The Weekly View (8/8/16 – 8/12/16)

What’s On Our Minds:

In our blog post about Brexit (http://tuftoncapital.com/the-weekly-view-71116-71516/), we discussed the economic effects of a free trade agreement. There has been a lot of talk about the Trans-Pacific Partnership or TPP recently in the run-up to the election. At first blush, the same arguments would seem to apply to the TPP as any free trade area. However, the TPP is much more complicated.

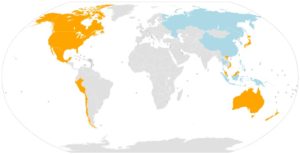

The TPP, signed but not yet ratified, has twelve members, orange in the map below: Singapore, Brunei, New Zealand, Chile, the U.S., Australia, Peru, Vietnam, Malaysia, Mexico, Canada, and Japan. Potential future members are shown in blue. (Credit: Wikipedia user L. Tak) The agreement is some 5,600 pages long, and makes many significant rules for signer countries.

The most obvious part of the TPP is free trade between members, with all tariffs on US manufactured goods and almost all farm goods being eliminated completely. But it also makes rules about environmental protection (but not climate change), governance standards, human rights, patent and copyright law (especially surrounding pharmaceuticals), and labor standards.

Respected academics, environmental groups, and public figures have come down on both sides of every major issue. For example, Nobel Memorial prize-winning economist Joseph Stiglitz points to “grave risks” and that the agreement “serves the interests of the wealthiest.” However, Harvard economist Robert Z. Lawrence finds that the economic gains to laborers will actually be greater than those for owners. Similarly divided, the World Wildlife fund wrote a piece in favor of the agreement in furthering environmental goals, while Greenpeace and the Sierra Club have come out against it.

The overall direct economic impact is likely to be small for the United States, on the order of a percentage point change in growth by 2030. But its impacts on other areas, such as the ease with which countries can trade with each other, or the ability for adversely affected companies to sue governments, could have ripple effects that cannot be foreseen.

We close this brief overview with a restatement of our previous view on trade’s effects on US jobs: the types of jobs that are in danger of being replaced, such as manufacturing, are in much more danger from automation and secular changes in our economy than they are from changes in our trade arrangements.

For those wanting more detail, there is a very good (albeit long) article on Wikipedia at https://en.wikipedia.org/wiki/Trans-Pacific_Partnership.

Last Week’s Highlights:

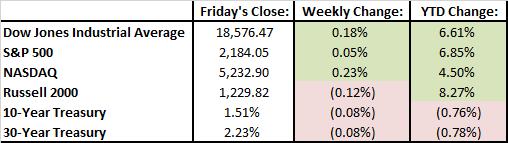

While it was a relatively flat week, markets continue to inch higher. The S&P 500, Down Jones, and the Nasdaq all closed at record highs on Thursday afternoon. Last week we saw strong earnings reports from several major retailers and higher oil prices. Nordstrom, Kohl’s and Macy’s reported strong earnings and sales that beat Wall Street estimates and these companies’ shares rose nicely. Oil was up almost 7% last week on news that Saudi Arabia would finally agree to cut their crude production. Earnings season is wrapping up, and we now see that about 70% of the companies in the S&P 500 beat expectations during the second quarter. With the excitement of earnings behind us, investor focus shifts towards macroeconomic themes; elections news and fed speak .

Looking Ahead:

A couple more earnings reports come across the wire this week with Cisco on Wednesday and Wall-Mart on Thursday. Cisco’s stock has been having a good year, up 15% YTD. Wall-Mart is up almost 20% YTD, and is one of the strongest performers in the DOW Jones this year. It will be interesting to see if their momentum continues. On Wednesday at 2 PM, minutes from the Federal Reserve’s July meeting will be released and analyzed by investors. While the Fed did not decide to raise rates last month, we have seen solid job growth in the US over the summer so a rate hike could be in the cards for later this year.

Maryland residents should get back to school shopping out of the way this week as it is tax-free week in retail stores. Through Aug. 15th, any single qualifying article of clothing or footwear priced under $100 or less, regardless of how many items you purchase, will be exempt from the state’s 6% sales tax. Good news for parents getting ready to send their kids back to the classroom!