The Weekly View (8/22/16 – 8/26/16)

What’s On Our Minds:

With summer coming to an end and fall quickly approaching, it’s important to make sure your IRA accounts are all set for the end of the year and that you maximize the tax benefits these accounts have to offer. It’s also important for IRA holders over 70 ½ years old to remember to take their required minimum distributions before the end of the year.

For folks saving for retirement, IRAs offer vast savings advantages over taxable accounts so it’s important to maximize your IRA contribution to grow your tax exempt accounts. If you are under 50, you can contribute $5,500 per year and above 50 years old, you can contribute $6,500 per year. If you make less than $117,000 per year ($184,000 if you are married and filing jointly) it’s a good idea to contribute to a Roth IRA seeing that accounts have the added benefit of tax free withdraws once you reach the age of 59 1/2. A lot of parents advise their young adult children to open Roth IRAs to help them to get a jump on retirement savings before they reach the Roth income threshold. With disciplined annual contributions and a sound investment strategy, these accounts can grow into rather substantial assets by the time you are considering retirement.

After years spent saving for retirement in your IRA, the time will inevitably come when you turn 70 ½ and you will have to a required minimum distribution (RMD) from the accounts. The good news in you can sell securities in the accounts without paying capital gains taxes, but the tough news is that each distribution you take from a retirement account will be taxed at your federal and state income tax rate (with the exception of distributions from a Roth IRA.) RMDs are calculated by dividing the balance of your account at the end of the previous year by a life expectancy factor that the IRS determines.

If you have any questions regarding your annual IRA contributions or distributions, feel free to give us a call.

Last Week’s Highlights:

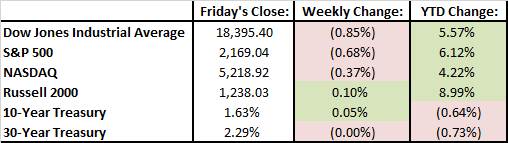

Equity markets were down last week with major indexes each ticking down almost 1%. Investors were a bit cautious last week going into Janet Yellen’s speech scheduled for the end of the week. On Friday, she addressed the Jackson Hole Economic Symposium where she was a bit more hawkish on interest rates so there is chance we will see a bump in interest rates in September. She had this to say on Friday: “In light of the continued solid performance of the labor market and out outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.” Currently the market is pricing in a 42% chance of a September increase and a 66% chance the fed moves higher by the end of 2016.

Looking Ahead:

Several important economic reports come across the wire this week: productivity numbers, weekly jobless claims, ISM manufacturing, and the U.S. unemployment report. Investors will be looking at these numbers as they are key indicators going into the fed’s September interest rate decision. Expect fed speak to dominate headlines this week.