The Weekly View (8/29/16 – 9/2/16)

What’s On Our Minds:

Last week, all eyes were on Friday’s Jobs Report released by the U.S. Bureau of Labor Statistics. Wall Street was estimating growth of 180,000 jobs in August, however, the report showed the economy added 151,000 jobs last month. As a result, investors speculated that the Federal Reserve could delay an interest rate hike when they meet in two weeks – September 20th and 21st.

Historically, the initial read on August job growth appears to be “noisy.” In this economic cycle, with an exception of last year, every August employment report has been revised higher – sometimes by more than 100,000 jobs. Growth in wages also appears to be in an upward trend as Average Hourly Earnings grew roughly 2.4% year over year, now comfortably above the average growth rate of 2.1% for the past five years. On the downside, people employed part-time for economic reasons (those looking for full-time employment but unable to find it) was essentially unchanged. Thus, the U-6 unemployment rate barely budged to 9.7% of the workforce. Included in this rate are the total unemployed, all workers marginally attached to the labor force, and those that part-time for economic reasons. In past economic cycles, this rate has trended as low as 7% to 8%, suggesting the current labor force still has room for improvement.

Consequently, the Fed faces a tough decision yet again as job and economic growth just cannot seem to switch into a higher gear. Fed Chair Yellen’s time at the September meetings could end much like Bill Murray’s character in Groundhog Day – “reliving the same day over and over.”

Last Week’s Highlights:

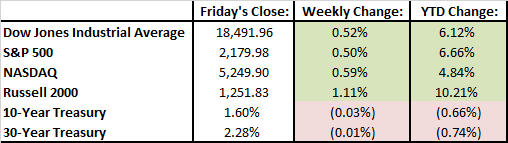

Last week, the main market averages rose about 0.5% on the back of the Jobs Report. The Dow Jones Industrial Average is now up 6.1% year-to-date, while the S&P 500 and Nasdaq Composite are up 6.7% and 4.8% respectively. The tech-heavy Nasdaq continues to be weighed down by Apple, which has return 2.4% this year. Apple currently represents approximately 10.6% of the Nasdaq Composite Index. The main market averages all sit just below their all-time high.

Looking Ahead:

Looking to the week ahead, the calendar is somewhat light on economic data and earnings announcement. On Wednesday, Apple is expected to present the iPhone 7 and the upgrade of the Apple Watch at an event in San Francisco. Also on Wednesday, computer manufacturer Dell and storage provider EMC are expected complete the largest technology merger to date. The markets will also gain further insight on the economy from the Federal Reserve when the Fed’s Beige Book is released. On Thursday, the European Central Bank releases their monetary policy decisions and US Consumer Credit information is reported for the month of July. On Thursday, the NFL season kicks off with a rematch of the Super Bowl as the Carolina Panthers travel west to take on the defending Super Bowl champion Denver Broncos.