The Weekly View (12/19/16)

What’s On Our Minds:

With the end of the year quickly approaching, most folks are enjoying the holidays but some might be a bit worried about their tax situation for 2016.

Taxes are an inevitable part of investing. The tax code complicates investment planning, and the impact of taxes has been steadily increasing as investment planning becomes more individualized. With careful planning, you can minimize the effect that taxes have on your investments. Your focus should be on the return generated at the end of your investing time horizon—after tax and transaction returns—making taxes an important concern for all investors.

Types of Taxes

A seemingly endless list of potential taxes could affect your investments, portfolio and net worth. Some of the more critical ones are as follows:

- Interest: Interest you earn on investments (typically from bonds and large cash holdings) is subject to tax rates that are the same as your ordinary income tax rate.

- Dividends: You’ll have to pay taxes on dividends that come from stock you own, but dividends are taxed with preferential treatment in comparison to ordinary income and interest income. To receive this treatment, the dividend must meet several requirements to be considered a qualified dividend.

- Capital Gains: When the value of your investments in stocks, bonds and other assets increases from the purchase price and you sell it for a profit, you’ll trigger a capital gains tax. Similar to dividends, long-term capital gains are taxed at lower rates than ordinary income.

- Estate Tax: For investors with significant holdings, estate taxes can have a substantial effect on the total value they can pass on to heirs or charity. Planning for estate taxes is especially important, and there are many strategies to maximize the value of portfolio holdings.

Tax-advantaged Accounts

- Retirement Accounts: One of the most prominent ways to take advantage of tax-friendly regulations is to create retirement accounts. These accounts include 401(k)s or 403(b)s (depending on type of employer), Individual Retirement Accounts (IRAs) and Keogh plans. All of these accounts qualify for preferential tax treatment and therefore are often referred to as qualified accounts. The benefits of deferring taxes can dramatically compound over time. For example, $1,000 invested in an IRA at a tax-deferred rate of 8 percent grows to $10,063 over 30 years. In a taxable account (assuming 28 percent tax rate), the funds would grow to only $5,366. Roth and traditional IRAs are both effective ways to save for retirement. With a Roth IRA, you contribute money that has already been taxed in exchange for the ability to make tax-free withdrawals upon retirement. In a traditional IRA, your contributions are pre-tax, but you pay taxes on distributions later on. But how do you choose between the two? Your choice depends on how you think your future tax rate compares to your current tax rate. If you assume your individual tax rate is not going to change between now and retirement, then the net result will be the same regardless of which type of IRA you choose. When looking at changing tax rates, it is most important to focus on both the changing landscape of tax rates as a whole, as well as how changes in your income will affect which tax bracket you fall under. Generally, as people age they earn more money and enter higher tax brackets. In this case, and assuming no change in the overall level of taxes, it would be more beneficial to pay the taxes now, at a lower rate. However, if you believe that your tax rate will decrease, then traditional IRAs will be more beneficial.

Tax-advantaged Investments

- Municipal Bonds: In addition to tax-advantaged accounts, you can also choose tax friendly investments. For instance, municipal bonds are an ideal way to invest in fixed income while limiting the effect of taxes. Municipal bonds are any bonds issued by a U.S. city or other local government. The interest received by bondholders is generally exempt from the federal income tax and from income tax in the state in which they are issued. On the other hand, municipal bonds are usually priced higher to account for these tax effects. However, the tax exemption on interest income will be more beneficial for individuals with significant income. Therefore, investing in municipal bonds may minimize the tax effect on investments for individuals in higher tax brackets.

In addition to taxes, you should also be aware of the effects of transaction costs and fees on your investments’ growth. Tax-advantaged accounts help to alleviate these costs as well, making them practical for investors who want to save for retirement or education expenses. The uncertain outlook for taxes as they relate to investment planning makes it critical to stay up to date with new developments, and discuss strategies to minimize your tax burden with your financial and tax advisor.

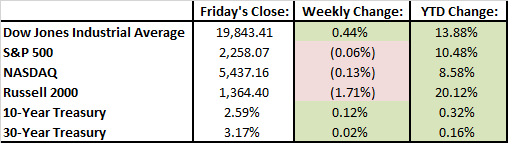

Last Week’s Highlights:

The Federal Reserve increased interest rates last week by 25 basis points, to between 0.5% and 0.75%. Fed Chair Janet Yellen stated, “considerable progress the economy has made” when explaining the rationale behind the decision. For the most part, investors had expected this decision.

Oil prices increased last week as OPEC members, including Russia, agreed to cut output by 558,000 barrels a day. Oil prices increased to 51.90 dollars per barrel which is the highest it has traded in the last 17 months.

Donald Trump announced some important appointments last week. He tapped Exxon CEO, Rex Tillerson to be Secretary of State Rick Perry as energy secretary, and Goldman Sachs’ Gary Cohn as chief economic adviser.

Looking Ahead:

There are a few important economic reports in the coming this weeks. The Purchasing Managers’ Index (PMI), which is an indicator of the economic health of the manufacturing sector, will be released on Monday. Also on Monday, Janet Yellen will deliver a speech on the state of the job market and the electoral college will officially cast their votes for president. Existing home sales will be released on Wednesday, durable goods and personal income and spending on Thursday. On Friday, consumer sentiment and new homes sales numbers will be released.