The Weekly View (8/28/17)

What’s On Our Minds:

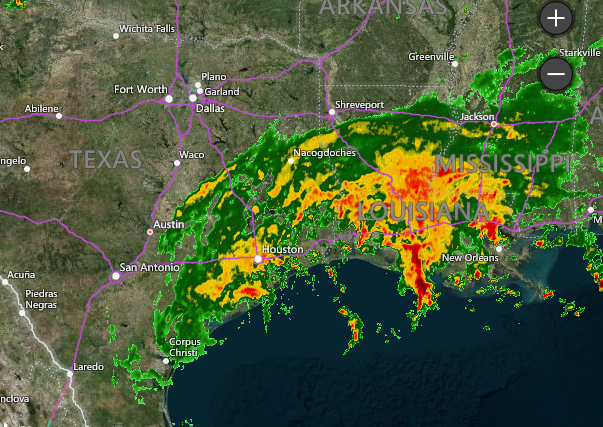

Over the weekend, Hurricane Harvey walloped the Texas coast and caused major flooding throughout the Houston area. Five deaths have been reported so far and over 3,000 water rescues have been performed. It looks like rain will continue through the week and the city could receive up to 50 inches of rain by the time it’s all said and done. Along with the humanitarian issues brought on by the storm, many are asking how this historic weather event will affect business along the Gulf Coast.

The storm will without a doubt be a major hit on insurance companies covering homes and business in the area and it will also affect the local oil industry. The hurricane’s path goes right through a corridor of critical energy infrastructure in the Houston and Galveston area. Investors are expecting the storm to send ripples through the energy industry this week. Thus far, the hurricane has forced 15% of the U.S.’s oil refining capacity to temporarily shut down, and it looks like it could get worse as the storm heads east towards refineries along the Texas and Louisiana boarder. Experts are saying that even though refineries may not be damaged, the Houston Shipping Channel has been closed since Friday. As a result, crude can’t get into port and refined product can’t be shipped. Several major pipelines that lead in and out of the Houston area may also see interrupted operations due to the storm. Rest assured, the U.S. prepares for times like these and has a large stockpile of gasoline on the east coast that can sustain the entire country for 2 weeks.

Oil investors are expecting the crack spread (the metric that tracks the difference between the price of oil and gasoline) to widen in the short term following the storm. Depending on how fast refineries can get back up and running after the storm will determine how quickly the crack spread will normalize. Look for gas prices to spike in the short term following the storm.

Texas and Louisiana are bracing for more rain as Hurricane Harvey moves onshore. Source: Accuweather.

Last Week’s Highlights:

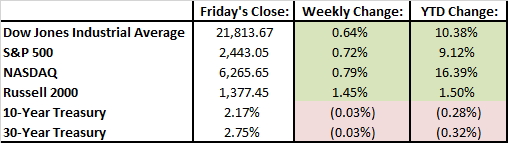

Domestic equity markets saw small gains last week. The S&P 500 was up 0.72% and the Dow Jones increased by 0.64%. Materials and telecom sectors had a strong week but consumer staple stocks declined. Grocery store stocks had a tough week due to Amazon’s announcement that they would lower prices at their recently acquired Whole Foods stores.

With earnings season wrapped up, happenings in Washington D.C. continue to drive investor sentiment. On Tuesday, markets were up 1% as President Trump renewed his focus on pushing pro-growth tax reform policies. Then, we witnessed a bit of a pullback on Wednesday when Trump threatened to allow for a shutdown of the federal government if Congress refused to fund his border wall.

Looking Ahead:

The last official week of summer going into the Labor Day weekend will have investors on their toes with a good amount of economic data coming across the wire. U.S. GDP numbers are being reported on Wednesday and consumer spending figures will be released on Thursday. Auto sales, ISM manufacturing data, and the unemployment number from August will all be reported on Friday. Wall Street is expecting strong gains in Friday’s job report.