The Weekly View (6/12/17)

What’s On Our Minds:

Forget about FANG; there’s an updated group of market moving mega-cap tech stocks in 2017. The “Fabulous Five” includes Facebook, Amazon, Apple, Microsoft, and Google. The street is calling the high-flying group “FAAMG”. Combined, the FAAMG stocks have added $660 billion in market value this year and even though these companies are only 1% of the number of companies in the S&P 500, these top 5 tech stocks account for 13% of the market value weighting in the index.

Last Friday, Goldman Sachs’ research department took a shot at the FAAMG high-fliers noting that the overall return of the Nasdaq and S&P 500 is getting increasingly dependent on the FAAMG group. The report even went as far to compare the run up in these stocks to the euphoria in tech stocks before the burst of the Dot-Com bubble nearly 20 years ago. Goldman analyst Robert Bourojerdi wrote, “This out performance, driven by secular growth and the death of the reflation narrative, has created positions extremes, factor crowding and difficult-to-decipher risk narratives (e.g. FAAMG’s realized volatility is now below that of Staples and Utilities).” For investors, Friday’s report from one of Wall Street’s top firms, was hard pill to swallow and the exuberance built in these companies’ share prices was interrupted. Facebook was down 2.27%, Amazon was down 2.95%, Apple was down 3.52%, Microsoft was down 2.39% and Alphabet was fell 2.3%.

Clearly, Goldman’s research department is a bit worried the investors are getting caught up in the game of chasing growth in this small group of names.

Even though these types of moves are exciting to follow, we urge our readers to avoid getting caught up in the day to day media hype, and remain focused on the long-term prospects of their investment portfolio. The Tufton investment team continues to diligently monitor developments throughout the market and clients’ individual portfolios.

Last Week’s Highlights:

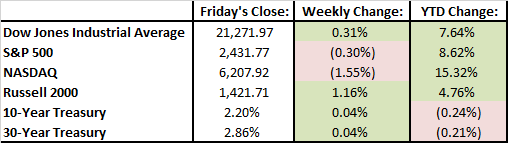

While financials had a great week due to a Dodd Frank repeal moving through the House of Representatives, a move Friday by technology stocks drove the S&P and NASDAQ into the red. NASDAQ was pushed lower by note by Goldman Sachs that suggested investors are overestimating the stability and strength of many recent outperformers in the Tech space. This led to a quick selloff and profit taking across the board in tech, and ended with the Technology Select Sector SPDR ETF (XLF) slumping -2.47%. Energy stocks had a volatile week, dropping in value midweek, but recovered on Friday. The price of WTI oil moved to its lowest level since November, on higher than expected inventory levels, as supply and demand forces continue to duel it out causing uncertainty in the energy sector.

Political forces continued to drive the narrative and influence the markets, but last week, economic forces took the wheel in moving the needle. The Comey testimony before Congress did not reveal anything particularly material or surprising, and markets reacted positively. In other news, Nordstrom is seeking to take itself private, GM sided with management against activist investor David Einhorn’s proposals, and Alibaba surged on raised guidance.

Looking Ahead:

All eyes will be on the Federal Reserve this week when they decide Wednesday whether to raise short term interest rates. The Street is expecting the Fed to increase rates by 25 basis points. Janet Yellen will also hold a press conference afterwards, which will be closely followed, because it could shed light on the state of the US economy, future Fed rate hikes, and if they will start to unwind the Fed’s $4.5 trillion balance sheet.

The Producers Price Index (PPI) and the consumers price index (CPI) will be reported Tuesday and Wednesday respectively. Both are measures of inflation and it is estimated that each increased between 0.2% and 0.5% this past month.

To wrap up the week on Friday, the stock market will likely see increased volume because it is a ‘triple-witching’ day. Triple witching days happen four times a year in March, June, September and December. It is a day when contracts for stock index options, stock index futures, and stock options all expire on the same day, and the stock market is flooded by arbitrage traders seeking to exploit price disparities.