The Weekly View (4/15/19)

Last Week’s Highlights:

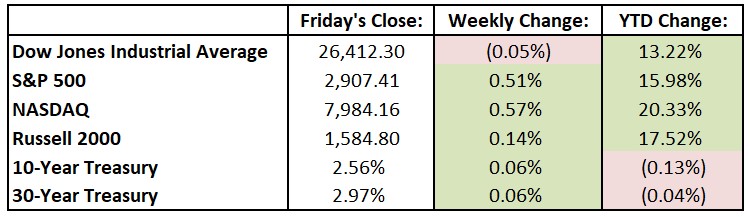

Global equity markets ended the week nearly flat, as solid earnings reports (largely from large U.S. banks on Friday) offset somewhat disappointing economic data. The International Monetary Fund cut its 2019 global growth forecast from 3.5% to 3.3%, pointing to tighter money, trade disputes, policy uncertainties and declining confidence for the estimate change. The week ended on a high note as markets were encouraged by solid bank earnings in the U.S. (led by JP Morgan Chase (JPM)) and a big acquisition in the energy space (Chevron (CVX) agreed to buy Anadarko Petroleum (APC)). For the past week, the Dow Jones Industrial Average (DJIA) dipped 12.69 points to 26,412.30, while the S&P 500 inched up 0.5% to 2907.41. The tech-heavy NASDAQ was up 0.57%, closing at 7984.16. Brexit drama continued, as talks continued between Conservative and Labour parties in the U.K.. Theresa May traveled to the Continent on what a German newspaper called her “begging tour”, seeking a longer extension past the April 12th deadline. The E.U. has offered a new deadline of October 31st. Walt Disney (DIS) hosted an investor day on Thursday, at which it unveiled new content and financial projections for its coming streaming service, Disney +. The stock popped 11.5% on Friday, finishing at its highest close ever ($130.04). Tiger Woods rallied from behind on Sunday to win the Masters golf tournament, his first major win since 2008.

Looking Ahead:

Monday is April 15th – Tax Day! Earning season picks up steam, with reports expected from Citigroup (C), Goldman Sachs (GS) and M&T Bank (MTB). Apple (AAPL) and Qualcomm (QCOM) face off in a San Diego courtroom over various patent disputes. Tuesday is a busy one for earnings results – look for numbers from Bank of America (BAC), Johnson & Johnson (JNJ), Netflix (NFLX), and IBM (IBM), among others. The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market Index for April – economists forecast a 63 reading, up from March’s 62. Wednesday brings earnings reports from Abbott Laboratories (ABT), Bank of New York Mellon (BK), Morgan Stanley (MS), Crown Castle International (CCI) and PepsiCo (PEP). The Census Bureau reports the trade deficit in goods and services for February – expectations are for a $54 billion deficit after a $51.1 billion shortfall in January. Earnings reports continue in force on Thursday, with results out from American Express (AXP), Honeywell International (HON), Travelers (TRV) and many more. Pinterest, the online image-search company, will begin trading on the New York Stock Exchange under the ticker PINS – it is expected to go public at $15 to $17 per share. Financial markets throughout the world are closed for Good Friday.

The Tufton Capital Team hopes that you have a wonderful week and a Happy Holiday!