinton had promised increased government regulation over these industries during her campaign. Companies benefitting from the Affordable Care Act had a tough week as many believe Trump will repeal and replace it.

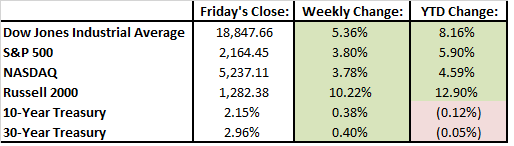

The biggest reaction to the election occurred in the bond market. US Treasurys have sold off because many believe that Trump’s economic policies will lead to higher inflation. Bond yields, which move inversely to bond prices, rose to the highest level of the year last week.

By the close on Friday, the Dow Jones Industrial average was up 5.4%, closing at a record high. This was the index’s strongest week in 5 years. The S&P 500 also had a strong week, up 3.8%.

Looking Ahead:

Domestic equity markets will begin the week trading at all-time highs. 31 S&P 500 companies will be releasing earnings this week. Home Depot, Target, Cisco, and Wall-Mart are included in the bunch. We will also get some economic reports this week. Retail sales will be reported on Tuesday, industrial production will be reported on Wednesday, and inflation data will be reported on Thursday. Members of the Federal Reserve are also speaking this week. With big moves currently occurring in the bond markets and an interest rate bump expected next month, their comments will be followed closely.