The Weekly View (1/17/17)

What’s On Our Minds:

The investment professionals at Tufton Capital believe that a long-term, buy and hold investment strategy is the to safest, and smartest, way to build wealth in the stock market. Quite simply, it’s been proven time and time again to return exponential gains on invested capital.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about your portfolio for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining a long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue owning that security. If the overall market changes dramatically, as it has in the past, you may actually benefit from selling an investment or group of investments. Finally, changing goals as you get closer to retirement may warrant a more conservative portfolio.

Bad Markets

The typical investor is tempted to get out of a bad market by selling when prices are low, which is a poor strategy. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. By holding on to your investments, you’ll be better able to ride out a down market, especially if your portfolio is diversified.

Taxes and Fees

Frequent trading results in higher fees, so long haul-investors pay less while fees eat up much of a day trader’s profits. Additionally, short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits will be diminished by taxes and fees.

Investing for the long-haul is the best investing strategy for the majority of investors because it not only ensures modest gains but is also less likely to yield major losses. A long-haul investment strategy is based on informed, careful decision making and patience.

Last Week’s Highlights:

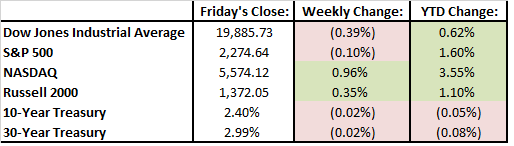

Investors were focused on the beginning of fourth quarter earnings season and political headlines last week. Stocks were slightly lower. After getting close earlier this month, the Dow Jones just can’t seem to crack the 20,000 point threshold.

President-elect Donald Trump held his first press conference in more than five months on Wednesday. Investors were looking for him to cover taxes, fiscal policy, or infrastructure spending but he didn’t elaborate on those topics.

Looking Ahead:

The market was closed on Monday for Martin Luther King Day.

Some important earnings announcements will be coming out this week including CSX on Tuesday, Netflix on Wednesday, and General Electric on Friday.

On Friday, Donald Trump will be sworn in as President. Investors are expecting a shift towards pro-growth policies that should result in better economic and earnings growth. Trump’s economic plans are broad and he hasn’t gone into specifics but he will likely focus on corporate tax cuts, repatriation of foreign cash, a fiscal push towards infrastructure spending, and perhaps some protectionist tariffs. We will have to wait and see if Washington can keep the bull market going in 2017.