The Weekly View (4/10/17)

What’s On Our Minds:

After you have achieved your goal of owning a home, you may be itching to jump into the real estate game again by buying a second home. While interest rates are low, it might make sense to buy a house to use as a vacation home, a rental property, or a home for retirement. The process of buying a second home is similar to the process you already undertook when you bought your first home, but the mortgage and tax implications will be different. Below we will discuss some of these differences.

Financing the House

At this point in your life, you may have more cash to put toward a down payment or may even be able to buy a second home outright. While rates are still historically low, it may make sense to finance a portion of the home. That being said, mortgages for second homes are often more difficult to qualify for and require stricter terms:

- Interest rates: Expect your interest rate to be half a point to one point higher than it would be if you were buying a principle residence.

- Down payment: For a principle residence, most mortgage lenders prefer 20 percent down, but don’t require it. For a second home, plan to put 20 to 25 percent down in order to qualify for financing.

- Credit score: Typically, you must have a credit score of at least 730 or 740 to get the best loan terms. Some lenders will require an even higher score for second home mortgage applicants.

- Debt ratio: The debt ratio (the ratio of your debt payments to your monthly income) that your second mortgage lender requires will probably be the same as for your first mortgage—typically no higher than 36 percent. However, when calculating the ratio for your second mortgage, you’ll have to include house payments, property taxes and insurance for two houses instead of just one.

Tax Implications

Your second home expenses will include additional property taxes. If you’re renting it out, you also need to pay income tax on your rent earnings, but you could be eligible to deduct operating costs. The sale of a second home is also subject to different capital gains tax rules than a primary residence.

- Property taxes: The taxes you pay on either of your houses will depend on where they’re located, how much land you own, and how many improvements the house has had. If you buy a run-down house with plans to make improvements, expect your property tax bill to increase. Similarly, if you buy a house that has seen major improvements since the last tax assessment, be prepared for it to increase after you buy it. You can write off your property taxes as a tax deduction, just as you can with a first home..

- Income taxes: If you rent your house out for more than 14 days and use it for personal reasons for less than 14 days of the year, you must pay income tax on your rent earnings. However, when you claim rental income on your taxes, you can also deduct rental expenses you incur from maintaining the property, finding tenants, etc.

- Interest deduction: You can also deduct your mortgage interest payments on your second house if you itemize your tax return. If the total value of both mortgages is below $1 million, you can deduct your interest in full.

- Capital gains taxes: When you sell your primary residence, you won’t be taxed on capital gains up to $500,000 (if you’re married) or $250,000 (if you’re single). With a second home, those limits don’t apply. Instead, you’ll be taxed on the entirety of your capital gains. To avoid paying high capital gains taxes, you must have lived in your home for at least two years before selling. If you’re selling a house that you used as a rental property or vacation home, consider making it your primary residence for two years before selling to reap the tax benefits.

While owning a second home comes with added expenses, the tax benefits provided by taking on a mortgage and potential appreciation of the home’s value can make it a sound investment strategy.

Last Week’s Highlights:

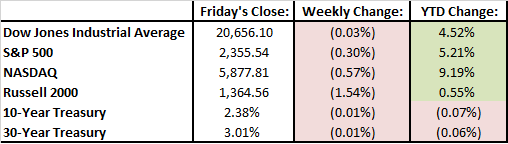

While stocks lost only a few points last week, there was no absence of market moving news. The Federal Reserve’s meeting minutes were released last week which revealed that the Fed is beginning to determine when and how it will reduce the size of its balance sheet (its ownership of bonds it purchased as part of its quantitative-easing stimulus strategy). The 10-year interest rates fell to as low as 2.32% last week, receding from the 2.60% level reached in March after the Fed announced its second rate hike in the span of three months. On Friday, we saw a weak jobs report that showed that the economy added only 98,000 jobs in March. The Street had expected 185,000 new jobs. Investors are blaming the weak job report on bad weather in March.

Looking Ahead:

After being stuck in a state of suspended animation for the past few weeks, the stock market will finally have its moment of truth as corporate earnings begin rolling out this week. JPMorgan Chase and Citigroup will kick things off on Thursday. Earnings report will reflect President Trump’s first quarter as President so investors will be crunching the numbers to see if they support the post election rally. The bond market will close early on Thursday in advance of Good Friday. On Friday, equity markets will also be closed.