The Weekly View (1/23/17)

What’s On Our Minds:

Acquisitions in the oil patch are finally back in style. Over the past few weeks, several multi-billion dollar acquisitions have occurred, particularly in the Permian Basin of West Texas. The Permian Basin has been established as the most prolific shale patch in the United States, possibly the world. Given this status, it should be to no one’s surprise that last week, energy bellwether ExxonMobil announced a $6.6 billion acquisition of Permian assets, their largest deal since the acquisition of XTO Energy in 2010. The company will net approximately 250,000 acres, paying roughly $27,000 per acre. On other metrics, Exxon paid $35,000 for each flowing barrel of oil per day – both attractive valuation multiples compared to other transactions in the oil patch.

In another transaction, Noble Energy agreed to purchase Clayton Williams Energy, another Permian based company, for $3.2 billion. The announced price values the assets at approximately $32,000 per acre, slightly higher than Exxon’s purchase price. It’s hard to believe that five years ago, the average price per acre in the same area was just roughly $4,500 when oil was trading in the range of $80 and $120 per barrel. This goes to show the profitability and efficiency of drilling in the shale patches.

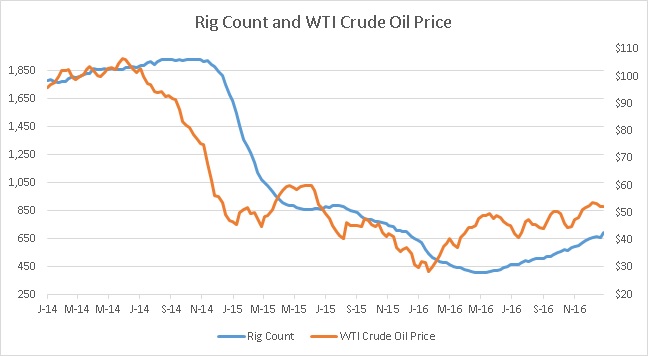

All of these transactions come at an interesting time – most analysts expected distressed companies to sell themselves or their assets around the time oil bottomed at $26 per barrel nearly a year ago and the rig count bottomed last May. However, due to the efficiency of shale production (and cheap credit), the drillers prevailed. With interest rates on the rise and the price of oil somewhat range bound, time will tell which companies continue to survive.

Last Week’s Highlights:

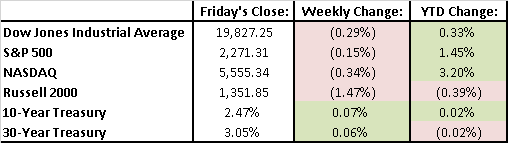

Last week, the Dow Jones Industrial Average fell 0.29%, the S&P 500 fell 0.15% while the Nasdaq slipped 0.34%. After beating the S&P 500 in 2016, the Dow is now barely positive on the year (up 0.33%), the S&P 500 is up 1.45% and the Nasdaq is leading the three major indexes, up 3.2%. Investors were focused on President Trump’s inauguration speech as well as rhetoric surrounding his changes to public policy.

Earnings season continued with most companies in the Financial sector reporting fourth quarter results. So far, 13% of S&P 500 companies have reported and 65% have had positive surprises relative to their earnings estimates.

This week, investors will continue to focus on President Trump and his policy initiatives. Earnings from several Dow Jones components will be released on Tuesday. Dupont, 3M, Johnson & Johnson, Travelers, and Verizon will all report before the opening bell. On Wednesday, AT&T and United Technologies will provide investors with their fourth quarter results. Thursday will give investors further insight into the oil patch as Helmerich & Payne and Baker Hughes both report. On Friday, the markets will be focused on the first read of fourth quarter GDP growth.