The Weekly View (1/9/17)

What’s On Our Minds:

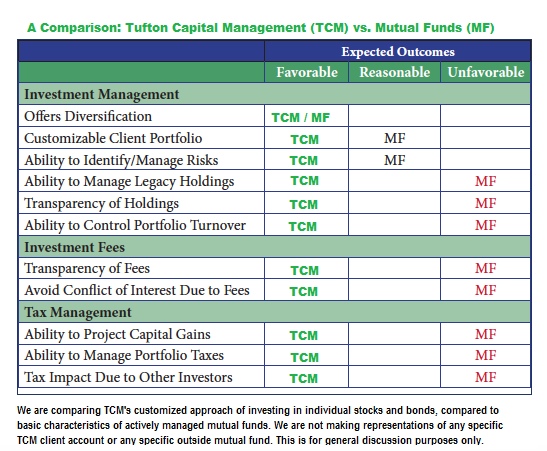

Often, members of Tufton’s Investment Committee are asked why our firm doesn’t use mutual funds in our clients’ accounts. While mutual funds may offer the benefit of diversification to small investors, our team doesn’t believe they are the best answer for clients with sizable assets. Sure, we could easily free up some time by directing assets to outside managers but we believe that mutual funds have a few key drawbacks.

First, they limit an advisor’s ability to customize a portfolio and manage risk effectively. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bills.

We also believe the limited transparency of mutual funds is problematic. Most investors don’t know what stocks they are holding in the fund, and some funds disclose their holdings only semi-annually. An investor may have 50 stocks or more in a single fund. Imagine tracking your portfolio if you own five or ten stock funds – that can add up to 500 or more stocks in your portfolio. Why not just buy an index fund for a fraction of the price? Diversification is a good thing, but not so for over-diversification.

Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet your goals.

If you would like to hear more about our investment philosophy, please feel free to give one our portfolio managers a call.

Last Week’s Highlights:

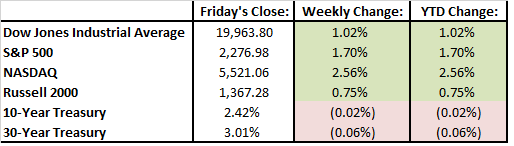

Stocks increased last week. The S&P 500 was up 1.7% and closed at an all time high on Friday. The Dow Jones also had a good week and came very close to hitting 20,000 for the first time in history. The December jobs report was solid. It showed the economy added 156,000 jobs and that hourly earnings rose by 2.9% through 2016. These results are in line with the Federal Reserve’s plan to increase rates two or three times in 2017.

The department store sector took it on the chin last week after Kohl’s and Macy’s reported downbeat holiday sales reports. With the advent of online shopping, brick and mortar stores are struggling.

Looking Ahead:

Analysts are gearing up for 4th quarter earnings season with Alcoa reporting after the closing bell on Monday. Delta Airlines reports its results on Thursday before the bell and Friday we will get results from Bank of America, Wells Fargo, and JPMorgan.

As of Monday morning, some merger news has come to light. Japanese drug maker Takeda Pharmaceiticals announced it is purchasing cancer treatment company Ariad for $5.2 billion. Ariad’s shares were up 75% on the news. M&M candy maker, Mars announced it is acquiring veterinary supply company VCA (WOOF) for $7.7 billion. Mars already has a large pet food business and VCA should help the business with future growth. On Monday, WOOF was up 27% in pre-market trading.