The Weekly View (3/18/19)

Last Week’s Highlights:

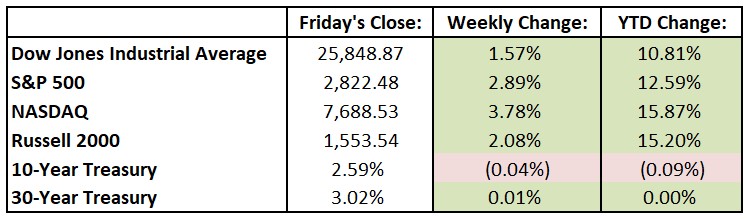

U.S. equities returned to their winning ways last week as stocks posted their best five day run since November. The Dow Jones Industrial Average (DJIA) rose 398.63 points, or 1.6%, to 25,848.87, while the S&P 500 advanced 2.9% to 2822.48. The tech-heavy NASDAQ gained 3.8% for the week to 7688.53. While the global economy is always on investors’ minds, macro factors were on the back burner last week as the attention was largely focused on individual stocks. The week began with news of the tragic crash of a Boeing 737 MAX 8 jet in Ethiopia. Boeing (BA) is a member of the Dow Jones, an index that calculates weighting by share price rather than market capitalization, so the stock’s price movement had an especially amplified impact on the DJIA throughout the week. Other individual names highlighting the tape included GE (GE), Tesla (TSLA), Facebook (FB) and Apple (AAPL). Friday was the busiest trading day so far this year, as the day marked a quarterly collision that traders call “quad witching”. This occurs when equity and index futures and options all expire on the same day. Adding to the action, dozens of S&P 500 indexes were scheduled to rebalance their holdings at the end of the day. The House of Commons took a series of Brexit votes last week after Prime Minister Theresa May returned with what she called European Union “legal concessions”. Her new Brexit plan quickly suffered another defeat in the House. The White House submitted a $4.7 trillion 2020 budget to Congress that featured cuts in safety-net and discretionary items and large additi0ns to defense and border protection.

Looking Ahead:

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for March on Monday – expectations call for a 63 reading, up slightly from February’s 62. Marriott International (MAR) discusses earnings prospects for 2021. On Tuesday, FedEx (FDX), HD Supply Holdings (HDS) and Tencent Music Entertainment (TME) release their quarterly results. Nvidia (NVDA) holds its annual investor day in San Jose, CA. Wednesday brings financial results from General Mills (GIS) and Micron Technology (MU). Starbucks (SBUX) and Agilent Technologies (A) hold their annual stockholder meetings. The Federal Reserve is on center stage Wednesday as the FOMC announces its monetary-policy decision. The central bank is widely expected to keep its benchmark federal-funds rate unchanged at 2.25% to 2.5%. On Thursday, earnings reports will be released by Conagra Brands (CAG), Nike (NKE) and Darden Restaurants (DRI). The Conference Board reports its Leading Economic Index for February – consensus estimates call for a 111.5 reading, a tad bit higher than January’s 111.3. The business week ends with Tiffany (TIF) reporting quarterly financials on Friday. The Census Bureau releases wholesale inventories data for January – economists forecast a 0.3% decline after a 1.1% jump in December.

The Tufton Capital Team hopes that you have a wonderful week!