The Weekly View (12/12/16)

What’s On Our Minds:

With the end of the year quickly approaching, it’s time to look back at what’s happened and how it will affect your financial future. Go through these important items so that you can go into the new year with financial peace of mind.

INVESTMENTS

- Consider tax-loss harvesting to lower taxes on capital gains.

By selling positions that are down this year, you can use the losses to reduce up to $3,000 of taxable income. If your total losses surpass $3,000, you can roll over excess losses to offset gains in another year. If you have losses from a previous year, calculate how they affect your gains or losses from this year.

- Check your performance.

Are your investments on track to meet your goals? If your portfolio is lagging behind the appropriate benchmarks, it may be time to reconsider your investments.

INCOME TAX

- Review your tax withholdings.

Have you had a major life change (employment change, marriage/divorce, a new child) that affects your income tax? Check to make sure your tax withholdings have been properly adjusted. Having low withholdings can lead to tax penalties, while having too high of withholdings prevents you from accessing your money until your tax return is filed.

- Estimate your AGI.

Determine your adjusted gross income (AGI) with the help of your tax advisor. Your AGI will help determine your tax bracket, which you’ll need for investment and retirement planning.

- Estimate your AMT.

Determine whether you will be subject to the Alternative Minimum Tax (AMT) and if there are ways to mitigate your AMT liability.

GIVING

- Reduce your estate through gifts.

You are permitted to give up to $14,000 ($28,000 for married couples) a year per recipient as an untaxed gift. Gifts above this value will consume part of your lifetime/estate tax exemption amount, $5.45 million in 2016.

- Donate to charity as a way to reduce taxes.

You can lower taxable income by 50 or 30 percent with a gift to a public charity or by 30 or 20 percent with a gift to a private foundation. If your gifts exceeds these limits, you can roll over the excess deduction for up to 5 years.

RETIREMENT ACCOUNTS

- If you are retired, make sure you’ve taken all necessary required minimum distributions (RMDs).

RMDs may be one of the most important items to review when going over your finances at the end of the year. Standard IRAs require these distributions be taken annually after the year you turn 70 ½; standard 401(k)s require them annually after you retire or turn 70 ½ (whichever is earlier). Failure to take an RMD will trigger a 50 percent excise tax on the value of the RMD.

- Max out contributions to an IRA and employer retirement plan for the year.

Both IRAs and 401(k)s have annual contribution limits. If you find you have excess savings and have not reached your annual limit, it may be a good idea to make additional contributions. Similarly, you may also consider making greater monthly contributions to your accounts next year, spreading out the cost of contribution. The deadline for IRA contributions is usually April 15 of the following year; 401(k) deadlines may be restricted to the calendar year, depending on your employer. If your children or grandchildren make less than $132,000 per year, consider gifting them $5,500 so they can make a Roth IRA contribution.

- Consider converting a traditional IRA to a Roth IRA.

Did you have a good tax year? It may be an opportune time to convert a portion (or all) of your traditional IRA to a Roth IRA and pay your taxes at a lower rate. It is important to understand, however, that Roth accounts have contribution limits placed on them, so keeping a traditional IRA might be beneficial. Before making any changes, consider seeking the help of a professional accountant who can help you with the conversion and calculate your new tax liability.

Last Week’s Highlights:

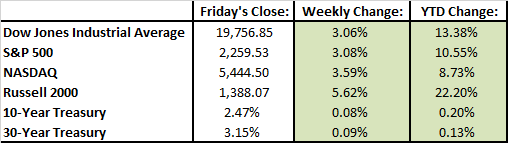

Markets continued their rally last week as indices continued to break records. The rally was broad; no sectors booked a loss last week. Among industries, chipmakers and banks had a particularly strong week as they outperformed the market. Since the election, investors have been favoring financial companies on the assumption that Trump’s administration will work to create a much more lenient regulatory environment. In general, a brighter economic outlook is favoring stocks.

The selloff in the bond market continued last week which is translating into higher rates and lower prices across the board.

Looking Ahead:

All eyes will be on the Federal Reserve this week as investors are expecting them to raise short-term interest rates on Wednesday. Janet Yellen will also talk about the Fed’s plans for 2017 during her press conference. Also on Wednesday, November retail sales and industrial production figures will be released. On Thursday, we will also get weekly jobless claim number.

Companies are releasing earning this week as well. On Wednesday, Pier 1 Imports releases their results and on Thursday Oracle released their numbers.