2008 Q4 | 2008… Good Riddance!

It was another difficult quarter for the stock market as measured by the S&P 500. Equity prices declined 21.8%, resulting in the worst quarterly performance since the market crash during the fourth quarter of 1987. For the year, the market declined 37.0%, the second worst year in the history of the stock market and the steepest one-year decline since 1931. Not surprisingly, the economic conditions deteriorated as housing prices continued to fall and foreclosure rates in many markets rose sharply.

It was another difficult quarter for the stock market as measured by the S&P 500. Equity prices declined 21.8%, resulting in the worst quarterly performance since the market crash during the fourth quarter of 1987. For the year, the market declined 37.0%, the second worst year in the history of the stock market and the steepest one-year decline since 1931. Not surprisingly, the economic conditions deteriorated as housing prices continued to fall and foreclosure rates in many markets rose sharply.

Employment levels also declined and the unemployment rate increased to 6.7% in the third quarter, up sharply from 5.0% at the outset of the year. This was still much better than the 8.9% unemployment level seen in the second quarter of 1975, the last serious recession since 1931. By comparison, unemployment levels of the depression years, 1933 – 1937, ranged from 14-25%.

The immediate outlook is not very pretty. Christmas retail sales in 2008 were poor, and this will hurt the first quarter economic activity. The U. S. automobile industry was given a short term reprieve by the U. S. government, but at a significant cost to consumers’ confidence in the future prospects of the industry. How many customers will buy an automobile from a company begging for its survival in the form of federal loans? What about warranties, spare parts, and import competition? When making a purchase second only to one’s home in terms of price, how does one justify taking a chance on a company that is hanging by a thread?

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

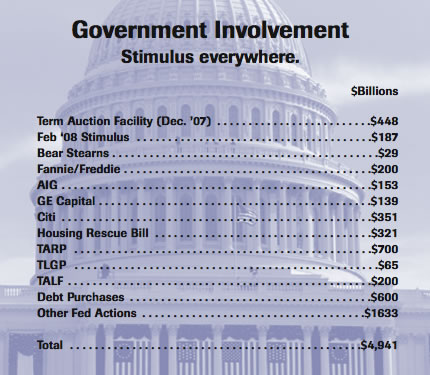

…the government has committed $5 trillion to the problem…

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

The U.S. Treasury Department and the Federal Reserve Bank both acted decisively to support the economy in the fourth quarter (see chart). The Troubled Asset Relief Program (TARP) was passed by Congress on October 3, 2008, giving the government a $700 billion check to shore-up our troubled financial institutions and to restore liquidity to the economy. So far these steps seem to have at least stabilized public confidence in our financial system, and this is no small achievement. By our calculations, the government has committed almost $5 trillion to the problem, clearly an unprecedented amount by any standard. The most interesting aspect of this is that a large preponderance of the money is in the form of investment, not outlay. With an outlay, there is no expectation of return—they are simply writing checks. Taxpayers should, however, expect to experience some type of return on the investments the government is making.

Many of the measures of the Bush administration appear to be short-term in nature, leaving the permanent solution to our new President-elect, Barack Obama. While logical, it places a large burden of the economy on the new President as he assumes office. However, the President-elect’s economic team is both intellectually impressive and experienced. Key members of the new President’s economic team include former Clinton Treasury Secretary Larry Summers, Timothy Geithner, President of the New York Federal Reserve Bank, and Paul Volcker, the retired Fed Chairman who successfully dealt with the inflation of the 1970’s. The team is betting that a significant stimulus program, perhaps as large as $750 billion, will help revive the economy and generate momentum for future growth. Details of the plan are now being formulated, with implementation coming as early as February.

The challenges the economic team face are formidable. In the fourth quarter, the world’s financial institutions experienced increased deterioration in credit quality, leading to a growing reluctance by lenders to extend credit. Companies, even those with solid balance sheets, experienced difficulty obtaining capital or had to pay higher prices to raise the capital they needed. Credit and the velocity of money through the system are critical variables supporting economic activity and growth. Without liquidity to provide the necessary lubrication, the world’s economic gears began grinding to a halt.

