The Weekly View (7/24/17)

What’s On Our Minds:

With very little volatility in domestic markets lately, let’s review the tax management strategy of “tax loss harvesting”.

Aside from research roles, Tufton Capital’s portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must pay a long-term capital gains rate of 15%. The tax savings increase for the highest income earners in the 39.6% Federal tax bracket, who must pay 20% on long-term capital gains. Plus, depending on where you live, you may be subject to capital gains taxes at the state level. Our clients in Maryland know this all too well!

Of course, we don’t make trades just for tax purposes. If we think a stock is going to increase in value, we hold it. If we think it is going to go down, we sell it. But using a tax wash sale, in which a security is sold and then repurchased after 30 or more days, enable an investor to claim the tax loss but still hang on to an investment that he or she thinks has long-term potential.

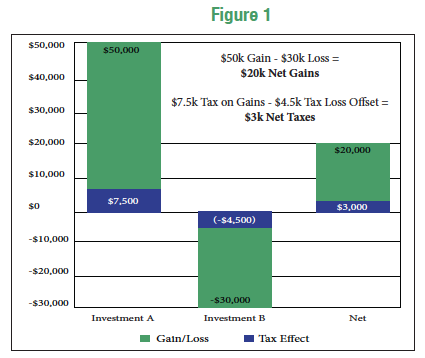

Take for example a single person who has an annual income of $100,000. He would be in the 15% long-term capital gains bracket. In his brokerage account, he has a realized long-term capital gain of $50,000 in Investment A and an unrealized long-term capital loss of $30,000 in Investment B. If he sells his shares of the losing stock, he can offset the $50,000 gain against the $30,000 loss, resulting in $20,000 of net long-term gains. If he does not harvest the loss, the Federal tax on his $50,000 long-term gain would be $7,500. By partaking in this tax loss harvest, he will save himself $4,500, which would have otherwise been a piece of his Federal tax liability for the year (See Figure 1).

Portfolios with large unrealized gains will likely have some positions that have unrealized losses. Although a loss may be hard to look at, sometimes it’s best to bite the bullet and clean these losers out of a portfolio. This management strategy allows investors to free up cash in the portfolio, which can be deployed into other, more attractive investments.

While it’s important to avoid the tax tail wagging the investment dog in your overall investment strategy, a disciplined approach to managing tax liabilities is an important component of wealth management.

Last Week’s Highlights:

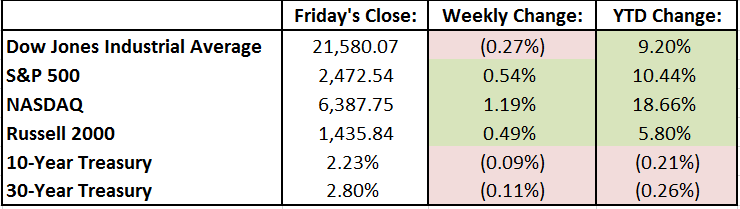

On the back of strong earnings, all three domestic market indices notched new record highs during the week, but finished with mixed results. Major banks reported earnings, with most producing top and bottom line beats but with mixed results beyond the headline numbers. Goldman Sachs had gains in its equity portfolio but reported weak trading revenue. Bank of America posted a surprise drop in net interest income. Netflix was a major winner for the week, adding 5.2 million users in the quarter, and posting a 32% jump in revenue. Activist investor Nelson Peltz stated his intentions to begin a proxy battle with Procter and Gamble over obtaining a board seat. He argues that P&G has not followed through on long term plans and doubts future plans will be implemented.

In economic news, ECB President Mario Draghi hasn’t discussed the wind-down of the ECB’s bond buying program, but is expected to do so later this year. Baker Hughes’ U.S. rig count reported a loss of 2 rigs but still reports 488 more rigs than the year prior.

On Capitol Hill, Republicans failed to bring the health care reform bill to vote due to lack of support, but they promise to bring a full repeal bill to vote soon. They also hinted at a potential tax cut, and Dodd-Frank partial repeal, but markets failed to react due to Republicans’ perceived inability to enact legislation.

Looking Ahead:

This coming week has a packed schedule, both on Wall Street and in Washington. The Senate is poised to vote on a stand-alone repeal of ObamaCare sometime this week, as Republicans try to keep true to their 7 year old campaign promise. The Senate is going to hear testimonies from Jared Kushner, Donald Trump Jr., and Paul Manafort, which should provide some color on the ongoing Russia investigation.

On Monday, ministers from six OPEC nations gather in Russia to discuss the current supply gut in oil and how the cartel is going to respond to it. On Wednesday, the Federal Reserve will end its two-day meeting and announce its decision on interest rates. They are expected to clarify their language on when they will start to normalize their $4.5 trillion balance sheet. Treasury Secretary Steve Mnuchin will testify on the state of the International Financial System on Thursday. Lastly on Friday, the US’s 2nd quarter GDP growth will be reported.

In the markets, Google, Haliburton, AT&T, Caterpillar, Coca-Cola, and Exxon Mobil are among the notable companies reporting earnings this week. Tesla is expected to deliver the first of its lower-cost Model 3 cars. Scaling and production have been hiccups for Tesla in the past, so the market is looking to see if the Model 3 rollout will be successful.