The Weekly View (12/24/18)

Last Week’s Highlights:

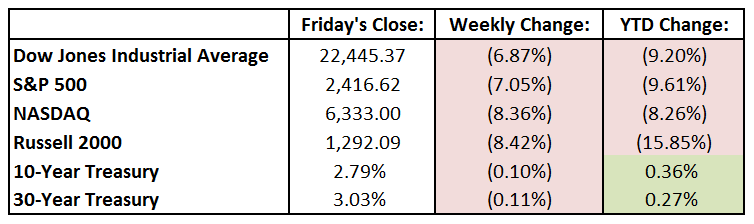

Bah Humbug! U.S. equities suffered their worst weekly loss of the year, with major indices now firmly in correction territory and the tech-heavy NASDAQ in a bear market (down 20% from its peak). Stocks started last week lower but stabilized going into the Federal Reserve’s interest-rate-setting meeting. Stocks began Wednesday on a positive note but plunged after the Fed announced a rate increase and pointed towards two more hikes next year. For the week, the Dow Jones Industrial Average (DJIA) tumbled 6.87%, to 22,445.37, while the S&P 500 decreased 7.05%, to 2416.58. The NASDAQ fell 8.36% for the week to 6332.99. Oil prices also fell for the week.

Looking Ahead:

U.S. markets close early on Monday for Christmas Eve, with the stock exchanges closing at 1pm and the bond markets at 2pm. Federal employees have an extra vacation day this year, as President Trump signed an executive order last Tuesday giving them Christmas Eve off. Tuesday is Christmas Day – Merry Merry! Markets in many countries including England, Canada and Australia are closed on Wednesday in observance of Boxing Day. On Thursday, the Department of Labor reports initial claims for the week ending December 22nd – economists forecast 215,000 claims, a slight increase from the previous week. Friday brings more economic reports, including data from the Institute for Supply Management and the Census Bureau.

The Tufton Capital Team wishes you and your families a Merry Christmas and a very Happy Holiday!