How did we land in this mess? It began with an enticing combination of historically low interest rates and lenders offering overly generous mortgages. Unsophisticated housing speculators entered the fray looking to profit from the emerging housing bubble, with financing provided by foolish lenders who ignored every traditional lending underwriting standard. Lenders’ failure to recognize the problem in late 2003 perpetuated the series of events that ultimately threatened the solvency of America’s leading investment banks, which—through their syndications of the mortgages underlying the housing market—were caught with insufficient equity to support their lending activities. The near failure of a number of investment banks, as evidenced by the emergency rescue of Bear Stearns on March 17, 2008 by the Federal Reserve (which was handily managed by J P Morgan), failed to alert the government to the depth or severity of the challenges facing the global financial system.

Only after additional cracks were detected did the government act decisively. In addition to TARP, The Federal Reserve’s Commercial Paper Funding Facility and the FDIC’s Temporary Liquidity Guarantee Program demonstrated the determination of the government to protect our financial system, culminating with a rescue loan to Citicorp in late December. These steps and assurances to take any required additional measures appear to have stabilized the markets.

What will it take to recover? First, we must address what started it all, a sharp drop in housing prices. A sharp reduction in 30-year mortgage rates to below 5% should help. Second, rising real disposable income aided by much lower inflation rates should increase housing affordability and enable the consumer to maintain spending levels to support economic growth. The dramatic drop in oil prices, from a peak of $147 in July of 2008 to below $40 recently, has put as much as $360 billion back into the hands of the consumer, as well as effectively reducing our import bill for nearly 3.6 billion barrels of oil per year. Also, large emerging economies offer large multi-national corporations growth opportunities in 2009 and beyond. Finally, President-elect Obama’s stimulus package aimed at public works and infrastructure reconstruction projects should aid the economy.

During the fourth quarter, the financial markets text-messaged fear, and even panic, as measured by daily volatility. Daily stock market(s)s movements of 3 to 10% were common. Since 1950, there have only been 68 days when the Dow Jones Average has moved more than 4% in a given day. Amazingly, 34 of these 68 days have been recorded in 2008. For the first time since 1958, the dividend yield on the S&P 500 now exceeds that of the 10-year U. S. Treasury obligation, suggesting that a floor in stock prices is near. Furthermore, Warren Buffett, a legendary investor, announced he was buying stocks in an op-ed article in the October 24, 2008, New York Times. Worthy of note, Buffet’s last investment call for buying stock was at the 1974 bottom.

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

We expect 2009 to be a very choppy year, particularly during the first half of the year.

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

For equity investors, this has been an awful year. In fact, it punctuates the worst decade ever for stocks since records have been kept dating to 1926. If there is any good news to be gleaned from this decline, it would be the resulting rise in the overall dividend yield of the stock market. A hallmark of this firm’s investment philosophy has always been its focus on well-established companies with a steadily increasing dividend payout—the current average 3.0% dividend level would indicate that future returns might be expected to approximate at least 9% annually. If economic conditions do not worsen and the dividends in our portfolio companies are sustained, then a recovery in share prices will commence sometime soon.

U. S. Treasury bonds, as well as investment grade bonds, surged in the fourth quarter as the Federal Reserve aggressively cut the Federal Funds interest rate. The 10-year Treasury rose 16% during the quarter, surging from 101 to 117 in price. Bonds produced substantial positive returns, which further enforces our confidence that the economy will recover. Strength in the bond market, in our opinion, is an important precondition for a recovery in equities that we expect to occur in 2009.

We expect 2009 to be a very choppy year, particularly during the first half of the year. The economic backdrop continues to deteriorate and that will certainly affect stock prices early in the year. It is extremely important to remember that stock prices discount the future. As the economy begins to improve in the second half of the year, stock prices should move higher. Our guarded optimism is supported by the huge government stimulus programs, the massive amount of cash reserves ($3 trillion) waiting for investment, the drop in commodity prices, and the expectation that housing will stabilize. If each of these takes hold, the market could rise by 20%. Without question, there is a great deal of risk in this forecast.

To the younger readers of this letter, I want to offer some personal advice. These are very unusual markets, once in a generation, maybe once in a century. Keep a journal of your feelings, so that you will know how to react if this ever happens again. Emotions run high at turning points. Understand your own, and you will be better prepared to deal with the future, if the conditions that we are witnessing today ever recur. 2008 has thankfully ended. Our firm and our clients must now turn to the New Year with hope and belief that economic growth will resume, bringing a recovery to our financial assets. We are very appreciative of your loyalty during this year, which has proven to be one of the most difficult in history.

—Jim Hardesty