The Weekly View (2/27/17)

What’s On Our Minds:

Everyone remembers the old saying, “don’t put all your eggs in one basket”. Well, sometimes investors end up with a whole lot of their eggs in one basket whether it be intentionally or unintentionally. Often times, entire fortunes are tied to the prospects of one single company and while this is great when business is good, it can get ugly when the tides turn. Large individual positions in companies are acquired every day through employer retirement plans, inheritances, stock options, and business sales. It’s not unusual for successful professionals and executives and their heirs to find themselves with too much of a good thing: owning a large quantity of highly appreciate stock or a large equity position in a private partnership.

While countless individuals and families have accumulated great wealth by holding large amounts of a single position, betting your financial future on a concentrated position is rarely the best course of action. Even if an investor has the utmost faith in their largest holding, the return prospects simply are not worth the risks. If you are approaching retirement age and will need to start living off of your investment portfolio, a concentrated position can create a problem because your long-term financial security is dependent on the success of a single business.

The only way to reduce the inherent risk of a concentrated investment portfolio is to diversify. Of course, this is easier said than done! Due to the bite of capital gains taxes, fully selling out of a concentrated position can be a long process, but over time an investor can sell a certain amount of shares, per quarter, or per year and reinvest the proceeds into a well-diversified account.

At Tufton Capital, we take a customized approach to wealth management which allows us to manage the complex situation brought on by a concentrated portfolio.

Last Week’s Highlights:

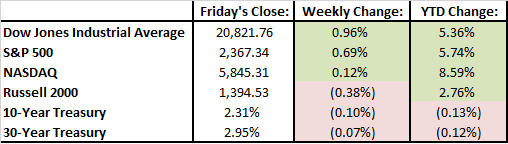

Equity markets continued their 5-week trek higher last week. The Dow Jones closed at 20,822 on Friday, which was a record high.

A better-than-expected earnings season has helped stocks move higher. Nearly 66% of S&P 500 companies have reported earnings above analyst estimates.

Treasury Secretary, Steven Mnuchin, laid out an ambitious time frame last week saying that a tax-reform package could be passed by Congress before their August recess. He also said that the Trump administration is aiming for sustained 3% or higher economic growth.

While equity markets have been chugging along, bond investors have been hunkering down recently. Despite a reflationary trade in stocks and expectations of an interest rate hike in by June, the 10-year U.S. Treasury ended the week at 2.317%, its lowest since last November.

On Tuesday evening, President Trump will address Congress in a televised speech. A lot is expected from this speech as he will lay out his plans for the rest of the year. He will likely touch on his fiscal-policy plans, and discuss tax reform, border security, healthcare, and future infrastructure spending plans.

Economic data from January is coming across the wire this week. Retail sales will be reported on Tuesday. On Wednesday, construction spending and automotive sales will be reported.